-

Even as the bank’s sales practices faced intense government scrutiny following the Wells Fargo scandal, senior leaders in Oregon were fostering a culture that valued credit-card sales above all else, according to several former employees.

August 27 -

Even as the bank’s sales practices faced intense government scrutiny following the Wells Fargo scandal, senior leaders in Oregon were fostering a culture that valued credit-card sales above all else, according to several former employees.

August 27 -

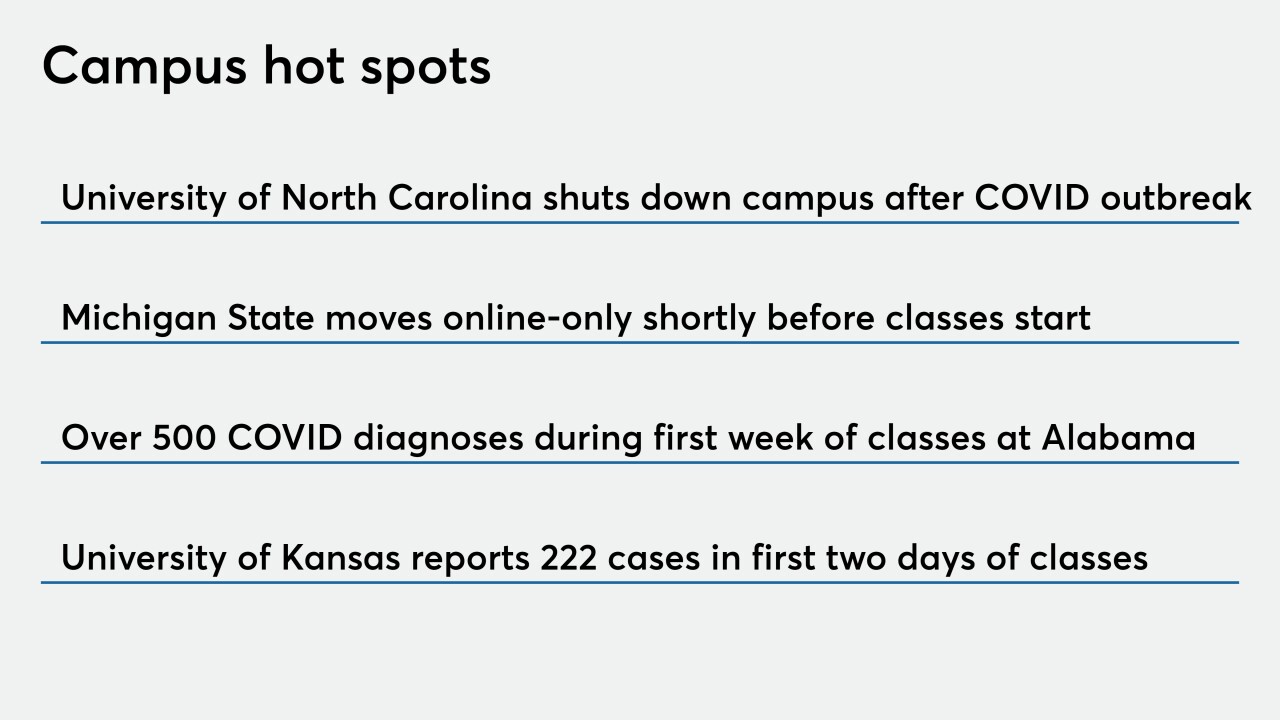

Institutions serving colleges and universities traditionally see membership surge in the fall, but are now planning for a decline as classes move online.

August 27 -

John Collins comes to the credit union industry after spending 20 years in a variety of roles at the national bank, including helping integrate two acquisitions.

August 26 -

The product, which is also aimed at community banks, includes a "take-back" option that allows consumers to withdraw extra funds they've paid that go beyond their monthly scheduled mortgage payment.

August 25 -

Whether the number of deals for 2020 can come close to last year's record-setting level will come down to one question: Can community banks generate strong enough profits in the second half to justify their independence?

August 25 -

Whether the number of deals for 2020 can come close to last year's record-setting level will come down to one question: Can community banks generate strong enough profits in the second half to justify their independence?

August 25 -

Social distancing and other pandemic-related measures are making it harder for banks in the Gulf region to rely on tried-and-true contingencies.

August 24 - Banking brands

SC Telco Federal Credit Union and Anderson FCU will adopt the name Spero Financial once their merger takes effect early next year.

August 24 -

Matt Rarden is taking over at the Albuquerque, N.M.-based institution after Tom Shoemaker retired in July.

August 24 -

Late fees on loan payments and late-arriving documents tied to forbearance and loan forgiveness are just some examples of how delays caused by cutbacks at the U.S. Postal Service could affect lenders and their customers.

August 24 -

Late fees on loan payments and late-arriving documents tied to forbearance and loan forgiveness are just some examples of how delays caused by cutbacks at the U.S. Postal Service could affect lenders and their customers.

August 21 -

The election of Mark Chancy continues a trend under CEO Charlie Scharf of adding directors with deep experience in the banking industry.

August 21 -

Howard Meller, most recently CEO at New York's GHS Federal Credit Union, previously worked at Bank of America and SunTrust Bank before moving to the credit union industry seven years ago.

August 21 -

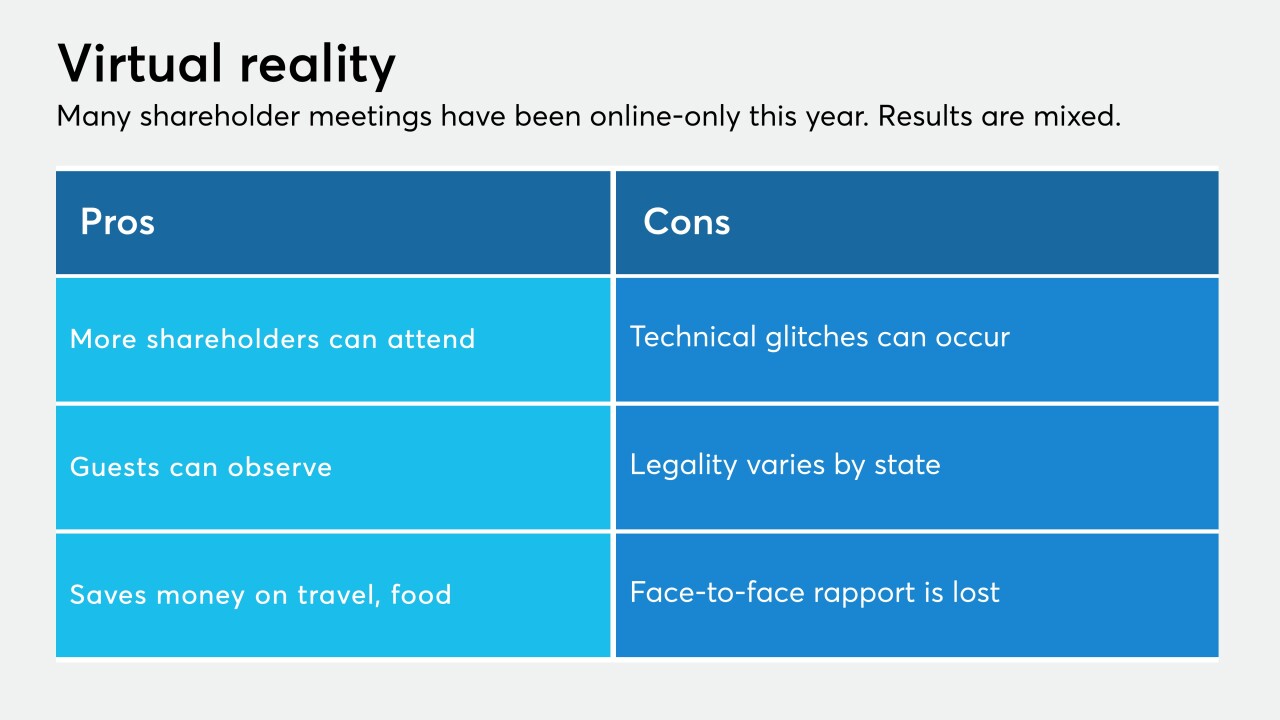

Discover Financial Services and Bank First in Wisconsin, two of the many companies that went all-remote with their annual meetings this year, gave the process high marks. But the longer-term prospects industrywide are unclear.

August 21 -

USAL Bancorp will have nearly $300 million in assets after it buys Escambia County Bank.

August 20 -

The company will pay $156 million for a bank with a large Small Business Administration lending platform.

August 20 -

CEO Keith Brenek plans to retire at the end of 2020, and the Texas-based institution found his successor in-house.

August 20 -

The Totowa, N.J.-based institution's board is working on finding a successor for Lourdes Cortez.

August 20 -

The higher charge on mortgages refinanced through Fannie Mae and Freddie Mac is supposed to cushion against a crisis but could contribute to one as the fees are passed on to struggling consumers.

August 20