-

More businesses are considering moving away from cash and checks, according to a recent survey by Citizens. That should be a wake-up call to smaller institutions, said Michael Cummins, who oversees treasury solutions at the regional bank.

May 27 -

Calls for getting more women into leadership positions, and strategies for achieving that, dominated the LEAD conference in New York.

May 25 -

The East Lansing-based credit union plans to open two branches in the Traverse City area, more than three hours north of its headquarters.

May 24 -

Credit unions are doing good in their hometowns in a variety of ways, including giving one middle school student an award for her business plan for a food truck.

May 24 -

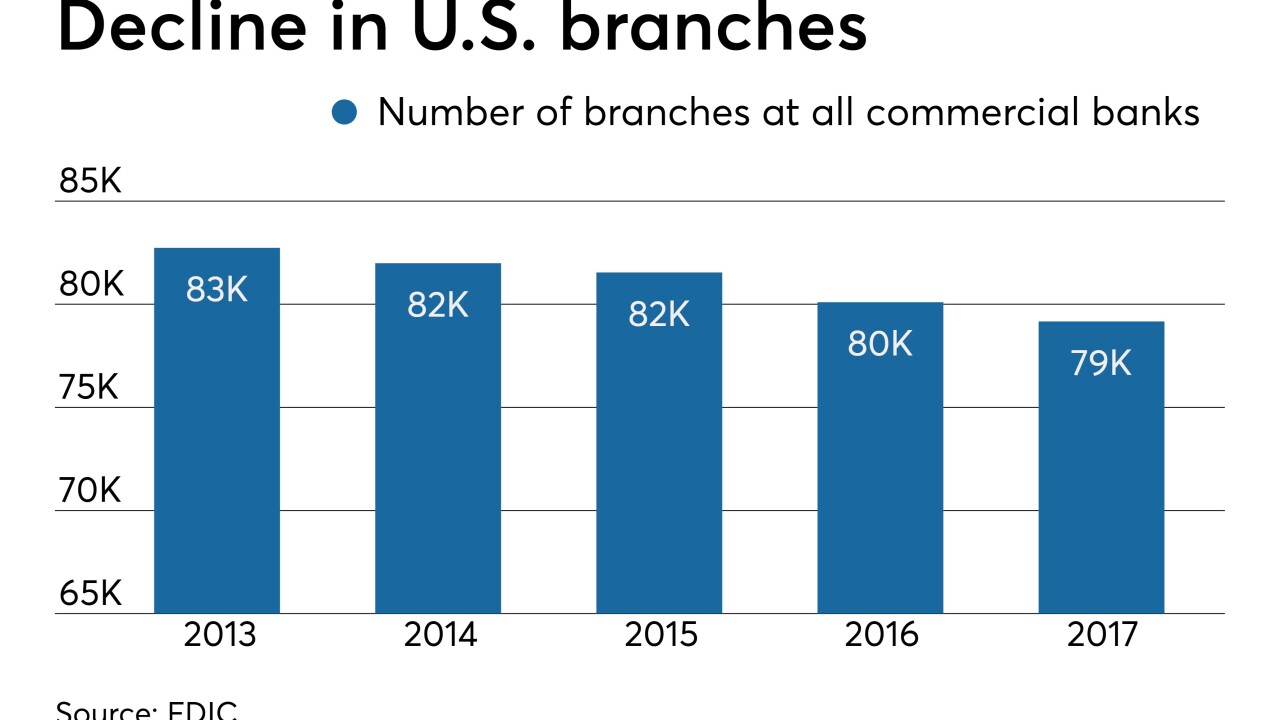

As foot traffic continues to decline, bankers are relying on gimmicks like dramatic lighting and placing buildings closer to highways in an effort to market their institutions.

May 23 -

Credit unions have announced new hires and promotions in areas such as human resources, business development and digital delivery.

May 23 -

The McLean, Va.-based institution said that its capital hit a record $2.5 billion last year.

May 23 -

-

Chris Lorence, a former marketing official at the Independent Community Bankers of America, is the Credit Union National Association's latest recruit from other financial services trade groups in recent years.

May 22 -

Anthony DeChellis’ strategy for staying relevant in a competitive metro market is a little odd — rebuild the private banking business his predecessor shrank — but observers say he might be the executive who can pull it off.

May 22 -

While regulation and nonbank competition are spooking some banks and credit unions, others believe low funding costs and the right relationships can help them succeed.

May 22 -

There have been six of these transactions announced this year and more are likely as credit unions look for loan and deposit growth.

May 22 -

The community-chartered credit union will now serve nine new counties following two years of reporting 2% or less in membership growth.

May 22 -

The Alabama-based CU will continue to look for a permanent replacement for longtime CEO, who is retiring in June.

May 22 -

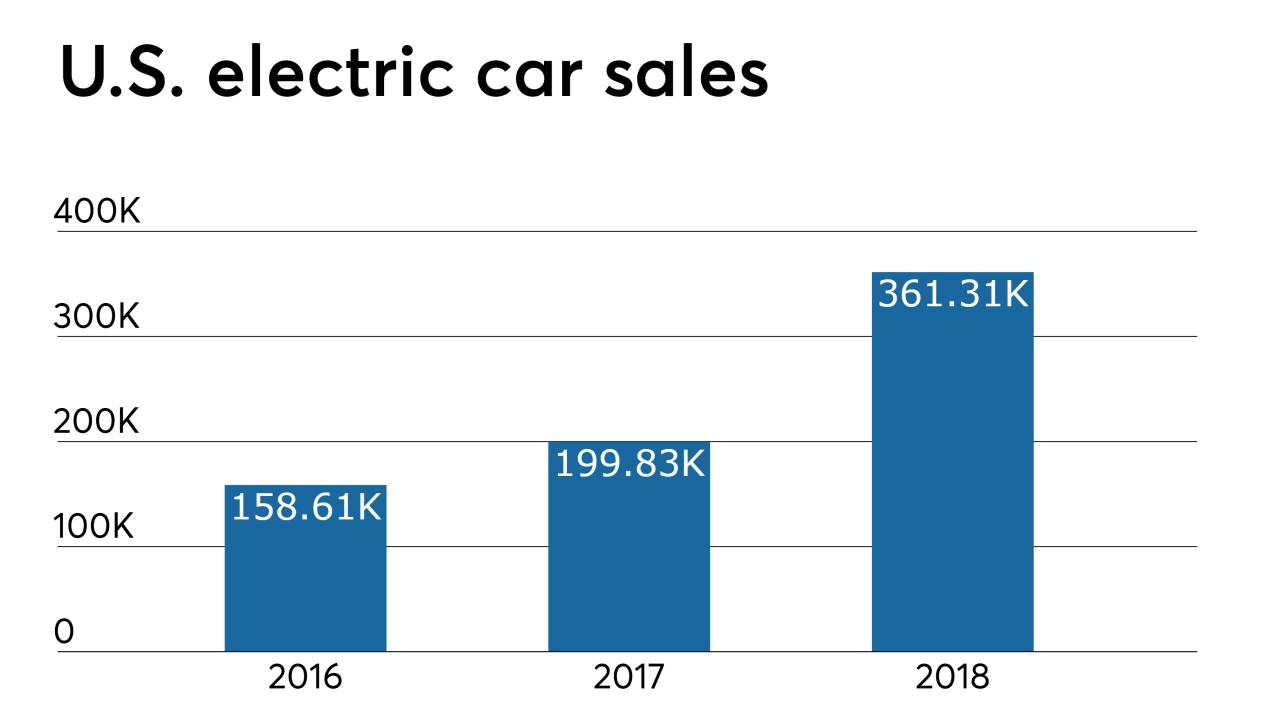

All-electric, zero-emission vehicles make up less than 2% of the market, but a handful of credit unions see an opportunity despite some unusual variables.

May 22 -

They’re communicators, bridge builders and young moms. Here’s what they might do differently from the older bosses they have had in their careers.

May 21 -

Metro Bank had worked to win shareholder support by raising fresh capital and cutting ties with Hill's wife's design firm.

May 21 -

While regulation and nonbank competition are spooking some banks, others believe low funding costs and the right relationships can help them succeed.

May 21 -

The 72% backing was the lowest approval rate for the resolution since 2015. An advisory firm criticized the bank's policy as too subjective.

May 21 -

The company agreed to buy Charter Bank, which has four branches and $161 million in assets.

May 21