-

Large banks had huge losses from originating mortgages in 2018 as costs were three times higher than similar-sized independent lenders, according to research conducted by Stratmor and the Mortgage Bankers Association.

June 21 -

The Federal Housing Administration is moving forward with a long-delayed plan to reduce the term of the home warranty required for high loan-to-value mortgages on new houses.

March 14 -

The Arizona-based CUSO returned $6.2 million in cash rewards to its credit union members for 2018.

March 1 -

The conventional market recaptured a lot of the first-time homebuyers it lost during the financial crisis, but service members instead have increasingly stuck with loans insured by the Department of Veterans Affairs.

March 1 -

Despite an overall weak mortgage originations market, Flagstar Bancorp's third-quarter earnings grew 20%, due in large part to its ongoing efforts to diversify operations.

October 23 -

Millennials are targeting homeownership within the next few years, but many are buying into certain house-purchasing myths, according to Bank of America.

October 10 -

Bill Emerson, the vice chairman of Quicken Loans, said mortgage lenders need to give time to consider innovation and not be deterred by naysayers.

September 18 -

To help close deals, there are steps online lenders can take to establish a quick and personal connection with real estate agents.

September 18 -

At Digital Mortgage 2018, Bill Emerson, the vice chairman of Quicken Loans and its parent company Rock Holdings, outlined a vision of dramatic digital disintermediation.

September 18 -

LoanDepot's CEO Anthony Hsieh delivered a bracing message to mortgage lenders on Monday — strong new competitors are coming into this market, so they need to expand their offerings.

September 17 -

Loan officers whose habits are attuned to the refi market need to improve their relationship game to make it in this business, NBKC Bank's Dan Stevens told attendees at Digital Mortgage 2018.

September 17 -

From falling originations to market share shifts for nonbanks and government loans, here's a look at key findings from the just-released 2017 Home Mortgage Disclosure Act data.

May 9 -

Housing confidence hit an all-time high as more consumers report it's a good time to sell, while also anticipating a rise in home prices but a drop in mortgage rates, according to Fannie Mae.

May 7 -

Recent developments in the Federal Housing Administration's Home Equity Conversion Mortgage program are making it easier for lenders to originate reverse mortgages to borrowers who want to buy a new-construction home.

March 6 -

Here's a look at the 10 housing markets with the biggest gap between growth in home prices and wages that could indicate a housing bubble is forming.

February 13 -

The maximum loan amount for Federal Housing Administration mortgages will go up in more than 3,000 counties for 2018.

December 7 -

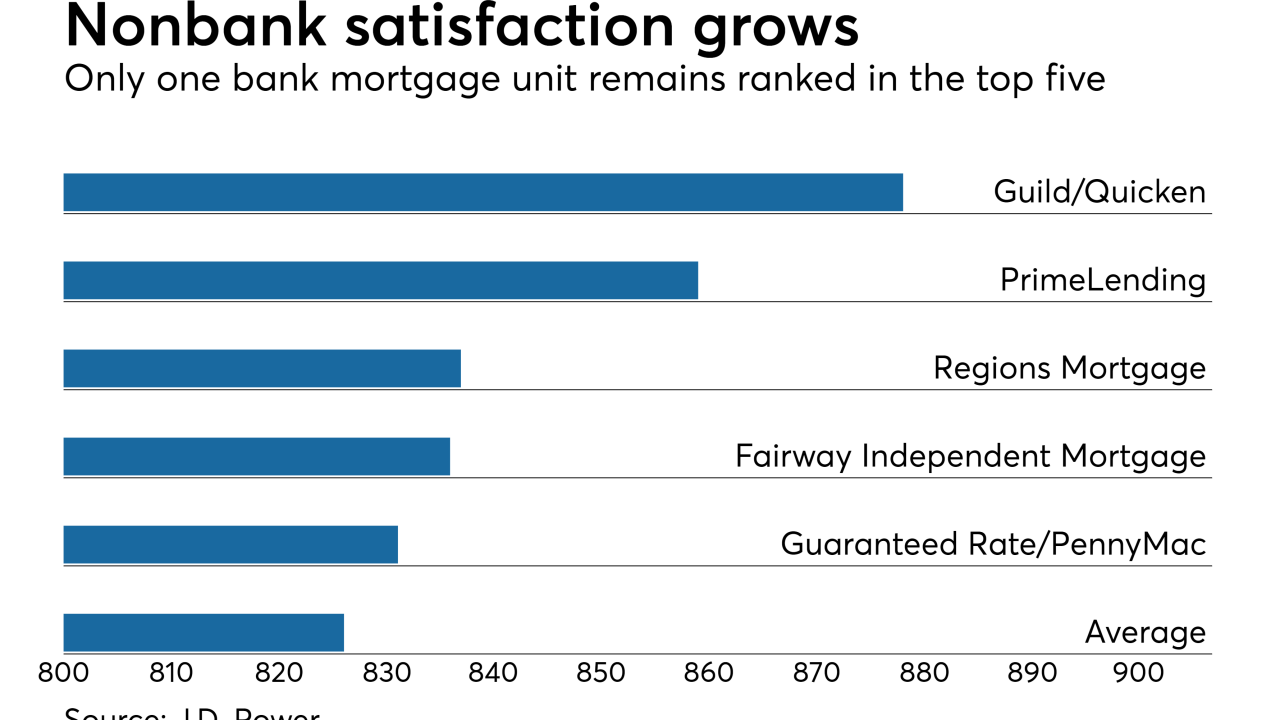

Despite digital mortgage advances, borrowers think it still takes too long to get a loan, J.D. Power finds in its annual customer satisfaction ranking of originators.

November 9 -

Here's a look at the 12 housing markets with the largest percentages of mortgages over $500,000 — the new threshold House Republicans have proposed for the mortgage interest deduction in their tax plan.

November 9 -

The share of purchase and refinance loans originated by nonbanks are at their highest point since at least 1995, according to an analysis of new Home Mortgage Disclosure Act data.

September 28 -

FHA loans made by millennial home buyers have been steadily decreasing the past four months, indicating they may be able to afford more at the moment.

August 10