-

The changes to the National Multistate Licensing System will include a more customized user experience for companies and functionality for states to share examination data.

September 7 -

The first compliance deadline fell last week for the state’s strict new regulation. Banks are struggling with certain elements, such as multifactor authentication.

September 5 -

States must recognize how their patchwork of different regimes stifles innovation, but they also have an opportunity to help maintain U.S. competitiveness in the global fintech marketplace.

September 5 Arizona

Arizona -

Nearly all branches in storm-affected areas were still closed a week after New Orleans' levees broke, but regulators and bankers went to work opening new emergency branches and taking other steps to get institutions operating again.

August 30

-

As Republicans policymakers pursue efforts to revamp the Consumer Financial Protection Bureau and replace its leadership, state agencies are already preparing to fill any vacuum that might ensue if the CFPB steps back.

August 30 -

The Department of Financial Services and Attorney General Eric Schneiderman are both inquiring.

August 2 -

The U.S. population is aging, and one of the well-established components of the American dream — buying and owning a home — appears poised to aid in the baby boomers next phase of life.

July 27 Buckley Sandler LLP

Buckley Sandler LLP -

Readers question acting comptroller Noreika, weigh in on SoFi’s charter application, defend Trump’s exit from the Paris Accord, and more.

July 21 -

A profile of New York's top cop for banking offers insight into her thinking on hot regulatory issues; the women behind the machine learning at Morgan Stanley and UBS see a future with better advice; plus, Jane Austen and the new Doctor Who.

July 20

-

While some policymakers are open to accommodating fintech companies with looser oversight compared with banks, the New York State superintendent is unapologetic about her tough approach.

July 14 -

A proposal on the agency’s overhead transfer rate would simplify how state- and federally chartered CUs pay for examinations by evenly splitting the costs of safety-and-soundness and insurance-related concerns.

June 23 -

Regulators cited "unsafe and unsound" practices at the credit union, which has assets of more than $76 million and turned a small profit in each of the last two years.

June 22 -

Iowa Governor Kim Reynolds has announced Kim Averill as the new head of the Iowa Division of Credit Unions, replacing retiring JoAnn Johnson.

June 7 -

Auditors performing a review of Ocwen Financial padded time sheets and claimed excessive and improper expenses, including lengthy travel and meals at strip clubs and casinos, according to a lawsuit filed against Fidelity Information Services.

May 30 -

State regulators felt they were strung along by the mortgage servicing giant Ocwen Financial after years of promises that were never fulfilled, resulting in successive enforcement actions against the company.

May 17 -

The accreditaiton period lasts for five years, subject to annual review. This is the fourth reaccreditation for Badger State regulators since 2001.

May 17 -

Johnson has led the Iowa CU regulator’s office since being appointed by the governor in 2011.

May 12 -

Compliance flexibility, state law harmonization and funding transparency requirements are among the regulatory steps that can encourage continued innovation.

May 12

-

In an echo of the rescue deals of 2007 and 2008, New Residential's CEO framed the transaction as something undertaken to benefit the entire industry.

May 1 -

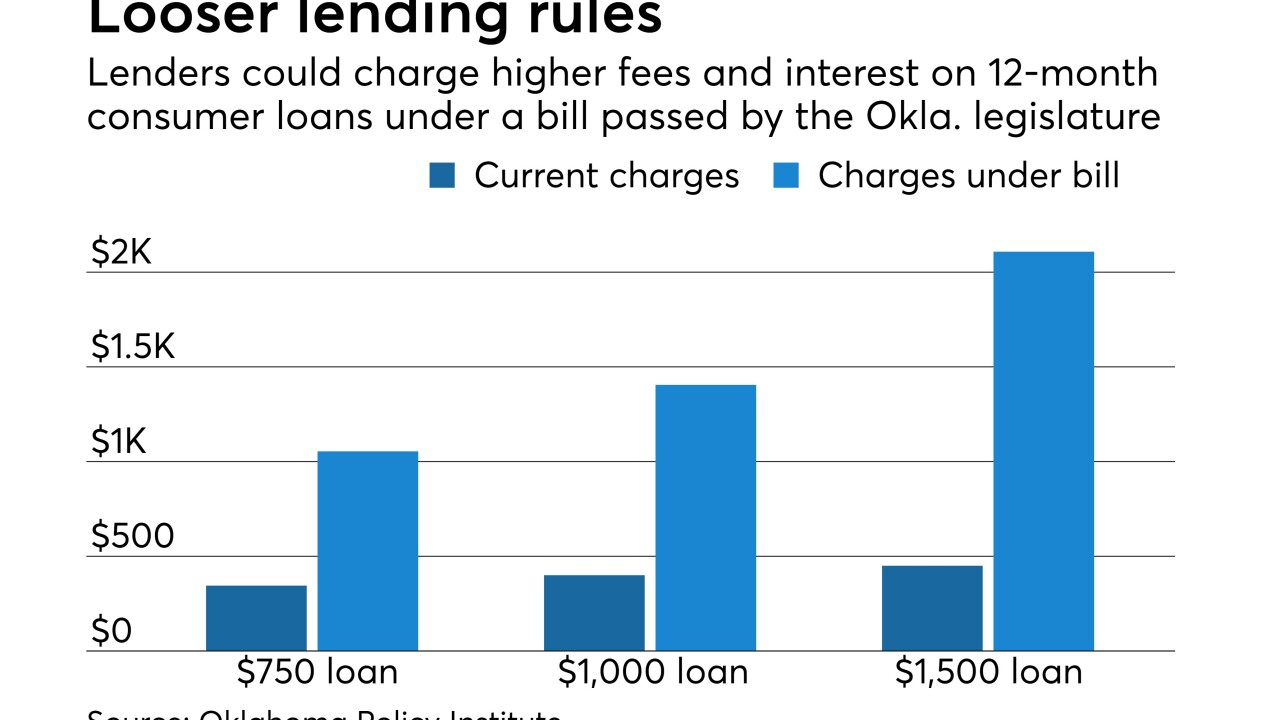

An industry-backed bill that is headed to the desk of Gov. Mary Fallin is seen by critics as an effort to minimize the impact of a potential CFPB crackdown.

April 28