-

The acquisition is expected to boost WesBanco’s presence in Huntington, W.Va., and provide a bridge to its existing operations in Charleston, W.Va., and southeastern Ohio.

November 14 -

The new vice chairman of supervision at the Fed said the agency will seek comment on its rules for stress tests, capital and other areas, as well as look at how fintech has impacted the industry.

November 7 -

During his time as Fed governor, chair-designate Jerome Powell has outlined his views on a host of bank regulatory matters, including the need for regulatory relief, the push for housing finance reform, blockchain and much more.

November 5 -

The political pendulum appears to be swinging toward significantly lower capital requirements, but that threatens to undo the gains banks made in the wake of the financial crisis.

October 30 Peterson Institute for International Economics

Peterson Institute for International Economics -

The Montana company agreed to buy Inter-Mountain Bancorp in an all-stock deal valued at $173 million. The company has lined up nine bank acquisitions in the last five years.

October 27 -

While stress testing can provide valuable insight into the strength and resilience of our financial system, regulators are increasingly acknowledging shortcomings in the post-crisis regime.

October 26 American Bankers Association

American Bankers Association -

The regulator is moving forward with a plan aimed at making it easier for credit unions to challenge supervisory decisions.

October 19 -

Acting Comptroller of the Currency Keith Noreika on Thursday called for steps to ease the asset thresholds that determine whether banks are subject to certain provisions of the Dodd-Frank Act.

October 5 -

Randal Quarles was confirmed 65-32 as a Fed governor, and by voice vote as the vice chairman of banking supervision.

October 5 -

Andrea Smith is leading an effort to address income inequality in Bank of America's hometown.

September 25 -

Unlike a visiting sports team, foreign banks can't just blame local referees they perceive as biased for penalties or fines.

September 21 IBM Global Business Services

IBM Global Business Services -

The purpose of the stress tests program is to reassure the public that the banking system is safe, but the stress tests are not an independent assessment of financial institutions’ actual strength.

August 29 Durham University

Durham University -

U.S. Bank and Wells Fargo to use Blend software to speed up mortgage origination processes; Robert Kaplan wants to keep stress tests on big banks.

August 25 -

As banks press for deregulation, the debate over whether high bank capital standards are inhibiting loan growth has taken center stage.

August 8 -

Financial regulation is too complex and needs to be retooled to improve access to credit, President Trump’s nominees to two top banking regulators told Capitol Hill on Thursday.

July 27 -

Readers question acting comptroller Noreika, weigh in on SoFi’s charter application, defend Trump’s exit from the Paris Accord, and more.

July 21 -

With a heavy focus on the granular details of compliance, bankers and regulators might miss the big picture — not unlike New York City’s approach to fighting crime in the 1990s.

July 17 IBM Global Business Services

IBM Global Business Services -

American card processor has a deal for its British counterpart; after passing Fed tests, banks still stressed by weak lending, low interest rates.

July 5 -

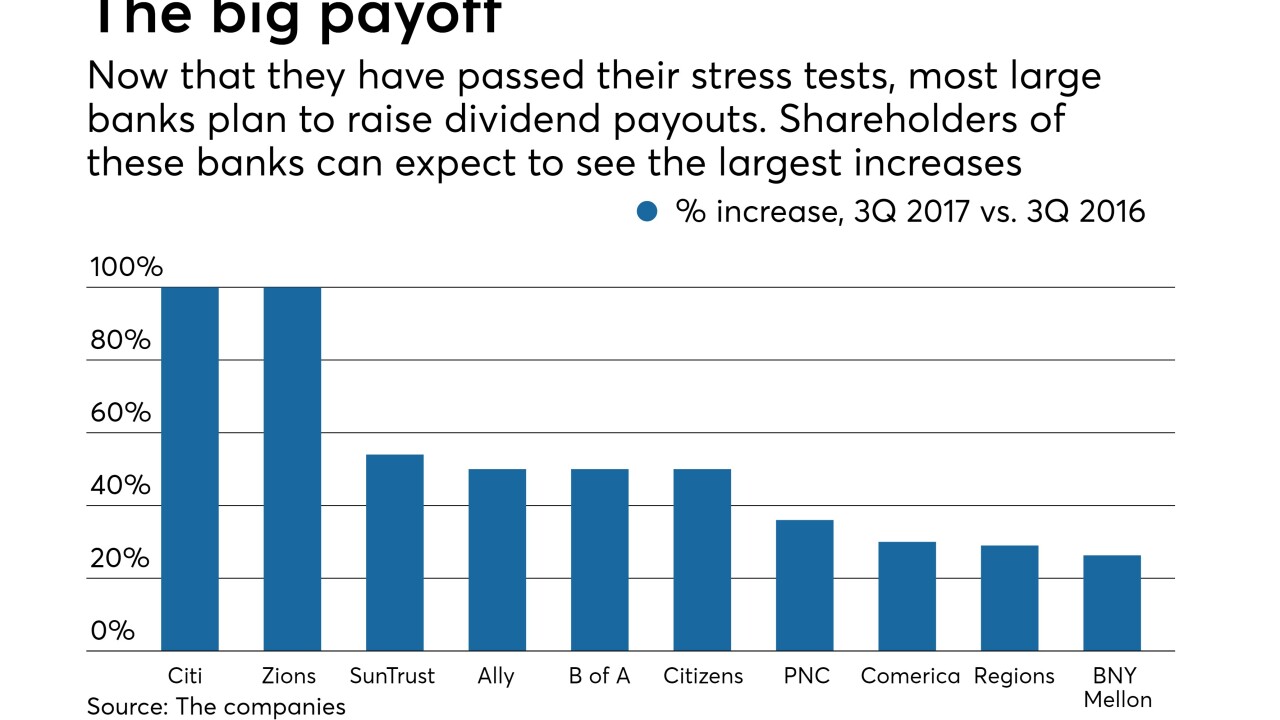

Higher dividends and more aggressive repurchase programs are bound to attract more investors, which could boost stock prices and prompt more dealmaking, analysts said.

June 29 -

The advanced approach has limited value, eliminating it has no downside risks and regulators have better tools at their disposal.

June 29