Technology

Technology

-

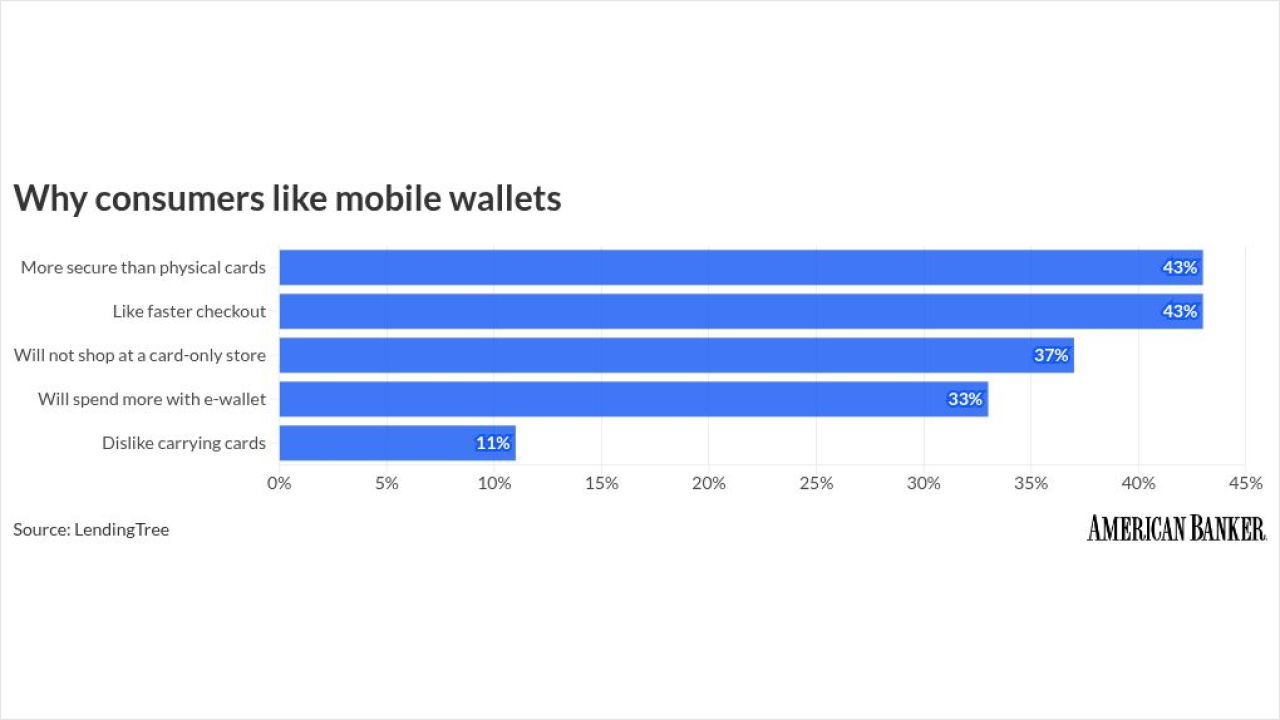

Consumer appetite for mobile wallets is growing, challenging banks to innovate to stay ahead.

December 29 -

From credit bureaus to software providers, 2025 saw attackers bypass bank defenses by targeting the supply chain and using social engineering.

December 26 -

Banks are beginning to engage with decentralized financial infrastructure. But until lawmakers create a foundation for allowing legally recognized entities like LLCs and nonprofits to govern these networks, compliance burdens will hinder full adoption.

December 26 -

CodeBoxx Academy is filling a void for banks and other companies that desperately need AI experts. Peret's time behind bars uniquely informed how he runs the school, he says.

December 25 -

The card network and bank technology seller partnered to expand AI protocols, while British payment companies face tougher fee disclosures but looser rules for contactless transactions. That and more in the American Banker global payments and fintech roundup.

December 24 -

Michigan State University Federal Credit Union avoided $2.57 million in fraud exposure through blocking AI deepfake fraud calls with Pindrop products.

December 23 -

Fifty-four individuals tied to the Tren de Aragua gang face charges for using Ploutus malware to drain millions from community banks and credit unions.

December 23 -

ServiceNow, with its largest-yet M&A deal, will fold Armis' threat prevention services into its larger cybersecurity suite.

December 23 -

An American Banker survey found that bankers think the industry isn't prepared for growth in artificial intelligence and digital assets.

December 23 -

Noelle Acheson shares her top 4 stablecoin trends of 2025 and what they taught us about the changing nature of money.

December 23 -

Fintechs are wrong to demand wholesale consolidation of community banks in the U.S. Real innovation doesn't stem from wiping out smaller institutions or forcing consolidation. Innovation comes from fair competition, secure data protocols, and clear rules that apply equally to banks and fintechs of all sizes.

December 23 -

Terron T. Brown used stolen mail and social media recruits to defraud banks such as PNC and Bank of America of millions, highlighting a rising industry threat.

December 22 -

Some consumers have been waiting a year and a half to get their money back.

December 22 -

The bank technology company is adding offices in the U.S. and India as part of its quest to reach clients outside of its U.K. home base.

December 19 -

The Swedish financial institution has developed an open standard that allows merchants' products to be catalogued and discovered by AI agents. It was designed to complement Stripe and OpenAI's Agentic Commerce Protocol.

December 19 -

Here are the 10 stories our readers paid the most attention to in a year of political, economic and technological change.

December 19 -

The Federal Reserve Board voted 6-1 on Friday to seek public comment on a proposed "skinny" master account.

December 19 -

Once artificial intelligence has eliminated all the human-driven volatility from financial markets, will there even be a reason to trade anymore?

December 19 -

The payment fintech is marketing technology that lets merchants sell through AI agents; Google adds a credit card for India's national real-time payment rail. That and more in American Banker's global payments and fintech roundup.

December 18 -

The megabank cleared a regulatory hurdle when the Office of the Comptroller of the Currency freed it from a July 2024 amendment to a consent order. Two other orders, one from the OCC and the other from the Federal Reserve, remain in place.

December 18