-

-

Senate Banking Committee Chairman Sherrod Brown urged the agency to share insights about the risks posed by neobanks, such as the San Francisco firm that sparked a customer backlash earlier this year.

July 27 -

The Treasury Department is awarding $1.25 billion to 863 community development financial institutions through the Rapid Response Program, which allows banks and credit unions to earmark funds for mortgages and business loans in underserved markets.

July 8 -

No-fee digital bank accounts subsidized by the Federal Reserve would help community banks draw in new customers and pay for technology upgrades, proponents of the idea say. But it's a hard sell to executives skeptical of government involvement in retail banking.

June 23 -

Southern Bancorp, a community development financial institution, will devote part of a multimillion-dollar investment from the payments giant to developing technology that helps consumers budget, buy a home and more.

June 22 -

With a big assist from M&T Bank, the software developer Magnusmode has added step-by-step instructions for conducting essential banking activities to its mobile service that caters to consumers on the autism spectrum.

June 17 -

The average American’s financial picture is bleaker than government data suggests, according to the former comptroller of the currency. Research from his new organization, the Ludwig Institute for Shared Economic Prosperity, has found that unemployment is higher and household wages are lower than reported by the Bureau of Labor Statistics.

June 8 -

Regulators must urgently usher the unbanked or underbanked individuals into the wider financial ecosystem as they continue to craft open banking rules, says FISPAN's Clayton Weir.

May 20 FISPAN

FISPAN -

The Charlotte, N.C., company and the nonprofit Operation HOPE already partner to provide coaching at nearly two dozen counseling centers within Truist’s branches. They plan to add 26 more counseling hubs, serving 1,000 Truist branches, by 2025.

April 29 -

The Mexican unit of the fintech Nubank, the world’s biggest standalone digital bank, is getting a $135 million injection to propel its nascent operations in Latin America’s second-largest economy.

April 8 -

The Cities for Financial Empowerment Fund, a nonprofit that seeks to improve financial stability of low- and moderate-income households, validated the account under its Bank On initiative.

March 29 -

The Ohio Democrat and chairman of the Senate Banking Committee told a virtual gathering of the American Bankers Association that FedAccounts, a plan opposed by industry trade groups, will lead to more bank customers.

March 17 -

Organizers of the proposed Our Community Bank still need to raise $18 million before opening.

March 15 -

Six startups that seek to cater to Black and Hispanic consumers outside the financial mainstream are attracting heavy interest from investors. However, the new banks will vie with megabanks eyeing those same customers and with established minority-owned institutions suddenly brimming with new capital.

March 4 -

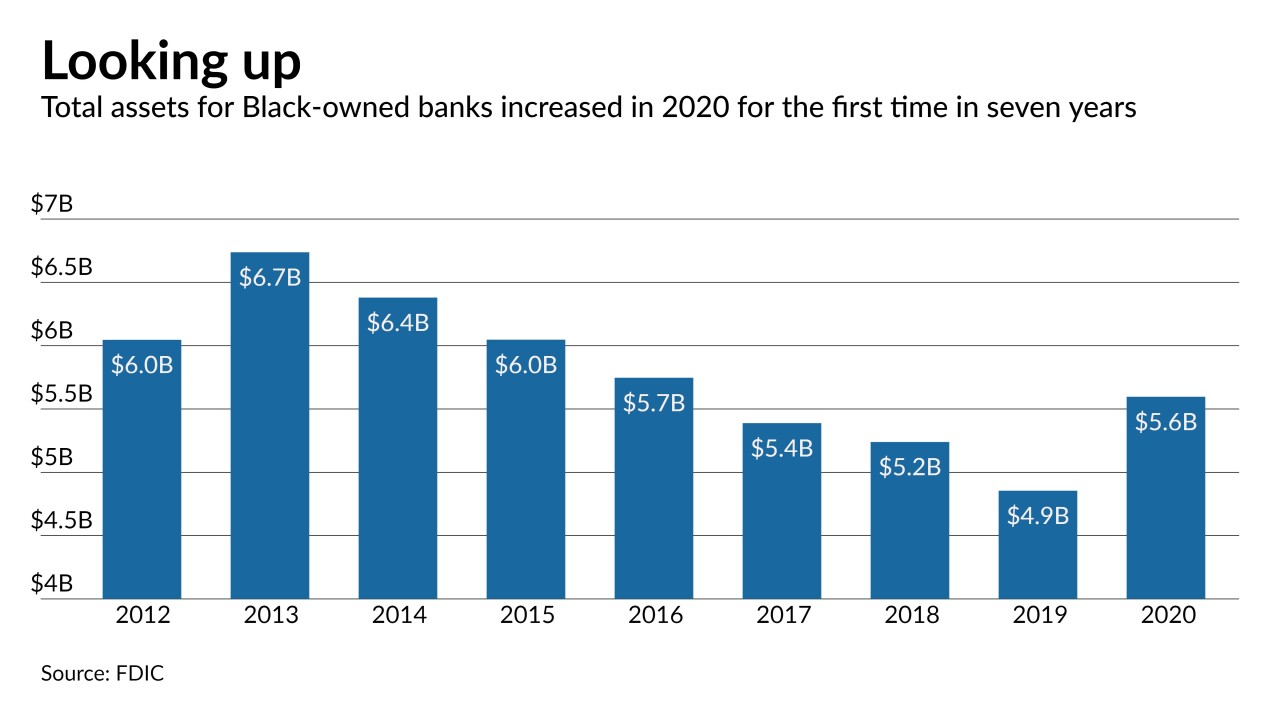

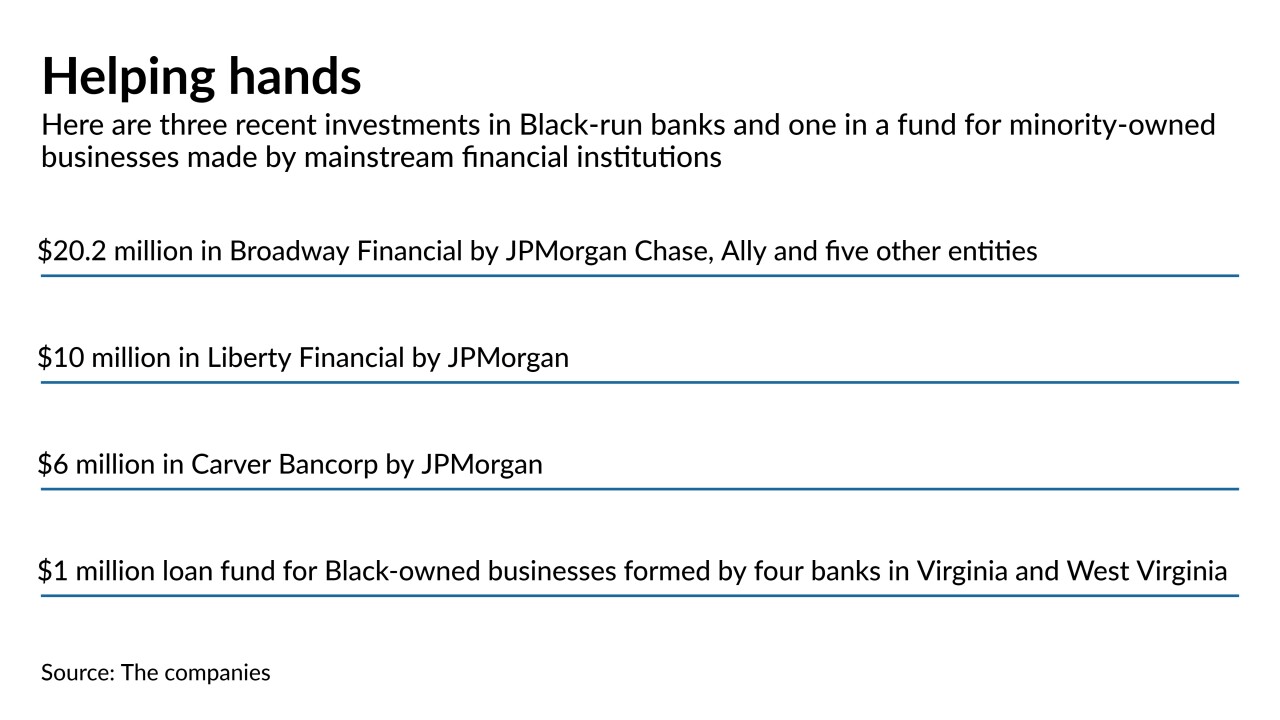

Several large and midsize banks are investing millions of dollars in Black-run banks, while four community banks have started a fund to make interest-free commercial loans in underserved communities.

February 24 -

If you are underbanked you probably have limited access to mainstream financial services normally offered by retail banks. Many fintech startups offer alternative ways to measure credit risk, and assert that their products can help extend financial services to consumers who have not been well-served by traditional banks.

-

The San Francisco company has faced financing challenges as its customers, largely lower-income Latinos, have struggled to keep up with monthly payments.

January 11 -

New guidance from the Consumer Financial Protection Bureau shows how companies that offer workers early access to their wages can avoid being regulated as lenders. But the incoming Biden administration could add new complications.

January 7 -

Challenger banks aimed at Blacks, Hispanics, immigrants and other underserved groups are offering financial education and support for charities in addition to basic banking services.

December 31 -

The Cincinnati bank joins a growing list of banks pledging billions of dollars to fight systemic racism and help close the wealth gap that exists between white and minority households.

December 9