-

The Cities for Financial Empowerment Fund, a nonprofit that seeks to improve financial stability of low- and moderate-income households, validated the account under its Bank On initiative.

March 29 -

The Ohio Democrat and chairman of the Senate Banking Committee told a virtual gathering of the American Bankers Association that FedAccounts, a plan opposed by industry trade groups, will lead to more bank customers.

March 17 -

Organizers of the proposed Our Community Bank still need to raise $18 million before opening.

March 15 -

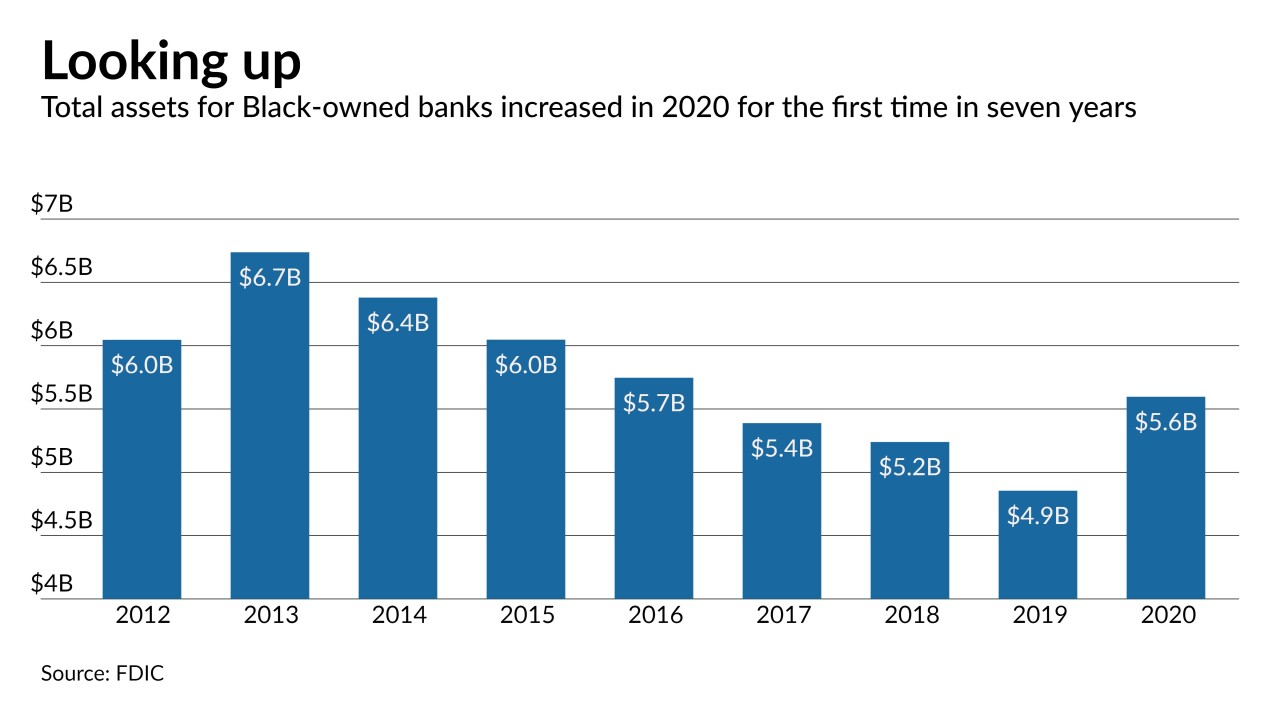

Six startups that seek to cater to Black and Hispanic consumers outside the financial mainstream are attracting heavy interest from investors. However, the new banks will vie with megabanks eyeing those same customers and with established minority-owned institutions suddenly brimming with new capital.

March 4 -

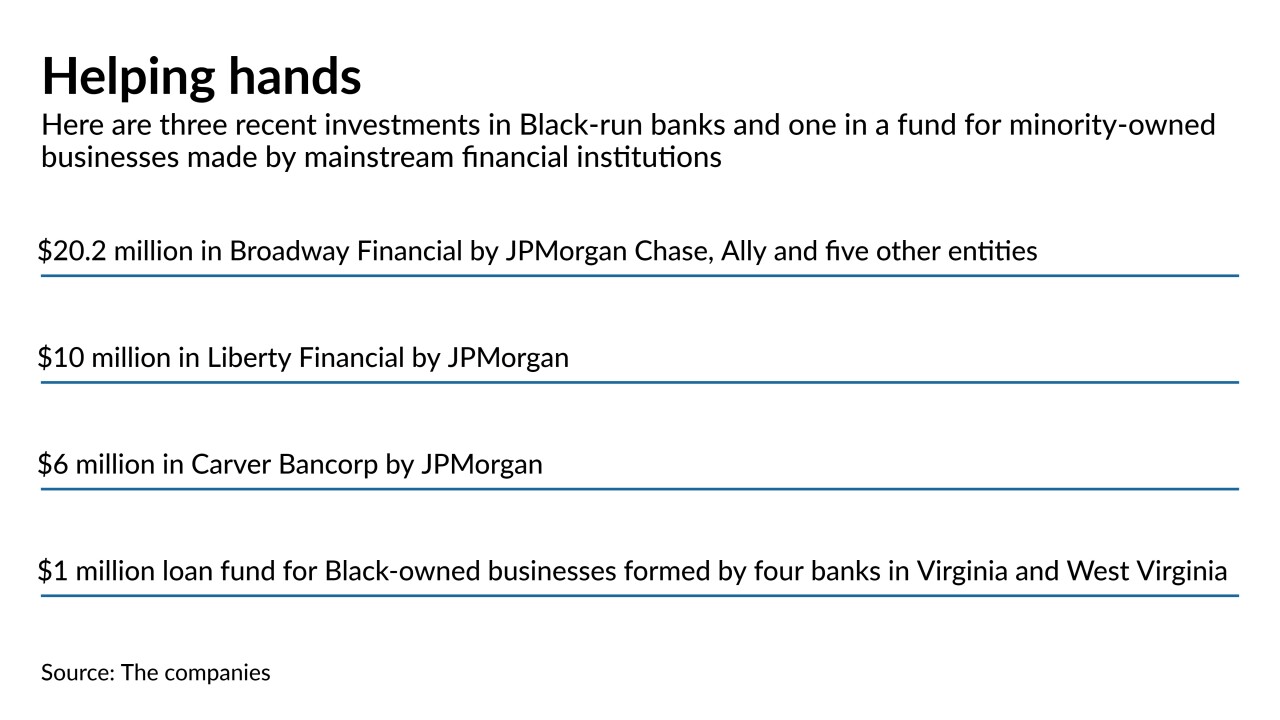

Several large and midsize banks are investing millions of dollars in Black-run banks, while four community banks have started a fund to make interest-free commercial loans in underserved communities.

February 24 -

If you are underbanked you probably have limited access to mainstream financial services normally offered by retail banks. Many fintech startups offer alternative ways to measure credit risk, and assert that their products can help extend financial services to consumers who have not been well-served by traditional banks.

-

The San Francisco company has faced financing challenges as its customers, largely lower-income Latinos, have struggled to keep up with monthly payments.

January 11 -

New guidance from the Consumer Financial Protection Bureau shows how companies that offer workers early access to their wages can avoid being regulated as lenders. But the incoming Biden administration could add new complications.

January 7 -

Challenger banks aimed at Blacks, Hispanics, immigrants and other underserved groups are offering financial education and support for charities in addition to basic banking services.

December 31 -

The Cincinnati bank joins a growing list of banks pledging billions of dollars to fight systemic racism and help close the wealth gap that exists between white and minority households.

December 9 -

The California company, which filed an application Monday with the Office of the Comptroller of the Currency, is following a path charted by Varo Money and SoFi.

November 23 -

The Toronto parent of BMO Harris Bank has joined a growing list of banks directing billions of dollars toward affordable housing and loans to low- and moderate-income communities.

November 11 -

The Pittsburgh-based institution can now serve more than a dozen municipalities in the Keystone State.

November 4 -

The Pasadena, Calif., bank is partnering with and investing $2.5 million in Gig Wage to offer services like debit cards and money management to gig workers, many of whom are among the tens of millions of unbanked and underbanked Americans.

October 27 -

Harvest, a fintech founded by Nami Baral, has developed an alternative scoring method that amasses data on spending patterns, debt payments and even earnings potential to get a better sense of consumers' creditworthiness.

October 1 -

A New York CDFI is halfway to its $100 million fundraising goal for a fund that would put deposits in Black-owned banks and make loans to key businesses or projects. It hopes the moves will improve availability of capital and access to mainstream financial products.

September 4 -

If the U.S. Postal Service can hold talks with big banks, like JPMorgan Chase, about offering financial services in post offices, then it could easily strike up similar conversations with credit unions.

August 26 National Association of Federally-Insured Credit Unions

National Association of Federally-Insured Credit Unions -

The 2020 election has tossed the U.S. Postal Service under extreme scrutiny, pressuring the institution at a time when it has become a potential catalyst for financial inclusion.

August 25 -

If the U.S. Postal Service can hold talks with big banks, like JPMorgan Chase, about offering financial services in post offices, then it could easily strike up similar conversations with credit unions.

August 21 National Association of Federally-Insured Credit Unions

National Association of Federally-Insured Credit Unions -

Treasurer Ma has championed programs to give minority and women-owned businesses a seat at the table throughout her career. A mission of the Treasurer is increasing diversity to increase equitable outcomes.

August 20