-

New president suggests less regulation and meets with bank leaders; state and city check for illegal lending activity.

May 21 -

Although higher corporate debt could hurt the economy, Federal Reserve Chair Jerome Powell argued changes made since the last crisis will guard against a meltdown.

May 20 -

Credit unions are helping out in a number of ways, including one institution that provided scholarships to student who excelled at a game about personal finance.

May 20 -

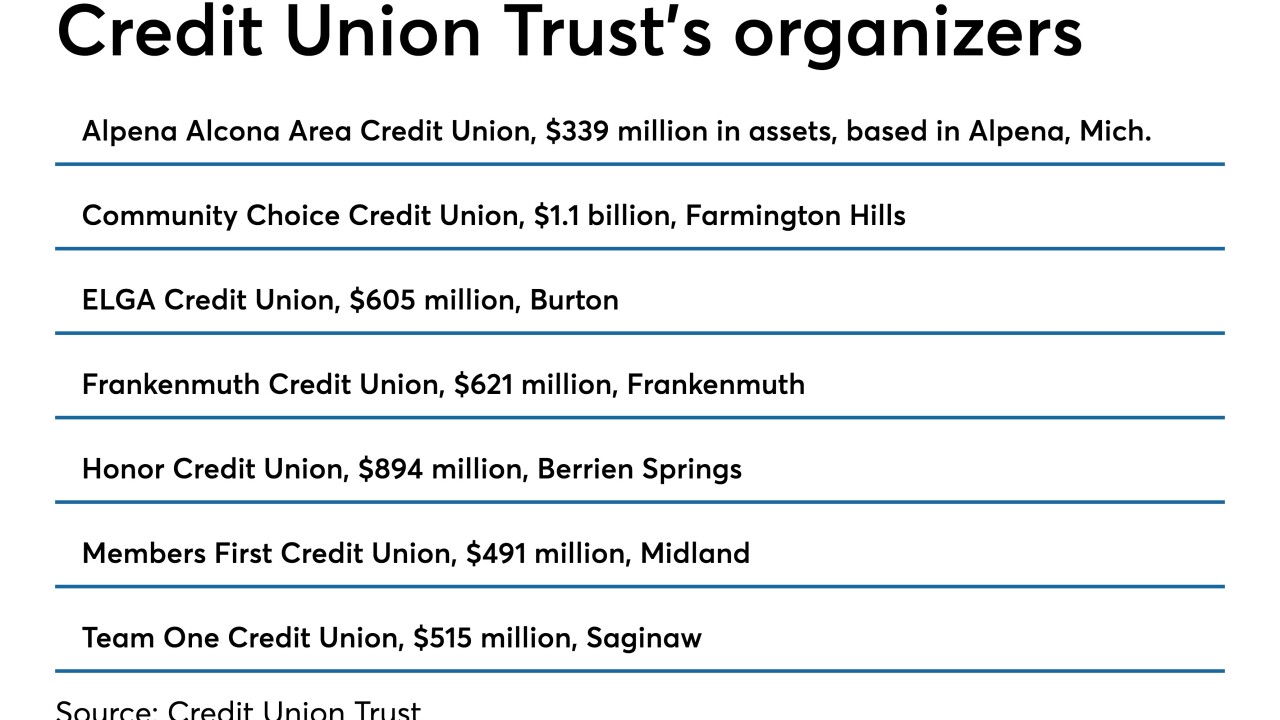

Credit Union Trust, a new credit union service organization, has obtained a bank charter that it will use in offering trust and investment-related services.

May 20 -

Vernon Hill's U.K. bank sold $479 million of new stock and issued fresh details about its turnaround efforts. Those included plans to cease its controversial practice of purchasing design and branding services from a business owned by Hill's wife.

May 17 -

Meridian Corp. may have breached sales agreements after originating nearly $100 million in loans in a state where it lacked a license.

May 16 -

As Metro Bank’s problems mount, calls for Hill’s ouster as chairman are getting louder.

May 15 -

The total includes donations to community groups helping low-income people, support for the development of financial coaching programs and investment in the creation and testing of fintech tools that can help underserved people.

May 15 -

The Illinois company will gain six offices after it buys Investors' Security Trust.

May 13 -

The U.S. government stepped up collections on delinquent student debt to $2.9 billion last year — or an average of $1,000 from 2.9 million former students and their cosigners, according to the Treasury Department.

May 13 -

The London bank, founded by American entrepreneur Vernon Hill, has lost three-fourths of its market value since British regulators found that some of Metro’s mortgages were given the wrong risk weighting.

May 13 -

Plinqit, led by a former banker, was developed specifically for community banks as a way to appeal to young customers.

May 9 -

The company said it could use proceeds from selling common and preferred stock to increase lending and add branches.

May 9 -

The presidential contender’s plan to eliminate more than $1 trillion in student loan debt could have far-reaching implications for credit unions

May 9 -

The Pittsburgh bank says it is selling the assets to Federated Investors to focus its PNC Capital Advisors unit on providing outsourced services.

May 7 -

-

New initiatives could give a boost to an already widely charitable industry, but fickle consumers and uncertain economic waters could prove a challenge.

May 6 -

Profitability improved significantly last year for banks with less than $2 billion of assets, but not because of anything they did. Some troubling trends lurk beneath those big gains too.

May 5 -

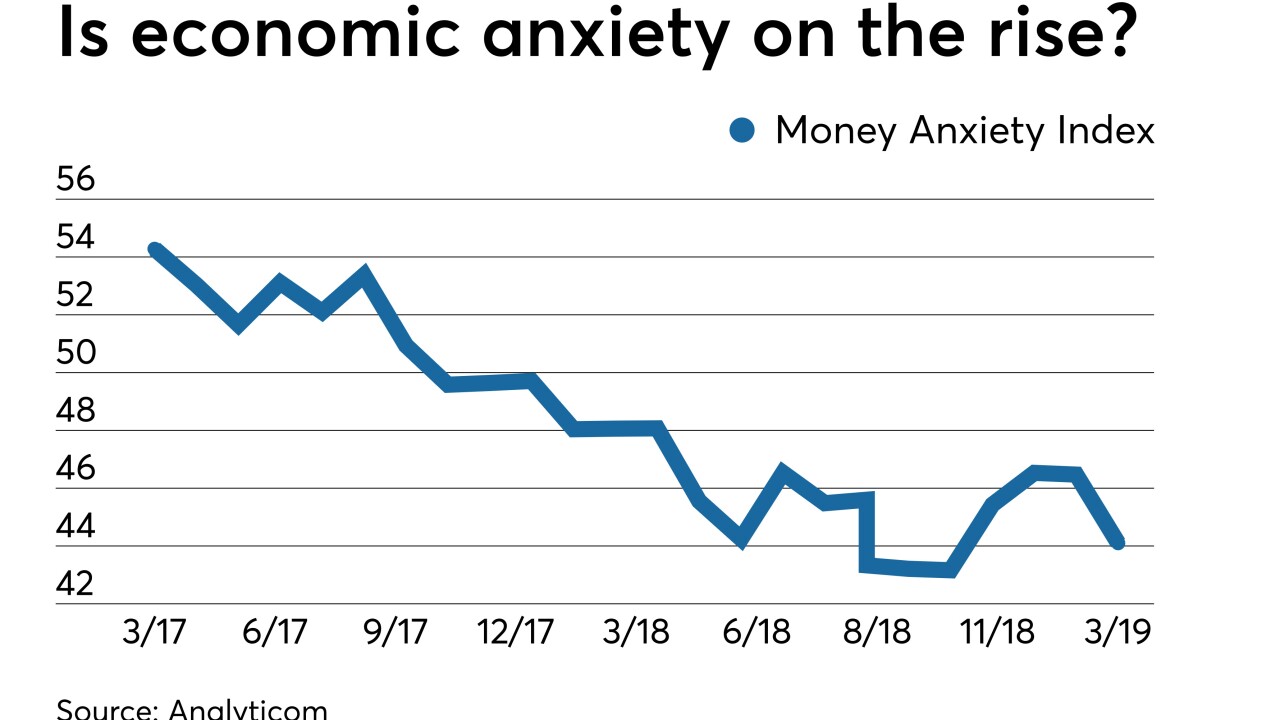

The Money Anxiety Index, a measure of consumer saving and spending habits, has started rising off a 50-year low. The economist who created it says that means another slump is nearing, and that banks should use the intel in pricing deposits and making other decisions.

May 2 -

When a tweet drew backlash from customers and politicians on Monday, it brought into question how banks should couch their messages on social media.

May 2