-

Through its partnership with SpringFour, a fintech BMO Harris mentored in 2017, the Chicago bank is referring customers — including many hurt by the pandemic — to reputable nonprofits to help with job training, financial assistance and more.

May 7 -

Industry giving is likely to decline in the wake of the pandemic, but it could force the movement to update its giving platforms.

May 7 -

The Illinois company will sell Bates Cos. to an undisclosed buyer less than two years after buying the wealth management firm.

May 4 -

Funneling fees from emergency loans to feed the hungry. Supporting psychological counseling for health care heroes and financial advice for the poor. Backing retrofits of customer operations to produce protective gear for front-line medical personnel. Bankers and financial educators have tossed out the traditional playbook to help clients and communities in crisis.

April 30 -

The S&P CoreLogic Case-Shiller home price index hasn't yet reflected the impact of the coronavirus, but an independent market maker has some thoughts on how it might.

April 30 -

Just over 40% of respondents with private student loans said they had worked with their lenders to come up with a plan for reduced payments.

April 28 -

The Los Angeles regional bank recorded the $1.5 billion noncash charge after its stock price ended March below its tangible book value.

April 21 -

As universities move classes online, there are signs enrollment could be down in the coming academic year. That could have a major impact on credit unions’ private student loan portfolios.

April 15 -

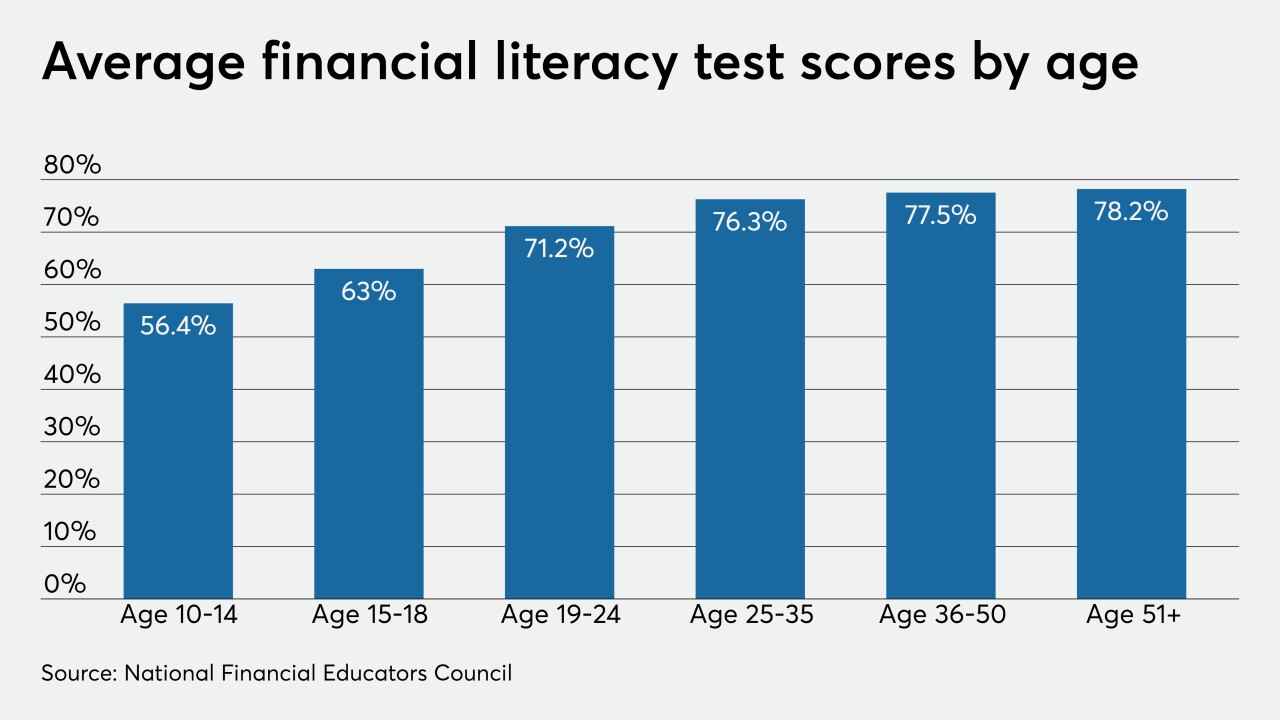

Older Americans also did fairly poorly by getting an average score equal to a C plus.

April 8 -

Requiring banks to test themselves is likely to be a waste of time in the current crisis, says a former Senate Banking counsel.

April 3 Corporations and society initiative at Stanford Graduate School of Business

Corporations and society initiative at Stanford Graduate School of Business