-

Rakefet Russak-Aminoach, who led the Israeli bank for seven years, now funds and helps build fintechs that work with other fintechs and banks.

June 23 -

Mobile payments got an early start in parts of Africa more than a decade ago, but the continent's overall banking infrastructure lags far behind, creating a void for companies like AZA and WorldRemit to fill.

February 14 -

Starling Bank Ltd. is weighing plans for a fresh funding round that could value the U.K. challenger at around 2.5 billion pounds ($3.4 billion), according to people familiar with the matter.

February 11 -

Taavet Hinrikus turned his startup into the one of the world’s biggest digital-payment firms, giving returns of about 35,000% to early investors including Peter Thiel’s Valar Ventures.

February 11 -

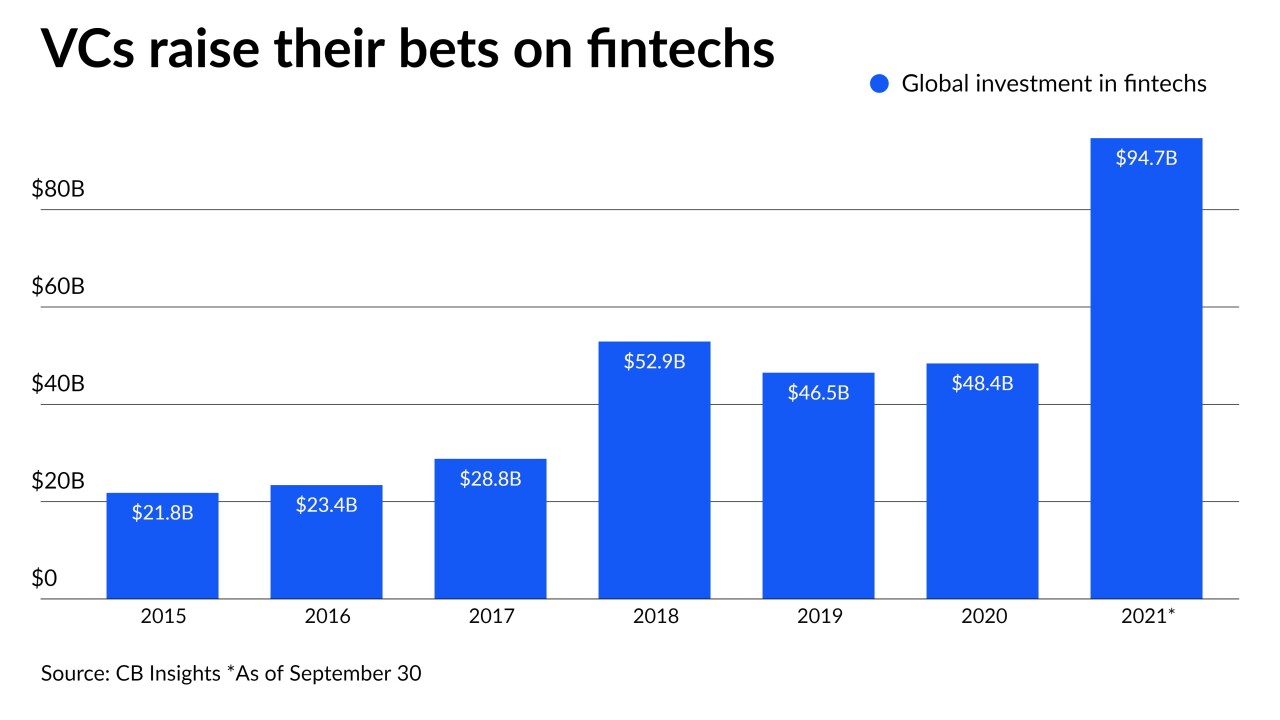

Valuations for payment technology companies skyrocketed over the past year, pushed by a wave of public listings and record venture capital investments. Some potential acquirers are waiting for prices to cool.

January 19 -

The funding is tied for the second-largest crypto- or blockchain-related venture capital deal of the year with FTX Trading’s $1 billion round in July, after Robinhood Markets' $3.4 billion raise in January, according to PitchBook data.

December 14 -

These venture capital firms are investing in young companies that could help small financial institutions meet their growing technology needs.

October 26 -

Maxwell, a startup that operates an online platform catering to mortgage loan officers and smaller lenders, raised $28.5 million in equity funding from investors led by the venture firm Fin VC and Wells Fargo Strategic Capital.

October 26 -

Companies like Ally are mimicking the approach of fintechs by curbing overdraft charges and instituting other changes. It is a sign that startups’ efforts to improve customer experience were successful and that competition in digital-first banking will intensify.

September 24Flourish -

Bilt Rewards, which offers a loyalty program and credit card that converts rent into reward points, raised $60 million from investors including Mastercard and Wells Fargo, giving the startup a $350 million valuation.

September 21 -

Canapi Ventures — created by former comptroller of the currency Gene Ludwig and banker Chip Mahan — and other venture capital firms say Peach Finance stood out because, unlike so many other startups, it's not focused on loan originations.

September 14 -

Industry experts weigh in on the future of wealth management.

July 29 -

The company, which started in personal financial management, has grown quickly by helping consumers avoid overdraft fees and, more recently, adding a no-fee bank account. It's counting on a merger deal with a special-purpose acquisition company to fuel further growth.

June 21 -

Rapyd's new venture capital arm seeks companies that can develop or benefit from an international identity verification system.

June 17 -

The New Jersey bank has been informally funding startups for more than a year. Now it has established Cross River Digital Ventures, which will focus on backing fintechs the bank wants to work with or ones that it feels will benefit the broader industry.

June 17 -

More than 97% of venture backing goes go white-owned startups. Firms like Mendoza Ventures, Chingona Ventures and MaC Venture Capital are stepping in to support underserved entrepreneurs.

June 14 -

The card brand has added a dedicated lane to its startup program to address the venture funding gap for race and gender. Overall, less than 3% of VC funding goes to startups with Black or Latinx founders.

June 9 -

The Curql Fund, an investor in upstart technology companies, is trying to help credit unions build relationships with cutting-edge firms.

June 4 -

Chargebee, a startup that helps enterprises with subscription billing and revenue management, raised $125 million in funding and boosted its valuation to $1.4 billion, reaching so-called unicorn status for the first time.

April 20 -

The financial-technology firm Plaid is close to a new round of funding at a valuation of about $13 billion, almost three months after scrapping its sale to Visa, according to people familiar with the matter.

April 5