-

The central bank is making clear it has doubts about the private sector's ability to implement a faster electronic payments system on its own.

November 15 -

You might expect Manolo Sanchez, the CEO of BBVA Compass, to renounce traditional branches since his bank is spending $117 million on the online-only startup Simple. But he joined other senior bank executives in defending the branch as "still relevant."

March 14 -

Branches are outdated, expensive and unwieldy. For years, bankers have postponed dealing with the dead weight. Now it looks like theyre starting to make the necessary hard decisions. Finally.

December 17 -

If U.S. banks can decrease costs in routine transactions, they will be able to serve mass segments more profitably and invest disproportionately in high-margin services for the affluent.

December 12 -

Valley National Bank (VLY) in Wayne, N.J., is joining the trend toward self-service banking with a plan to upgrade the technology at most of its 204 branches over the next five years.

December 23 -

The Minneapolis bank is adding new imaging and location-aware features to its mobile banking apps.

April 1 -

Capital One takes a bold idea and runs with it in a new promotional video featuring adventurer Jonathan Watson using its mobile banking app while participating in Atlantas Great Bull Run.

November 14

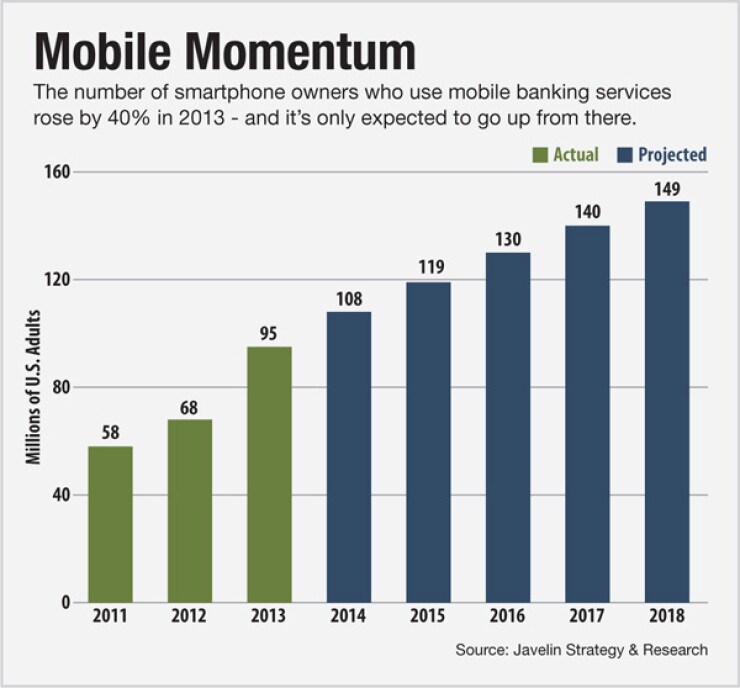

Many lenders see mobile banking as the Taylor Swift of financial services: undoubtedly popular, but mostly among the young.

Now the technology is going mainstream, according to a new report from Javelin Strategy & Research. The number of mobile banking users in the U.S. is projected to rise to 149 million in the next five years up 57% from 2013.

If banks want to ready themselves for waves of mobile customers from all walks of life, they need to ensure that their apps are fast and easy to use, according to the report. They also need to develop branch strategies that evolve apace with the digital times.

At a minimum, banks should make their mobile apps Luddite-friendly, says Mary Monahan, a research director at Javelin who co-authored the survey of 3,285 respondents conducted in July 2013.

"Twenty-seven million people adopted mobile banking" between 2012 and 2013, Monahan says. "These new users are not first adopters who are willing to put up with figuring out how to do something. They're going to be trying out [mobile banking] for the first time, and they're going to want it to work."

Lenders looking to ensure that their app features are as simple as possible might take a cue from U.S. Bancorp (USB), according to Monahan. The Minneapolis company introduced

Banks can further simplify mobile customers' lives with features that offer shortcuts for frequent transactions, according to the report. Lenders like SunTrust Banks (STI) in Atlanta and

"We identify that it's your phone and all we're really showing is the balance, so it's not really a security risk," says Jeff Dennes, who heads SunTrust's digital services.

Banks should also work on streamlining and speeding up their peer-to-peer payment options, according to Monahan. Right now, her bank allows her to send online payments over her phone but only after she's entered information about the intended recipient on her computer. "That's crazy!" she says.

Peer-to-peer payments also

Banks that want to stand out among their competitors should give mobile customers the ability to add new accounts via smartphones and tablets, according to Monahan.

"That's really rare in the banking world," Monahan says, noting that know-your-customer requirements which mandate that lenders gather key information about clients to reduce the risk of money laundering and other illegal activities may hold them back from offering this option. "But there are definitely vendors that have the capabilities to do it," she says. "You want to be able to open mobile banking accounts and also savings accounts, CDs, money market funds."

Meanwhile, banks of all sizes are revamping but not necessarily replacing branches as customers learn to do more for themselves from home, the coffee shop or the carpool line.

Citigroup (NYSE: C) announced in mid-March

Valley National Bank (VLY) in Wayne, N.J., launched an initiative in late 2013 to integrate more self-service technology into its branches. Operating on a hub-and-spoke model, the bank is reducing staff at some branches, counting on automated technology like interactive video teller machines to pick up the slack.

"

Valley National is also working to integrate mobile technology into its physical outlets, Piro says. One initiative will allow clients to bring tablets into branches that they can use to open new accounts.

"There's still a need to have bank branches out there, I fully believe that," Piro says. "There's always going to be that need for human interactions."

Indeed, branch visits remain a fairly regular outing for the majority of bank customers, according to a new study from Bankrate.com. Seven out of ten people in the March survey of 1,003 customers said they had visited a branch within the last six months. Half of the respondents said they had been to a branch within the last month.

The study also found that customers visited branches with similar levels of frequency, regardless of age. Forty-two percent of people under age 30 had been to a branch within the last 30 days, while 52% of those over 50 had, too.

Customers "may not necessarily need or want to go [to branches] now," says Greg McBride, Bankrate.com's chief financial analyst. "But they take comfort in the feeling of knowing that they could."

This news suggests that while mobile banking may have a big impact on branches, the technology is unlikely to replace them.

"Branches are going to have to change," Monahan says. "But there'll always be a need for advisory services. How do I invest, how do I save money for retirement those kinds of questions need to be answered in person."