Bankers aren't known for being warm and fuzzy.

But the idea of being more empathetic, an idea championed by startups, is insinuating itself into the wider banking landscape.

“I feel like this industry, more than any other industry in America, really needs to have a sense of empathy for the customer and clients that we serve each and every day,” Joel Kashuba, head of innovation and design for Fifth Third Bank, said last week at American Banker’s Digital Banking conference.

He isn't talking about a marketing campaign, but changes to business models. In some cases, that means skipping revenue opportunities in the name of making customers' lives better.

Challenger bank Chime operates on that idea, as the company claims customer financial wellness is its first goal.

“Current business models don’t align well with leading consumers to financial health,” Melissa Alvarado, vice president for growth and analytics at Chime, said during a panel at the conference. “With Chime, we wanted to make sure people had better options to lead healthier lives.”

That meant forgoing fees associated with banking, such as overdrafts and monthly account maintenance.

Chime once charged a foreign transaction fee, but eventually eliminated it. Customers do pay $2.50 for out-of-network ATM withdrawals, but Chime provides customers access to a free network with 33,000 locations through Moneypass and the Visa Plus Alliance.

Alvarado said the no-fee approach means Chime relies solely on interchange fees for revenue. Chime’s idea behind the no-fee structure helps its debit card become top-of-wallet with users, which leads to more interchange revenue for the bank, Alvarado added.

“It’s a business model that aligns with financial health” since Chime is not making a precarious situation worse for customers by charging any fees, Alvarado said.

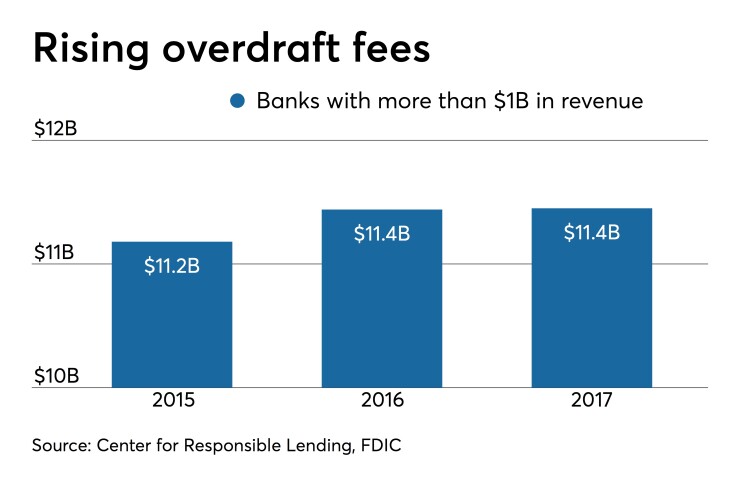

Megabanks aren’t likely to follow Chime and eschew overdraft and monthly maintenance fees out of goodwill, however. There’s too much money involved. Banks collected $11.45 billion in overdraft fees in 2017, according to the latest available data from the FDIC.

But there are other ways banks can work empathy into financial services.

“Money is certainly emotional and banks have a great responsibility, as well as an opportunity, to help guide those emotions,” Jacob Jegher, senior vice president of banking and head of strategy at Javelin Strategy & Research, said on the sidelines of the conference.

Banks have begun offering features that put a more positive spin on customers’ financial habits. While the true effectiveness of personal financial management tools with customers is debated within the industry, every major bank features them within their mobile banking app.

Bank of America has taken that a step further and is using artificial intelligence and analytics to provide customers with what it calls "proactive insights,"

Jegher said the “positivity” surrounding customers’ finances is something “that needs to be integrated into digital experiences.”

“In the early days of money management, it was all about bad news,” he added. “It was, ‘You spent too much in this category, or, ‘You spent too much relative to your peers.' "

“That paradigm needs to be flipped. It needs to be turned into how we can help consumers,” Jegher said.

The prevailing thought in the industry among observers is that if banks don’t provide empathy as a part of financial services, consumers will turn elsewhere.

One such alternative, the microsavings app Digit, was founded on many of the same principles as Chime.

“We really believe there is a deep, societal need when we think about financial health, and that’s why Digit exists,” Ethan Bloch, Digit’s founder and CEO, said during the same panel as Alvarado.

Another Digit feature lets customers link credit card information to a Digit account to make extra payments to reduce debt. Customers using that feature could potentially pay off an extra $1,000 in debt per year, Bloch said.

“We’re trying to get a better understanding of the impact that has one someone’s life,” he said.