Credit analysts say climate risk could still pose a financial threat to financial institutions, even though the federal government has taken an ax to Biden-era climate guidance.

A core processing startup gets $16 million and a U.K. challenger bank raises $27.6 million.

-

The reduced pace of consumers moving into delinquency adds evidence to the thesis that households are facing lower financial stress.

-

Bank fees don't arise from a naked profit-grab, but from an effort to offset current or expected losses. Eliminating one kind of fee just pushes banks to find an alternative method of recouping those losses.

-

The Swedish payments company ends months of speculation about whether Klarna would list. Analysts valued the company last month at about $14.6 billion.

The lumbering pace of product development is one of the typical drags on large bank technology firms, while nimble startups can seemingly launch new offerings overnight.

Heightened expectations for increased economic activity could boost loan demand after a soft 2024.

The tentative settlement represents a step toward resolving an issue that hung over Capital One's acquisition of Discover. That blockbuster deal closed on Sunday.

-

The next few years will mark the transition of sustainable finance in Latin America through its adolescence and towards maturity.

-

Banking regulators' push for higher capital for the largest banks may very well pass in some form, but before it does, there needs to be an articulated plan for tackling the migration of banking activities out of the banking system.

-

The CFPB is well within its authority to make these changes, which will increase the availability of credit to many Americans.

-

The 23rd annual dinner honored bankers and finance leaders at the top of the industry.

-

Zelle's parent Early Warning Services said Friday it was planning to take its peer-to-peer payments network international through a new stablecoin initiative. It says the details will come later.

-

Nicolet Bankshares has agreed to buy MidWestOne Financial in an $864 million, all-stock deal. The acquisition will move the Wisconsin-based buyer into Iowa and the Twin Cities, while also allowing it to vault past a key regulatory threshold.

-

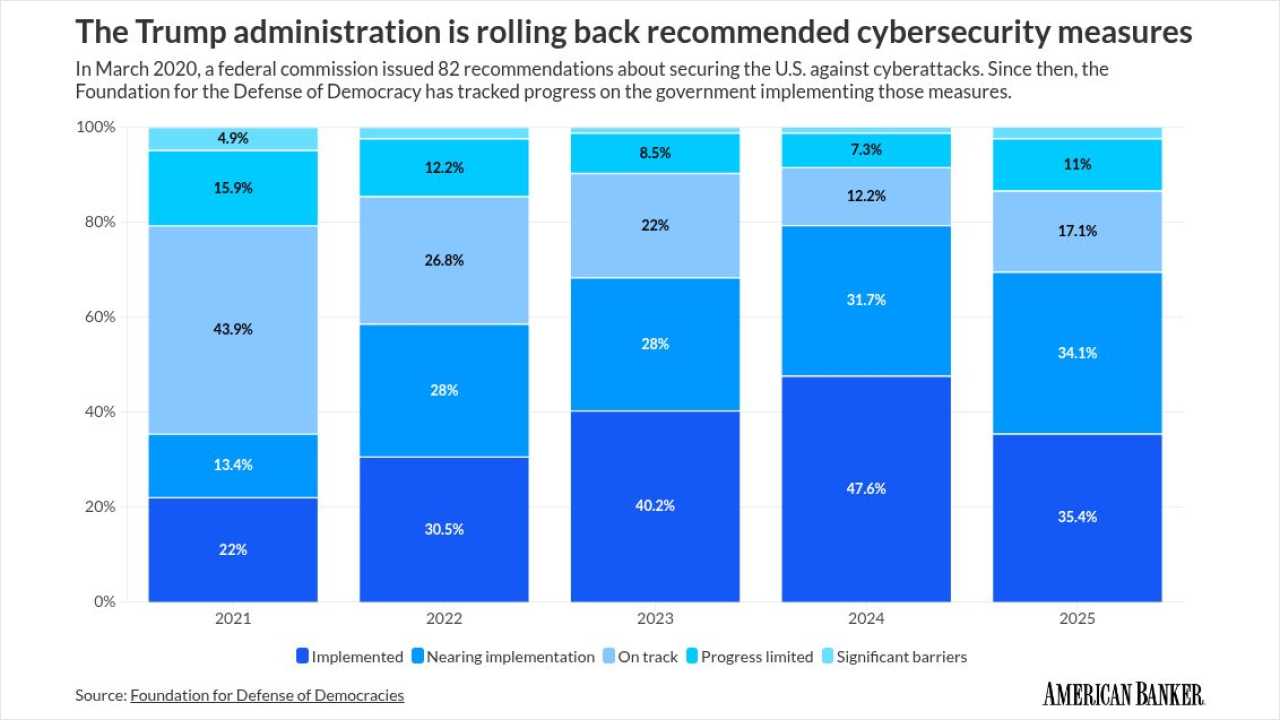

A think tank report details setbacks in U.S. cyber strategy, from shuttered partnerships and staff cuts to the expiration of key info-sharing laws.

-

Needham and Provident banks received all regulatory approvals and merge date; JPMorganChase hired veteran tech dealmaker Kevin Brunner from Bank of America; RBC Capital Markets will expand its presence in the equity derivatives market with two senior hires from UBS; and more in this week's banking news roundup.

-

The Federal Reserve Friday issued a set of proposed changes to its stress testing program for the largest banks that would disclose the central bank's back-end stress testing models, a move that the Fed had long opposed out of fear of making the tests easier for banks to pass.

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- TechnologyWednesday, ThursdayThe latest industry developments from digital banking to cybersecurity to AI.

- PaymentsDelivered Every WeekdayAn early-morning roundup of important headlines from the past 24 hours.

- Best of the WeekFridayThe most important and widely read stories from the previous week.

Treasury Secretary Scott Bessent said the Federal Reserve Board should reject the renomination of any regional Federal Reserve Bank presidents who have not lived in their districts for three years, signaling a potential confrontation when reappointments come before the board in February.

As artificial intelligence boosts productivity gains, there is a danger that additional profits will accrue only to investors, leaving workers in the dust. A "10% for the people" tax could allow everyone to share in AI's benefits.

The 23rd annual ranking of women leaders in the banking industry.