Fifty years of sanctions has forced the Middle Eastern country to develop its own isolated financial system. But money has still found a way to move in and out of the country.

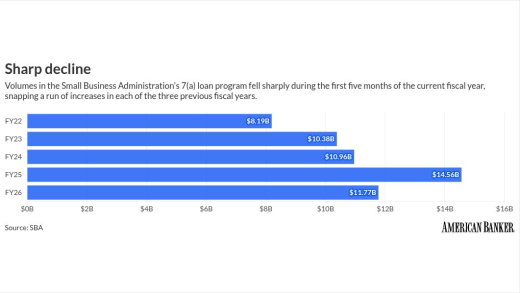

Fintech lenders are positioned to help businesses navigate the latest round of global tariffs announced by President Trump, even as the volatility causes overall decreases in loans.

-

In separate arrangements, Mastercard is working with SoFi and Visa is working with Bridge to build scale in anticipation of greater demand for the digital asset.

-

With the likes of Amex and JPMorganChase upgrading card perks, BofA is expanding no-fee access to more customers and products and adding incentives.

-

Block last week cut 40% of its staff and attributed the layoffs to artificial intelligence, leaving many to wonder whether Jack Dorsey's payments company was a bellwether for widespread AI-driven layoffs, or a one-off.

Cybersecurity stocks tumbled after Anthropic unveiled a new vulnerability scanner, prompting vendors to defend their runtime protection platforms.

Senate Banking Committee Chair Tim Scott, R-S.C., told reporters that community banking didn't fit into the housing package moving forward in the upper chamber, but that he's in discussions with House leaders and the White House to move a separate financial services package.

Sens. Tim Scott, R-S.C., and Elizabeth Warren, D-Mass., released new legislative language Monday night that includes a ban on institutional investors' purchase of single family homes and a temporary ban on the Federal Reserve issuing a Central Bank Digital Currency.

-

Sanctions forced Iran to build its own financial network, but technology allows it to take the war anywhere

-

The Block CEO said companies will need fundamentally fewer workers in the AI age. The question is, how many fewer?

-

If the next phase of digital money policy is to succeed, it must grapple with a simple truth: People do not experience money through legal categories. They experience it through use. That's a fact that supervision must account for.

-

The Supreme Court slammed the door on CashCall's final appeal, cementing a massive win for the Consumer Financial Protection Bureau after a 12-year legal marathon.

-

"AI may not take your job, but somebody who knows AI will," says Raymond George, CIO of Clearview Federal Credit Union.

-

The proposed national trust charter company would be a wholly owned subsidiary of Morgan Stanley. The application was filed on Feb. 18.

-

Fulton Financial received the necessary approvals to acquire Blue Foundry Bancorp; JPMorgan hired two Bank of America health care veterans while shuffling leadership; Mizuho Financial Group has plans to replace about 5,000 administrative jobs with artificial intelligence over the next 10 years; and more in this week's banking news roundup.

-

Preferred Bank moved a $115 million block of loans to nonaccrual status after the borrower, which is battling fraud charges leveled by other banks, began missing payments.

-

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- TechnologyWednesday, ThursdayThe latest industry developments from digital banking to cybersecurity to AI.

- PaymentsDelivered Every WeekdayAn early-morning roundup of important headlines from the past 24 hours.

- Best of the WeekFridayThe most important and widely read stories from the previous week.

-

The annual rankings honor the notable performances of individuals in banking and finance and as teams.

-

Call for submissions for women 40 years and younger who are rising leaders at their bank or financial institution.

-

Think your credit union has one of the best workplaces in the country? Here's how to apply for American Banker's ranking of the Best Credit Unions to Work For.

The 23rd annual ranking of women leaders in the banking industry.