Market watchers expect the Federal Open Market Committee to announce a 25 basis point rate cut today, but are also watching for signals of more cuts to come and how many members push for a larger 50 basis point cut.

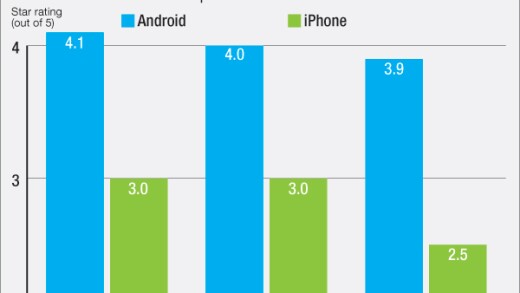

U.S. Bank recently updated its mobile app to a system that would allow it to react more quickly to new technology. It's going to need that flexibility now that consumers are complaining about missing features in the latest upgrade.

-

The Federal Reserve would seem to offer a compelling alternative to the bank-backed RTP network, but some credit unions — which typically see bank systems as competitive threats — are making more nuanced choices.

-

In the news this week: A consumer group filed a complaint against Starbucks over its mobile app and reloadable gift cards, Apple Pay added a new payment tech firm, The Clearing House hired Amanda Stewart as its new marketing chief, and more.

-

These executives have taken charge at firms like PayPal, Discover and Early Warning Servcies during a volatile time for the entire industry.

CEO Max Levchin said the lender is testing technology that allows merchants to perform more advanced testing of promotional financing offers.

Quaint Oak Bancorp sold its majority stake in an equipment lender less than two years after the partnership helped drive record profits at the Southampton-based company.

Capital One's five-day interruption, President Trump's planned dismantling of the Consumer Financial Protection Bureau and more this month.

-

We can't afford to miss this opportunity to build capacity in community development financial institutions.

-

Banks have been barred from trading on their own account for almost a decade because Congress wanted to quash any potential conflict of interest. They should hold themselves to the same standard.

-

Small-business owners who can't get loans from traditional sources need alternative ways to access capital.

-

This corporate "lifer" is building a rich legacy that's going to be hard to beat, but she's committed to helping others follow her playbook.

-

The firm's 'management-as-a-service' philosophy fuels Ferris' achievements.

-

A penchant for asking questions led to Cheslin's promotion to managing director.

-

Levine built BNP Paribas' cash equities business three years ago and now trades billions of dollars daily for clients.

-

In her role, Honeycutt has to challenge business line leaders to ensure the bank's capital is deployed appropriately.

-

Naroditsky is leading initiatives that combine how faster payment processing improves the bank's delivery of products through partners.

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- TechnologyWednesday, ThursdayThe latest industry developments from digital banking to cybersecurity to AI.

- PaymentsDelivered Every WeekdayAn early-morning roundup of important headlines from the past 24 hours.

- Best of the WeekFridayThe most important and widely read stories from the previous week.

Huntington's $7.4 billion acquisition of Cadence would give the Ohio-based bank a top-five market share in both Dallas and Houston. It comes just a week after Huntington closed its last Texas acquisition.

Empowering Small and Mid-Sized Businesses: A Bank's Role in Local Economies

The 23rd annual ranking of women leaders in the banking industry.

- Sponsor Content from PrecisionLender

- Sponsor Content from PrecisionLender

- Sponsor Content from Atos

- Sponsor Content from Donnelley Financial