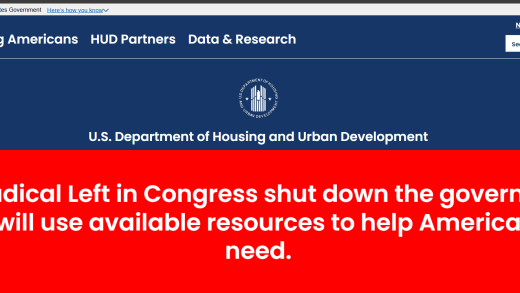

Department officials pushed back on criticism that a banner on its homepage violated a statute meant to curb partisanship in government operations.

Huntington Bancshares is the latest institution to add a cybersecurity expert to its board, highlighting the growing importance of guarding against hackers and other online dangers.

-

Michigan State University Federal Credit Union is working with the relationship-based lending app Zirtue to offer members a tool for outlining lending agreements and repayment plans.

-

GLS had already stopped issuing first-use plastic as of 2018, but it wasn't enough for the eco-minded German bank. Fake plastic still looks and feels like plastic.

-

The Wyoming-based digital asset bank filed paperwork to challenge last month's district court ruling, which affirmed the Federal Reserve's view about its discretion over master account applications.

Decision Intelligence uses artificial intelligence iin an attempt to increase the accuracy of real-time approvals of safe transactions and reduce false declines.

Industry Bancshares got into a deep hole after rising interest rates tanked the value of its sizable bond portfolio. Now the Texas community bank is expecting a $195 million capital infusion and taking steps to start relying more on revenue from loans.

New guidance from the Office of Personnel Management states that unions' collective bargaining agreements cannot interfere with mass layoffs carried out by federal agencies.

-

In his new book, the technology and financial services veteran Thomas Vartanian explores how countries could band together to create a more secure digital world while explaining what's holding society back from achieving this.

-

The Financial Stability Oversight Council is clearing the administrative road to designate nonbank firms and activities as systemically risky, but if it wants those designations to stick it needs the public on its side.

-

Federal officials should have protected both banks' uninsured depositors by following the law's carefully designed framework for dealing with failures of systemically important banks.

-

After a slump of several years, there's been a renewal of payment and financial tech firms going public.

-

Senate Banking Committee ranking member Elizabeth Warren, D-Mass., led a group of congressional Democrats in a letter to bank regulators telling them that loosening capital rules wouldn't improve the Treasury market's functioning.

-

The cards, which are expensive, have not grown quickly. But payment companies are angling for a pickup.

-

The dollar-backed digital assets have to clear many hurdles before they find a place in the future of finance, speakers at a Columbia University event said.

-

The bank teamed up with Euronet Worldwide subsidiary Dandelion for cross-border payments to digital wallets in the Philippines, Indonesia, Bangladesh and Colombia in an optionality play.

-

S&T Bancorp is shuffling its board structure as Chairwoman Christine Toretti plans her departure; Philip Bohi is named general counsel of the American Financial Services Association; Coastal Community Bank appoints Brandon Soto as its new chief financial officer; and more in this week's banking news roundup.

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- TechnologyWednesday, ThursdayThe latest industry developments from digital banking to cybersecurity to AI.

- PaymentsDelivered Every WeekdayAn early-morning roundup of important headlines from the past 24 hours.

- Best of the WeekFridayThe most important and widely read stories from the previous week.

HoldCo Asset Management drops its pursuit of proxy battles with Columbia Banking System and First Interstate; Cape Cod's Mutual Bancorp prepares to acquire Bluestone Bank; Servbank HoldCo announces plans to acquire IF Bancorp; and more in this week's banking news roundup.

The 23rd annual ranking of women leaders in the banking industry.

-

-

- Sponsor Content from SAS

-