Levine built BNP Paribas' cash equities business three years ago and now trades billions of dollars daily for clients.

Can true innovation happen when so much of the industry is still working on systems built in the 20th century?

-

Australia plans to put Apple Pay and Google Pay under the same rules that apply to credit cards, NatWest is inviting customers into its branches for a tabletop game about the perils of financial scams and more.

-

Two years after acquiring the installment lender Afterpay, Block, which also owns Square, is seeing the payoff of a strategy that focuses on the sale of specialty items.

-

Goldman Sachs, which has been trying to jettison its struggling credit card business, now has a potential way out of its partnership with Apple.

Federal Reserve Vice Chair Philip Jefferson said in a speech Friday that long-term productivity gains brought on by artificial intelligence could compel the central bank to maintain higher rates to keep prices stable.

The Office of the Attorney General in New York says the bank violated the state's Exempt Income Protection Act, illegally transferring customers' money to debt collectors.

The Senate Banking Committee Chair launched an agenda that puts agencies on a shorter leash and separately took aim at the FHFA recent moves.

-

Strong climate policy and continued development of stress-testing tools by central banks are essential to transitioning to carbon neutrality.

-

We’re all entitled to our own opinion at work, but what if it starts impacting improvements and growth?

-

Here's what industry executives have stopped talking about — and what they're focused on today.

-

The payment company is incenting users to adopt Perplexity's Comet Browser, automating subscription management and shopping as card networks and other payment companies ramp up use of generative artificial intelligence.

-

The wireless service plans join a variety of banking and payment products offered by OnePay, a fintech company backed by the big-box retailer Walmart.

-

Credit Union of Colorado is using Scienaptic AI to make about 60% of consumer loan decisions.

-

The database contained internal user emails, KPI report templates and other internal data, but no personal or financial customer data.

-

Stephen Miran will take unpaid leave from and might seek to return to President Trump's Council of Economic Advisers, he said, raising conflict of interest questions in his nomination hearing for a seat on the Federal Reserve Board.

-

The Justice Department has opened a criminal investigation into Federal Reserve Gov. Lisa Cook and allegations of mortgage fraud, allegations that spurred President Trump to terminate her position on the Fed Board last week. Cook is challenging the president's authority to remove her in court.

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- TechnologyWednesday, ThursdayThe latest industry developments from digital banking to cybersecurity to AI.

- PaymentsDelivered Every WeekdayAn early-morning roundup of important headlines from the past 24 hours.

- Best of the WeekFridayThe most important and widely read stories from the previous week.

In a series of inspiring Lightning Talks, hear from top banking and fintech executives as they present the business metric they're most proud of this year

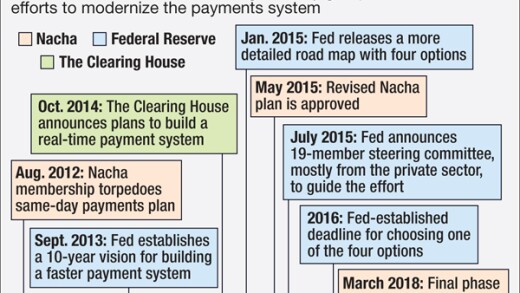

As customers expect banks and financial institutions to conduct business on their behalf in real time,

The 23rd annual ranking of women leaders in the banking industry.

-

- Sponsored by S&P Global

- Sponsored by S&P Global

- Partner Insights from Copado