-

The core-banking vendor won the investment and ringing endorsements from the trade group and several banks because its open system and cloud delivery could eventually challenge entrenched tech players.

January 25 -

The question of what banks are doing to aid government workers shows how the industry is still struggling to rebuild its image following the crisis.

January 24 -

Financial institutions of all sizes are offering low- or zero-rate loans, waiving fees and making other arrangements to aid federal workers — a practice that regulators officially blessed on Friday, the 21st day of the closing of many U.S. agencies.

January 11 -

The American Bankers Association has called for an end to the government shutdown, saying it has prevented customers from securing loans and threatens even more damage.

January 11 -

More consumers fell behind on their loans in the third quarter of 2018, even as average wages rose and the unemployment rate fell to a 50-year low.

January 8 -

An “emergency merger” with the troubled Progressive Credit Union gives PenFed — already the nation’s third-largest credit union — the ability to welcome any potential member nationwide.

January 4 -

An “emergency merger” with troubled Progressive Credit Union gives PenFed – already the nation’s third-largest credit union – the ability to welcome any potential member nationwide.

January 4 -

Both sides acknowledge where expectations haven't been met, and are feeling the same market pressures to adapt faster.

December 28 -

Both sides acknowledge where expectations haven't been met, and are feeling the same market pressures to adapt faster.

December 28 -

Lawmakers and industry groups were caught off guard when FEMA said it wouldn't issue flood insurance policies during the government shutdown, despite an extension passed last week.

December 27 -

There are steps financial firms can take to protect their customers in the event a major wireless network is compromised, including reconsidering the use of SMS messaging for account authentication.

December 24 -

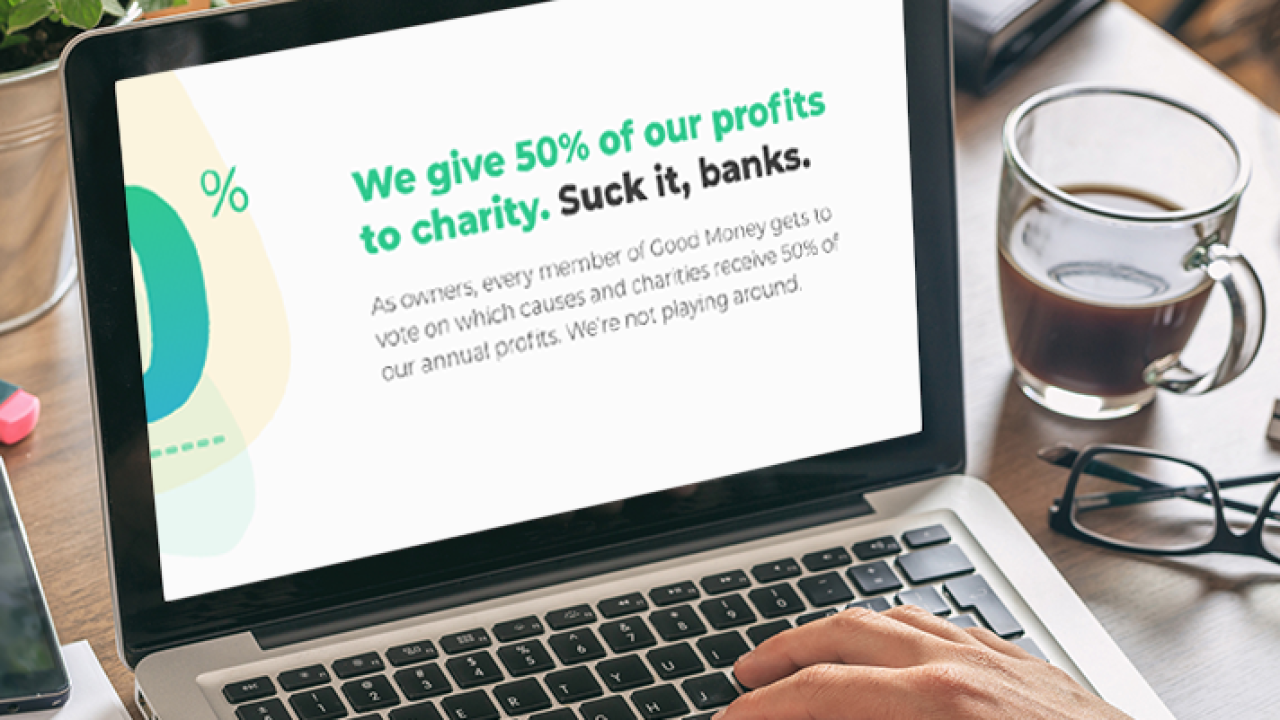

Good Money just raised $30 million and is a year away from launching, but already is raising concerns for its trash-talking of established players.

December 19 -

The fintech's new products may violate several banking and securities regulations and could mislead the public about the differences between coverage on banking and investment accounts, industry officials say.

December 14 -

One week after NCUA filed its own appeal brief, three major organizations banded together in support of the expanded field-of-membership rule

December 14 -

The regulator claimed Congress has already granted it the authority to define field-of-membership areas.

December 7 -

A recent report – supported by the National Council of Postal CUs – says the USPS is ill-equipped to manage the risks involved in offering banking services.

December 7 -

A report released Tuesday echoes bankers’ arguments that the USPS is ill-equipped to manage the risks.

December 4 -

Bank groups are pushing a variety of proposals to delay the loan-loss rule or soften its impact. The accounting standards board has agreed to review at least one of them — but at a pace that might not be fast enough for lenders.

November 21 -

Tester is the only Democratic supporter of the recent regulatory relief package sitting on the Banking Committee to win re-election this fall.

November 7 -

Jon Tester is the only Democratic supporter of the recent regulatory relief package sitting on the Banking Committee to win re-election this fall.

November 7