-

By using some of the sales and performance analysis associated with e-commerce, Revel says the inherent advantage that stores have in connecting with consumers can be enhanced for the next generation of retail competition.

January 4 -

The phony-accounts scandal at Wells Fargo illustrates how sales quotas can incent bad behavior. Is your bank effectively mitigating the risk of 'managing to metrics'? Or could it be in danger of becoming a 'cargo cult'?

January 2 -

Even in a digital era, human connections still matter. That is one big disadvantage for fintech startups and increasingly for banks as customers stop making regular branch visits. So it is instructive to hear SoFi's thinking on how to overcome this challenge. It is trying some unorthodox tactics to better understand the people behind the data and to create meaningful connections with them.

January 2

-

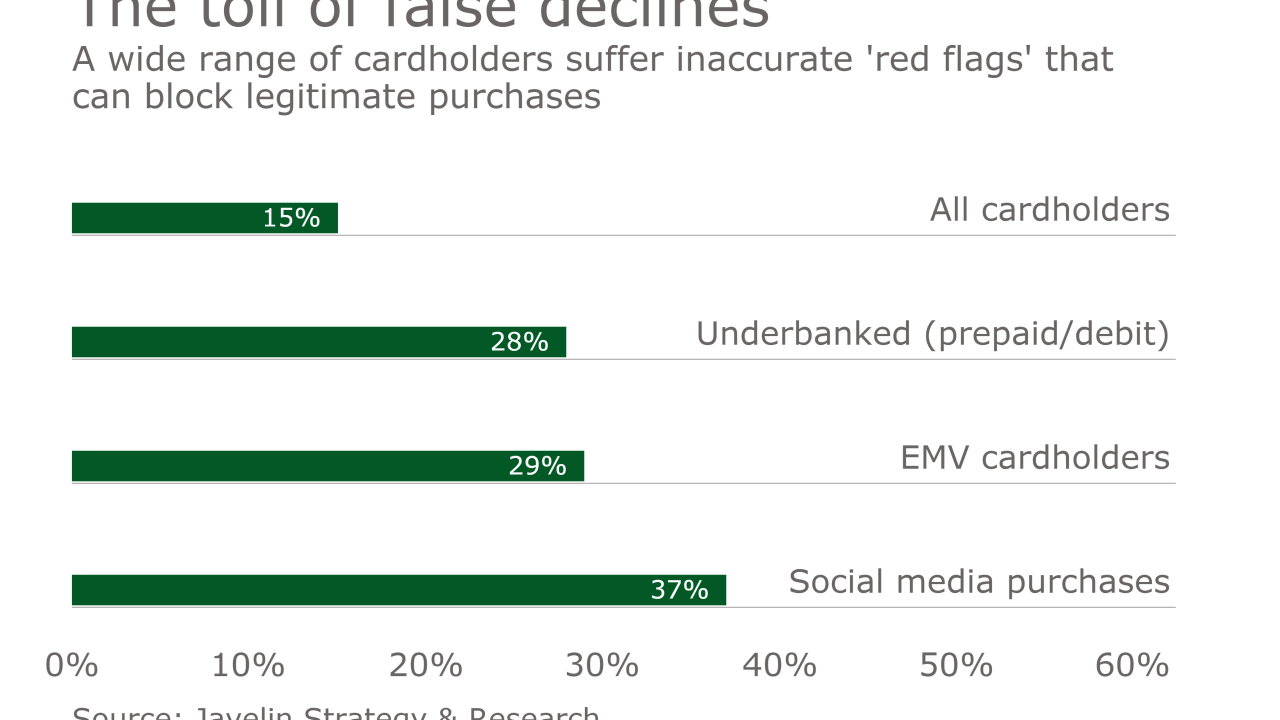

The time banks have to investigate red-flagged credit payments has shrunk from several days to a few hours and fraudsters have already taken notice.

December 29 -

Banks have used biometrics for about a decade, but there are a number of hurdles that banks, device makers and customers need to overcome before passwords are history.

December 27 -

With identity management now established as a distinct industry, it needs an organization to nurture its practitioners like those that exist for the privacy and security sectors.

December 21 Kantara Initiative

Kantara Initiative -

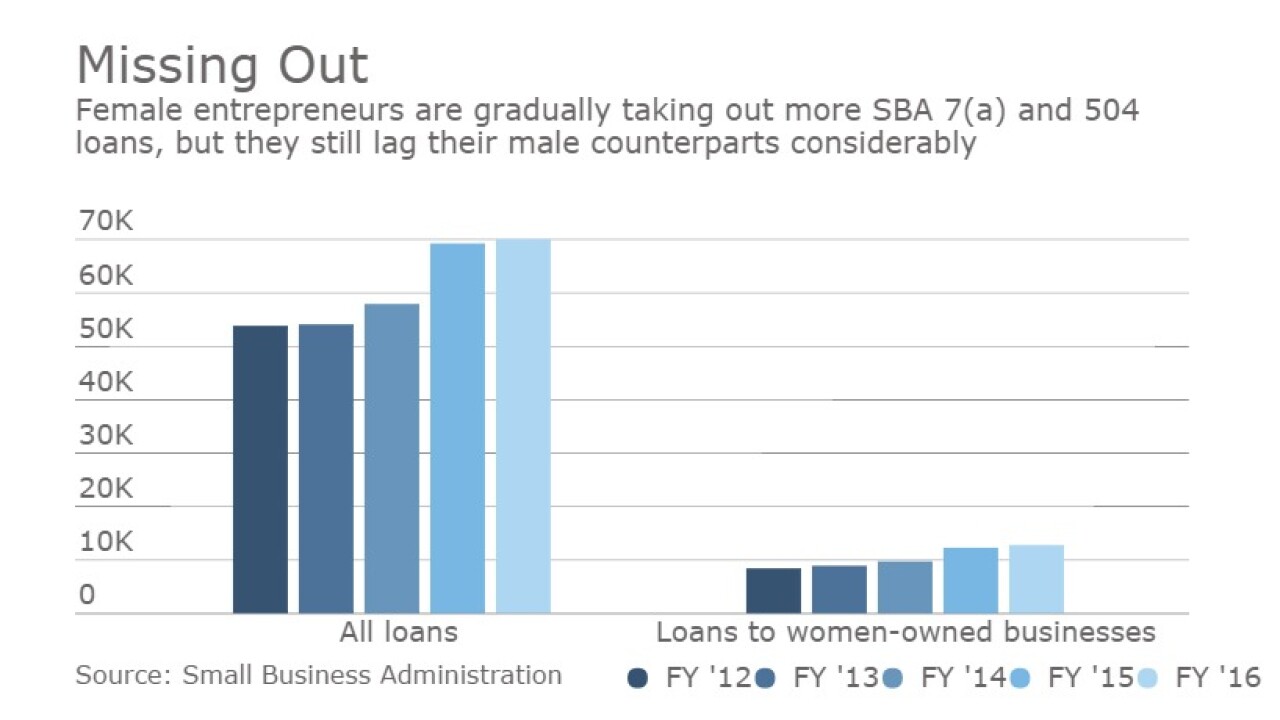

Female entrepreneurs who apply for loans online and are evaluated by an automated system get a bigger share of online credits than they do traditional in-person bank loans. It could be a sign that automated credit decisions are fairer.

December 20 -

The appeal of information pathways such as the internet were seen as possibly bringing about a "comeback" for artificial intelligence in financial services in the 1990s.

December 19

-

Banks should embrace artificial intelligence so that they can more easily navigate policy shifts that will affect their compliance resources and processes.

December 14 The Rudin Group

The Rudin Group -

The core-tech vendor Fiserv has agreed to buy Online Banking Solutions in Atlanta.

December 12 -

When BankMobile, the brainchild of Jay Sidhu and his daughter Luvleen, relaunches on a new platform in January, security especially for the onboarding process will be completely redesigned.

December 8 -

A preview of the next version of Moven's personal financial management app finds a new direction helping people understand the trade-offs they make between short-term and long-term financial goals.

December 6 -

Inaccurate rejections of legitimate transactions aren't a new problem, and companies can't always use past transaction data to spot future risk on a large scale. Artificial intelligence can change the game.

December 1 -

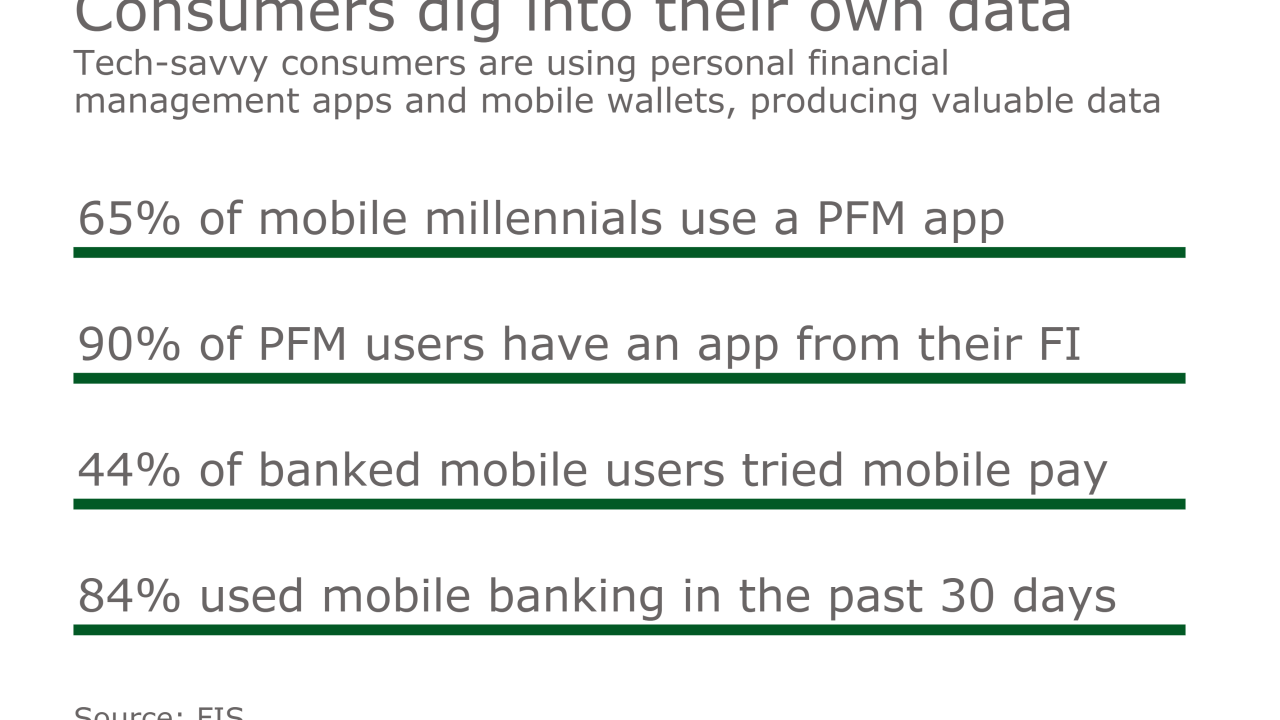

Big data was supposed to unleash a lot of powerful insights for banks, but many financial institutions still haven’t found a way to harness their own data because the amount of available information is so vast.

November 30 -

Consumers aren't just sharing the charming personal moments of their lives on social media — they're producing data that Israeli startup Feelter contends can revolutionize online shopping.

November 30 -

JPMorgan Chase seeks to reshape its business through technology, but there is a natural gap between the megabank and Silicon Valley startups. Larry Feinsmith's job is to bring the two together.

November 28 -

Belmont Savings in Massachusetts isn't trying to fire or replace its employees who work the phones pursuing sales leads, but it has made some technological investments to get more out of them.

November 23 -

Banks should focus on strategies to ensure their sales incentives programs actually help drive profits. Otherwise, their rewards programs are at risk of adding zero benefit to their bottom line.

November 18 New York Institute of Technology � Accounting and Business School

New York Institute of Technology � Accounting and Business School -

Behavioral biometrics has already stopped several million dollars worth of online banking fraud at National Westminster Bank in London.

November 17 -

With 14 million trades a day on Nasdaq and innumerable chats and emails, the stock market's risk and surveillance officers can't look at everything. Enter artificial intelligence.

November 15