-

A rash of scams targeting foreign students is turning the business of handling tuition payments from a relatively low-risk proposition to one fraught with challenges.

August 11 -

From the buzz in the technology press over the last two weeks, one might think that end times are nigh in the world of authentication.

August 11 The Chertoff Group

The Chertoff Group -

Square Inc. is joining with restaurant technology startup Upserve to offer loans to eating establishments, extending credit for the first time to businesses that operate outside of its own payments processing system.

August 10 -

Card manufacturer Oberthur Technologies is offering issuers facing a shortage of EMV chip cards an option to receive as many as 25,000 in five days, rather than waiting the standard three to four weeks.

August 10 -

To help people keep their card information safe when they shop online, a handful of fintech startups are following Apple Pay's example of keeping that information hidden, providing merchants with tokens instead.

August 9 -

Payment technologies are in an unwelcome spotlight this month, as security researchers expose their weaknesses just as the products are winning a long-desired trust among mainstream consumers.

August 9 -

Dubai-based payment service provider Payfort has formed a partnership with Mastercard to improve fraud-screening and streamline the checkout process for e-commerce and mobile point of sale transactions for hundreds of merchants across the Middle East.

August 9 -

Three quarters of debit cards will have chips by the end of the year, but slow merchant adoption is limiting use, according to Pulse.

August 9 -

The proliferation of smartphones and the onset of mobile payments has brought biometrics to the forefront of security for financial transactions.

August 9 CCG Catalyst

CCG Catalyst -

The National Australia Bank will partner with digital identity proofing company iSignthis to provide advanced card services to merchant customers in Australia and New Zealand.

August 8 -

Under pressure from regulators to beef up risk management in commercial real estate lending, banks are using new software tools to improve analysis.

August 8 -

Community banks are often burdened with manual data entry for processing commercial loans. Union State Bank has turned to digitization software to make it easier. It may sound modest in the age of APIs, but it made a quantifiable difference.

August 8 -

The U.S. EMV migration has been rough, but one of the sharpest pain points of all was felt by merchants not yet processing chip cards who were hit by a costly surge in chargebacks.

August 8 -

Once fraud has been detected and a customers usual payment mechanism is broken, what happens next to ensure that customer remains happy and loyal?

August 8 Pegasystems

Pegasystems -

Banks must use analytics rather than customer surveys to determine what does and what does not inspire prospects to become customers.

August 5 Liberty Bank

Liberty Bank -

If new research from NCR about a flaw in chip cards proves to be reproducible by fraudsters, it may undermine the core benefit of EMV security.

August 4 -

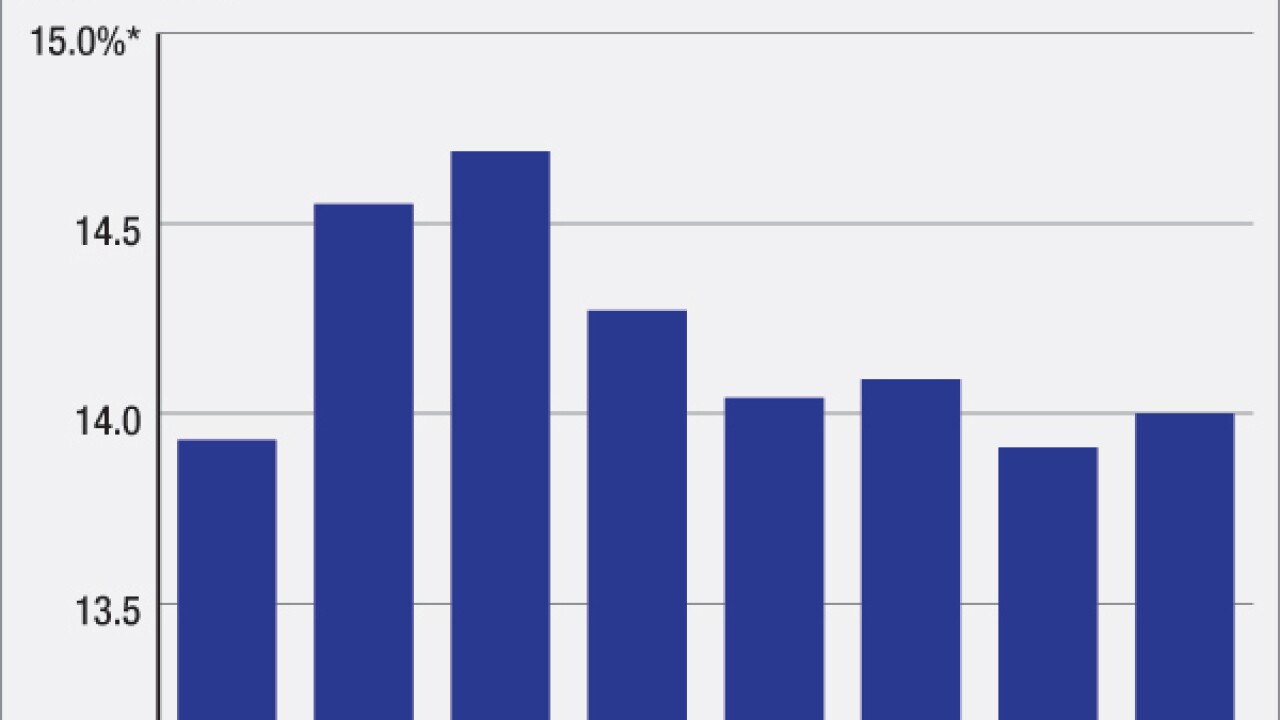

Overall card fraud losses in Europe have declined slightly over the last five years, but that trend is starting to reverse course, based on new data from FICO and Euromonitor International that points to sharp regional upticks in card-not-present fraud.

August 4 -

To thrive in todays internationally volatile markets, financial institutions and other organizations must attend more closely to the cross-border payments process.

August 4 INTEL FCStone

INTEL FCStone -

Barclays threw out security questions for telephone banking access this week and began using voice recognition technology, representing a step in an industry-wide move to eliminate passwords and challenge questions.

August 2 -

Whether it is EMV, NFC, HCE or TSP, there is certainly no shortage of acronyms within the payments ecosystem. And this is one trend that is here to stay.

August 2 Rambus

Rambus