-

Una Fox will be in charge of using AI and other data-driven technology to figure out what customers want from digital banking and how they want it.

January 22 -

Data scientists from NASA, Google and hundreds of other places are working for financial firms in their spare time. Is this a good idea?

January 22 -

Data from real-time payments creates powerful opportunities for upselling and cross-selling because it reveals what, when, and how people and businesses actually consume, writes Michael J. Alfonsi, senior vice president of digital solutions and strategy at Exela Technologies.

November 19 Exela Technologies

Exela Technologies -

After incorporating big data, tweaking existing products and reducing barriers for new members, the Mass.-based credit union saw increased checking usage, more deposits and higher PFI levels.

November 16 -

Credit union business boomed in the wake of the financial crisis, but that growth could backslide if the industry doesn't keep up with the competition.

November 14 Personetics

Personetics -

An effective data analytics strategy could require rethinking all your institution's processes and touch points.

November 12 -

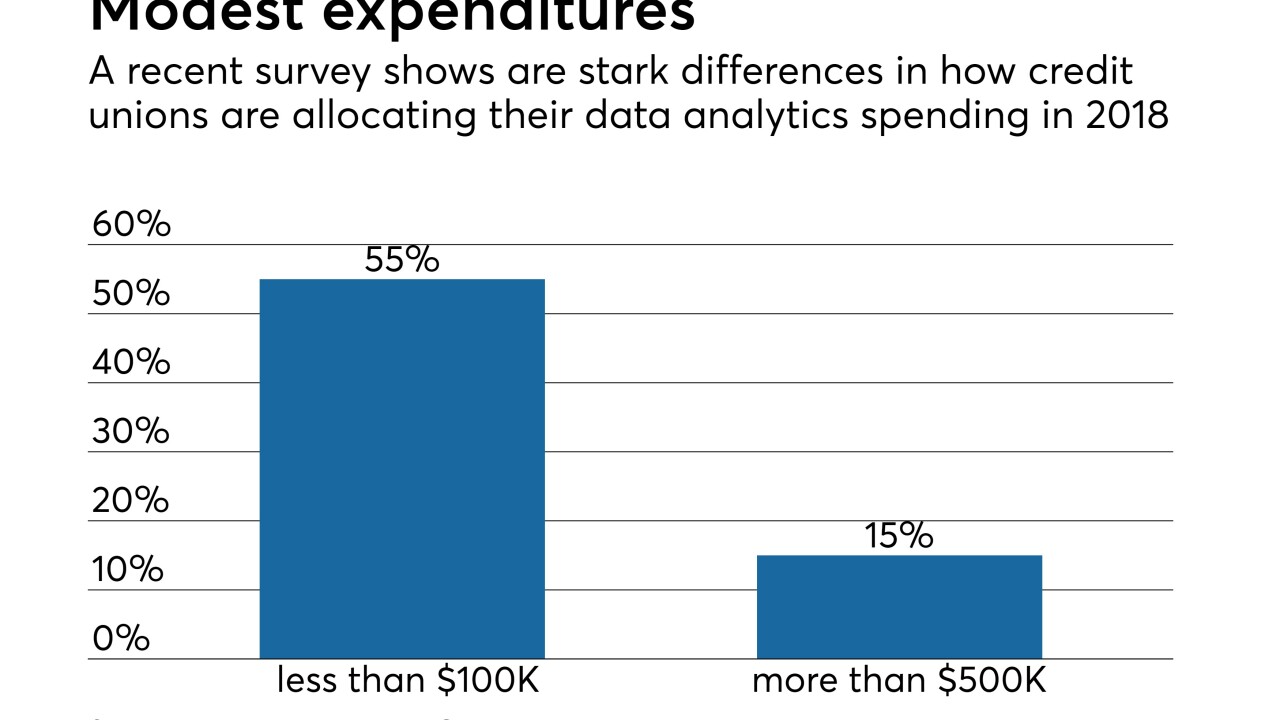

A recent report from Best Innovation Group reveals a significant number of credit unions don't have a data analytics plan, and many that do are putting off spending money on it.

November 8 -

Envestnet|Yodlee wants accessing data to be as simple as selecting a song to play, while bringing institutional analytic power to the bank branch level.

October 2 -

Trellance has acquired IronSafe, which provides data analytics to more than 2,300 credit unions.

October 2 -

A big investment in data and analytics is paying off for KeyCorp, says Chief Information Officer Amy Brady.

September 27 -

At Beth Johnson's insistence, the bank built an analytics platform that can anticipate customers' needs. It's an investment that is paying off in big ways.

September 26 -

Chief Information Officer Amy Brady is revamping payments, commercial and consumer banking by not settling for the status quo.

September 25 -

Two of the credit union movement's biggest names are teaming up to help CUs better tackle big data.

September 13 -

Technology developers have little choice but to see big data deals like Mastercard’s reported collaboration with Google as an opportunity for deep, actionable analysis, setting aside the chilling effect of privacy concerns and a consumer buy in.

September 6 -

Community bankers take pride in their personal touch with customers, but they must extend it to mobile platforms. A good start is creating digital hubs that let customers view their full financial picture in one place, a chief technology officer says.

August 21 -

Four credit unions in the billion-dollar-asset range all recently signed on to CUNA Mutual Group's data analytics service.

August 21 -

Three of the trade group's specialty councils banded together on a report that looks at how credit unions can improve their metrics and data analytics related to growth.

August 9 -

The credit union service organization focuses on predictive modeling, business intelligence and technology services.

July 30 -

Aggregate data from analytic and predictive modeling is helping State Employees' Credit Union improve delinquencies and other areas.

July 23 -

People's United in Connecticut pored over all the customer data it could find to persuade customers to give the midsize bank — instead of advisory firms and investment houses — a shot at managing their money.

July 13