Aaron Passman is editor of Credit Union Journal, the nation’s leading credit union news resource. He was appointed editor in 2018 after two years as an assistant editor at CUJ and nearly five years as a reporter there. He has worked as a staff writer or freelancer for a variety of publications across the country and is a graduate of the University of Kansas.

-

Bathrooms are probably cleaner than automated teller machines at banks and credit unions across the country, according to a new study. Here are some insights on how to protect public health – and your financial institution's image.

January 22 -

With government workers off the job, some credit union call centers are extra busy as worried members reach out with questions.

January 11 -

As government employees carry on without pay, Cabrillo Credit Union and others must balance liquidity concerns with staying out of a political fight.

January 11 -

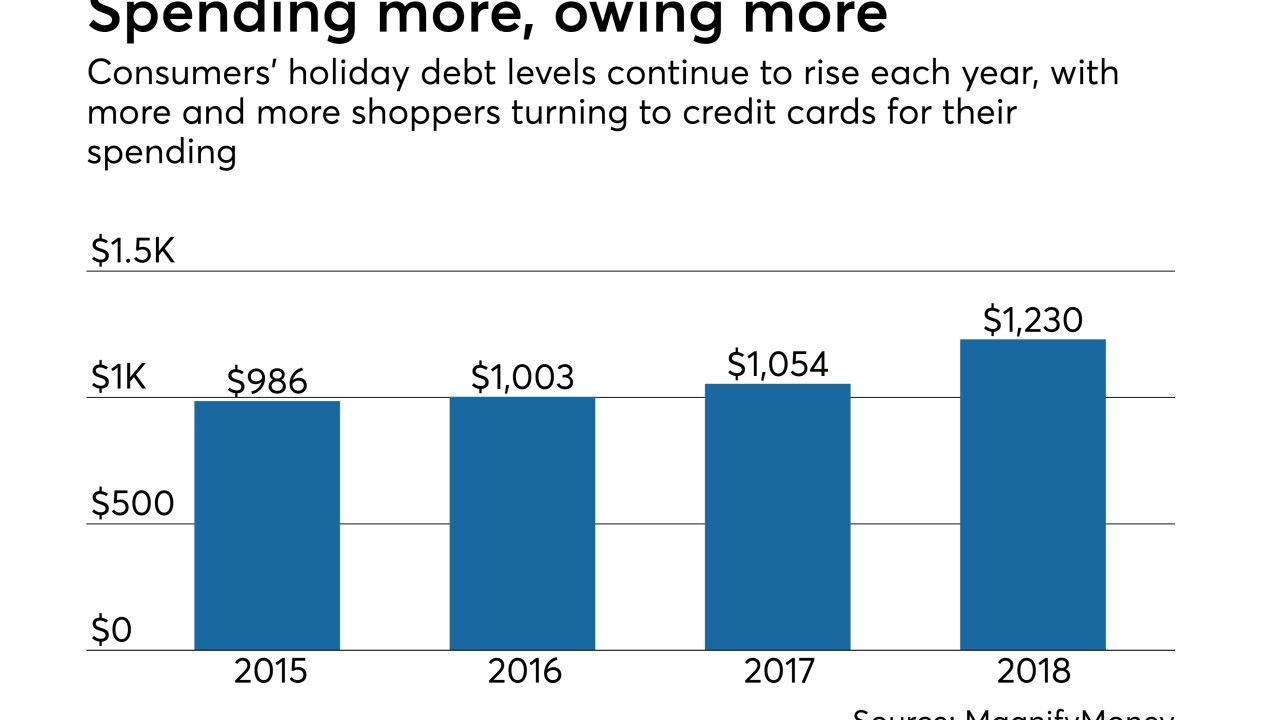

A pair of studies released Thursday show consumers once again added to their debt burden during the holiday season even as they admit to needing more financial education.

December 27 -

As more states permit medical or recreational use, and legal uncertainty persists at the federal level, CUs' decision whether to do business with marijuana firms is trickier than ever.

December 27 -

The Lafayette, La.-based credit union was accused of firing an employee who complained about a training video with racially offensive content.

December 26 -

A 2017 holiday shopping growth strategy worked so well for the $4.1 billion-asset institution that management decided to hit the mall again this year.

December 24 -

The Indiana-based institution has increased its starting pay for the last three years.

December 19 -

From partnerships with law enforcement to Toys for Tots drives, here's how credit unions are making the holiday season special for those in need.

December 17 -

As Congress races to fund the government, a criminal justice reform bill could also include the STATES Act, which would provide safe harbor for credit unions serving the legal marijuana industry.

December 17 -

Despite continued growth and regulatory victories, this year saw challenges on a number of fronts that could have lingering – and even negative – consequences for the industry in 2019 and beyond.

December 17 -

The legislation follows passage of a similar bill in the House and would push back implementation of NCUA’s risk-based capital rule to 2021.

December 13 -

CU*Answers is working with VantageScore, and now its institutions will be able to get additional information on members' credit history.

December 7 -

The regulator claimed Congress has already granted it the authority to define field-of-membership areas.

December 7 -

The Mt. Pleasant, Wis.-based credit union has returned more than $7 million to members in the last three years.

December 3 -

CUNA and NAFCU have asked lawmakers to include a variety of specific provisions in an update to the 2017 tax reform package.

November 29 -

The New York-based credit union has returned more than $7.6 million to members since 2003.

November 26 -

Many credit unions are pushing credit card offers in advance of Black Friday while also encouraging responsible spending.

November 21 -

In a push to be on the leading edge of technology, Tennessee-based Enrichment Federal Credit Union launched a service through Amazon's Alexa by first making sure employees knew what to do.

November 21 -

A new report finds credit unions' edge in satisfaction rates has all but been wiped out, while a separate study finds negative interactions with CU staff could have a big impact on the bottom line.

November 13