Kevin Wack is American Banker's national editor, and is based in southern California. He was formerly the publication's consumer finance reporter and its Capitol Hill correspondent. Earlier, he worked on financial policy in Washington. He has also reported for the Associated Press and worked as the investigative reporter for the Portland Press Herald in Maine.

-

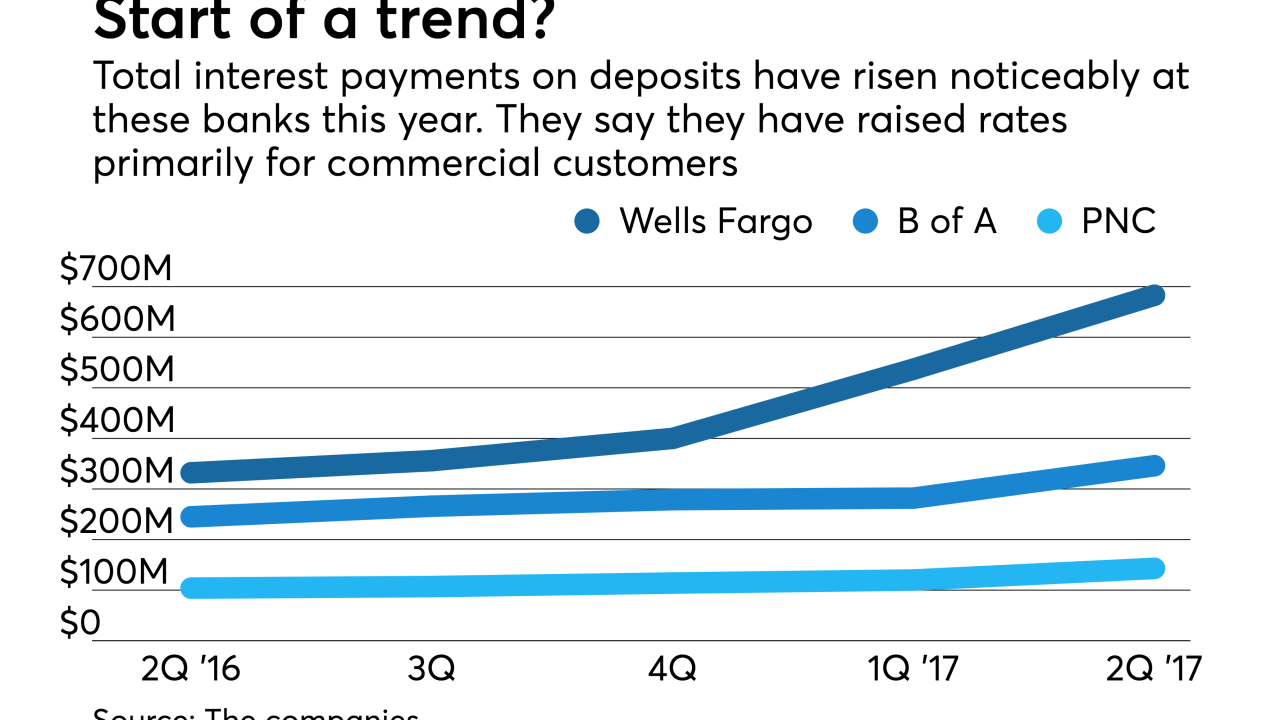

In a sign of broader competition ahead, bigger banks are raising the interest they pay on deposits held by business customers. The big question is how hard will it be for banks to maintain margins and to stave off consumer demands for better rates.

By Andy PetersJuly 18 -

The firm’s latest financial outlook suggests an opportunity to earn profits comparable to those recorded by large, well-established credit card issuers.

By Kevin WackJuly 18 -

The phony-sales scandal forced a reckoning over an organizational structure that had long encouraged autonomy for the bank’s various business units.

By Kevin WackJuly 14 -

On the first big day of 2Q results, bankers said their investments in middle-market lending have started paying off. JPMorgan Chase and PNC have added commercial loan officers in new markets across the country.

July 14 -

It's not only regulation that is hurting profitability, but also banks' failure to adapt to the internet age, according to a recent study.

By Kevin WackJuly 12 -

The nation’s largest state set out to bring a once-illicit industry into the financial mainstream but is now running into a Washington, D.C.-size barrier.

By Kevin WackJuly 10 -

The subprime business lender halted new business and laid off scores of employees after recording higher-than-expected losses.

By Kevin WackJuly 6 -

AutoGravity of Irvine, Calif., has received $30 million in equity financing from VW Credit, according to a source familiar with the matter.

By Kevin WackJuly 6 -

A new report from the American Bankers Association reinforces existing concerns about the ability of U.S. consumers to manage all of their debts.

By Kevin WackJuly 6 -

Though they face an array of competitive threats — from digital currencies to peer-to-peer payment apps — the vast majority of community banks do not have a payments strategy, according to a recent survey.

By Kevin WackJune 30