-

The Ohio company, which has beefed up its loan-loss reserves, raised the possibility of more sales of oil and gas credits and talked up strong retail segments such as its marine and RV loans.

July 23 -

Delinquencies have been ticking up since the start of the coronavirus pandemic and Capital One is warning of more pain unless the government provides additional relief to tenants and landlords.

July 22 -

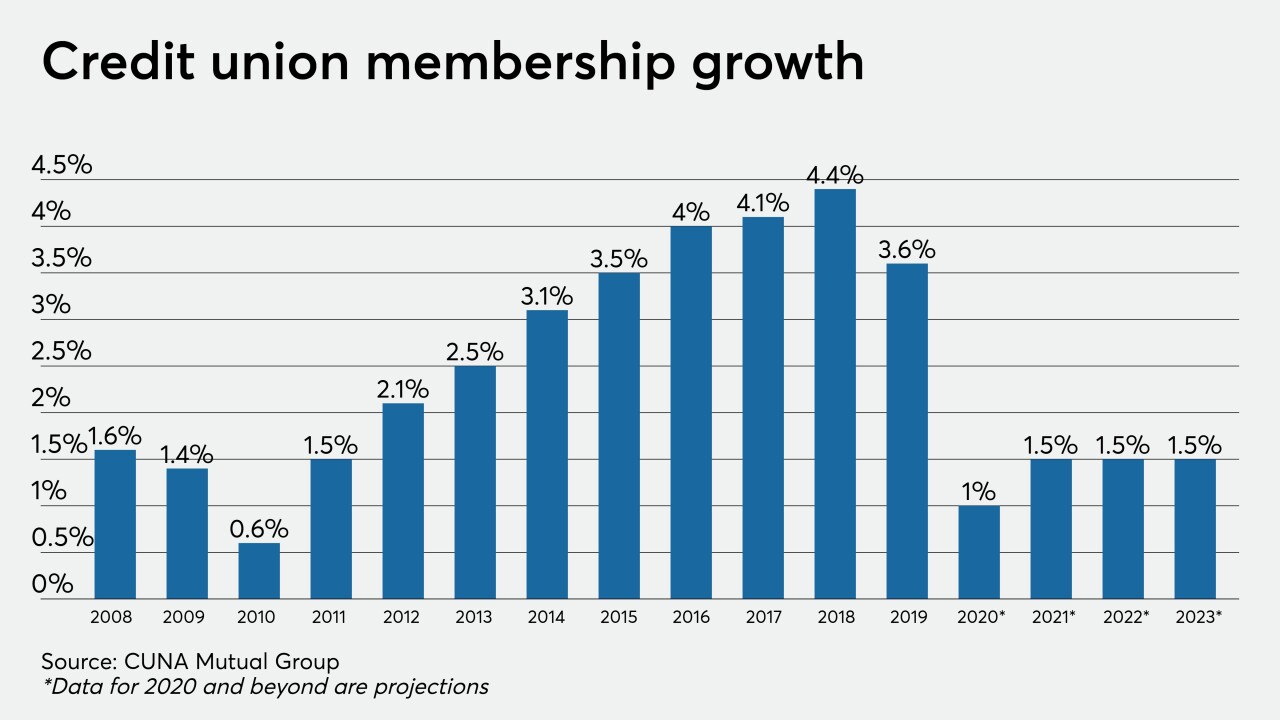

The streak of strong gains for new members was flagging by the end of 2019 and has only worsened since then.

July 20 -

Some 60% of Ally’s auto originations in the second quarter were used-vehicle loans, the highest percentage in the company's history.

July 17 -

Ride-hailing services and public transit were gaining ground until the pandemic struck, but the outbreak has quickly and radically changed how consumers think about buying cars.

July 2 Credit Union Leasing of America

Credit Union Leasing of America -

Upstart, which specializes in the use of alternative data and AI in credit decisions, will make car loans directly and sell its technology to banks and other lenders.

June 24 -

Consumers are parking their funds at financial institutions as lending slows and interest rates remain near zero, making it difficult for credit unions to deploy these deposits.

June 22 -

After drawing industry opposition, legislation that would have added broad new borrower protections during the pandemic failed to advance out of the state Assembly.

June 19 -

Small businesses that took out the loans will soon be applying for forgiveness; U.S. Secretary of State Pompeo and one of HSBC's large investors criticized the bank for buckling to Chinese pressure.

June 10 -

New York State regulators may bring an enforcement action against the German bank as early as this month; Wells Fargo’s decision to stop making loans to the dealers has more to do with credit quality than asset limits.

June 3 -

The consumer bureau said Approved Cash Advance improperly collected amounts that were five times higher the legitimate fee schedule disclosed to borrowers.

June 2 -

Loan volumes were already slowing before the pandemic. New restrictions and changes in consumer behavior are likely to make growth in this portfolio even harder.

June 2 -

A Democratic measure to freeze foreclosures and auto repossessions through the coronavirus crisis while expanding eligibility for loan forbearance is getting strong pushback from banks and credit unions, which complain it would constrain credit.

May 21 -

One of the biggest subprime auto lenders agreed to pay $550 million to settle predatory lending charges; the bank regulator has largely completed his goal of overhauling the Community Reinvestment Act.

May 20 -

The lender will pay $65 million in restitution and forgive nearly $500 million in auto debt to settle charges that it steered subprime borrowers into risky loans.

May 19 -

The Baltimore-area credit union crossed the latest threshold despite a dip in net income during the first quarter as many organizations struggle with the coronavirus fallout.

May 19 -

A surge in demand for home loans drove the increase, but the second quarter could see a slowdown in borrowing and more delinquencies as consumers contend with the economic fallout of the coronavirus pandemic.

May 5 -

Lenders are throwing money at buyers with stable jobs while making it harder for weak borrowers to get loans; $50 billion in loss provisions may not be enough and could stifle lending.

May 4 -

Credit inquiries for auto lending, revolving credit cards and mortgages fell sharply in March as unemployment surged, according to a Consumer Financial Protection Bureau report.

May 1 -

The company’s latest Credit Union Trends Report predicts that membership and lending will stall as job losses rise and consumer demand for loans dries up.

April 29