-

The consumer bureau said Approved Cash Advance improperly collected amounts that were five times higher the legitimate fee schedule disclosed to borrowers.

June 2 -

Loan volumes were already slowing before the pandemic. New restrictions and changes in consumer behavior are likely to make growth in this portfolio even harder.

June 2 -

A Democratic measure to freeze foreclosures and auto repossessions through the coronavirus crisis while expanding eligibility for loan forbearance is getting strong pushback from banks and credit unions, which complain it would constrain credit.

May 21 -

One of the biggest subprime auto lenders agreed to pay $550 million to settle predatory lending charges; the bank regulator has largely completed his goal of overhauling the Community Reinvestment Act.

May 20 -

The lender will pay $65 million in restitution and forgive nearly $500 million in auto debt to settle charges that it steered subprime borrowers into risky loans.

May 19 -

The Baltimore-area credit union crossed the latest threshold despite a dip in net income during the first quarter as many organizations struggle with the coronavirus fallout.

May 19 -

A surge in demand for home loans drove the increase, but the second quarter could see a slowdown in borrowing and more delinquencies as consumers contend with the economic fallout of the coronavirus pandemic.

May 5 -

Lenders are throwing money at buyers with stable jobs while making it harder for weak borrowers to get loans; $50 billion in loss provisions may not be enough and could stifle lending.

May 4 -

Credit inquiries for auto lending, revolving credit cards and mortgages fell sharply in March as unemployment surged, according to a Consumer Financial Protection Bureau report.

May 1 -

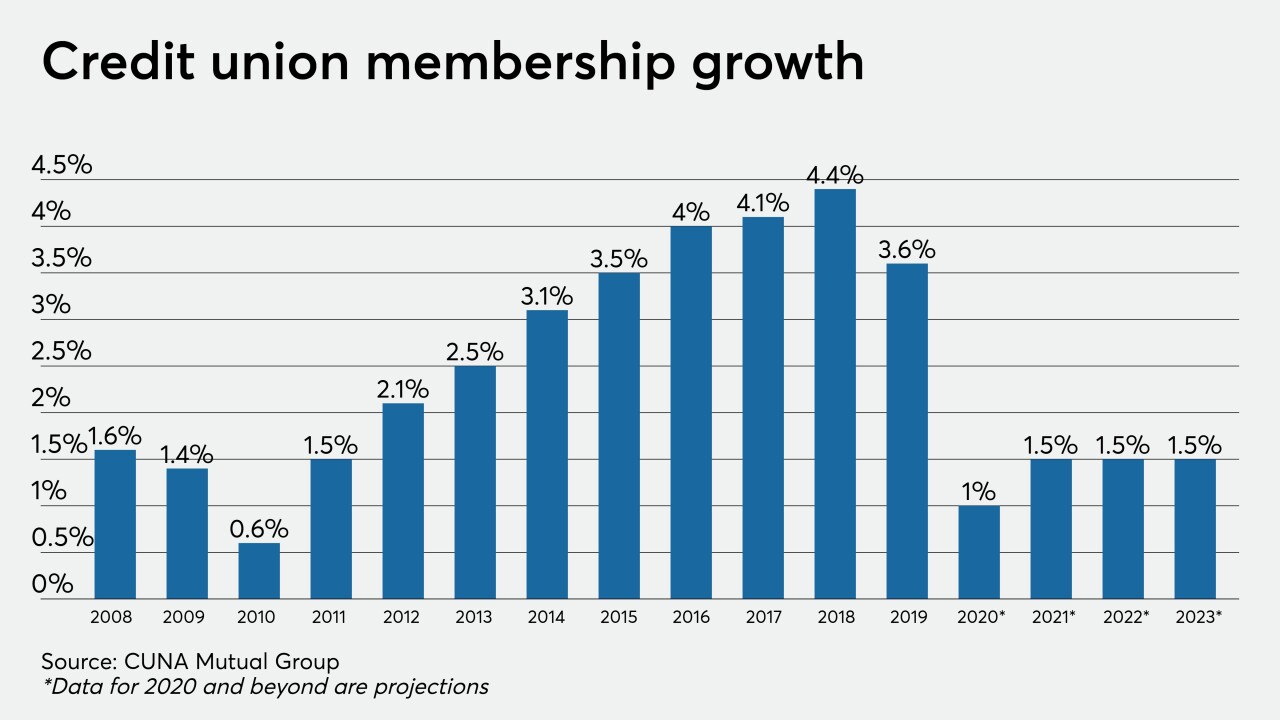

The company’s latest Credit Union Trends Report predicts that membership and lending will stall as job losses rise and consumer demand for loans dries up.

April 29 -

Credit Acceptance Corp., the lender to car buyers with subprime credit scores, warned it's seeing a sharp drop-off in payments as people shift their financial priorities to get through the coronavirus pandemic.

April 21 -

After more than tripling its loan-loss provision, the $182 billion-asset company became the first large U.S. bank to report a quarterly loss as a result of the coronavirus pandemic.

April 20 -

After opening-day fiasco, SBA upgrades lender portal with Amazon assist; West Virginia’s First State Bank closed by regulators; BofA offers emergency loans to borrowers first, freezing out depositors; and more from this week’s most-read stories.

April 10 -

Closed showrooms, temporary bans on repossessions and a sudden spike in unemployment have dimmed the prospects of a sector that has boomed since the last recession.

April 8 -

Car loans make up about a third of credit unions' total lending portfolio, and any drop in that sector could resonate across the entire industry.

April 6 -

The CEO says he is getting stronger and working remotely; if the lockdown lasts several months, the GSEs may need a bailout, FHFA head Mark Calabria says.

April 3 -

Last month's enforcement actions included the former CEO of Western Heritage Federal Credit Union in Alliance, Neb.

April 1 -

Ball State FCU has announced plans to merge into Financial Center First CU following losses tied to high charge-offs, particularly in the used car area.

March 20 -

Sens. Sherrod Brown and Elizabeth Warren criticized Director Kathy Kraninger for not issuing any public enforcement actions against auto lenders during her tenure.

March 17 -

With prices rising rapidly and loan terms increasing, some institutions may want to consider adding a leasing option to their auto loan portfolio.

March 6 Credit Union Leasing of America

Credit Union Leasing of America