-

The company will gain more than $500 million in assets after buying Eastman National and Cache Holdings.

July 17 -

Several RBB Bancorp executives and directors, including CEO Alan Thian, will also sell a significant number of shares when the Los Angeles company goes public.

July 14 -

As NCUA continues work on creating another avenue for building capital, credit unions need to bone up on what the different terms mean and the potential impact.

July 14 CUNA Mutual Group

CUNA Mutual Group -

Readers slam credit unions’ ever-inclusive membership criteria, weigh in on the OCC’s proposed fintech charter, encourage a rewrite of the CRA, and more.

July 14 -

First Citizens is pressuring KS Bancorp to sell even though the banks' operations overlap in many markets in eastern North Carolina.

July 13 -

The North Carolina company could issue $200 million in new securities over time to fund acquisitions and other investments.

July 13 -

Property Assessed Clean Energy loans can no longer be offered in unincorporated areas of Kern County, Calif. The controversial loans, meant to promote energy efficiency, began in California and are now offered in a number of states.

July 12 -

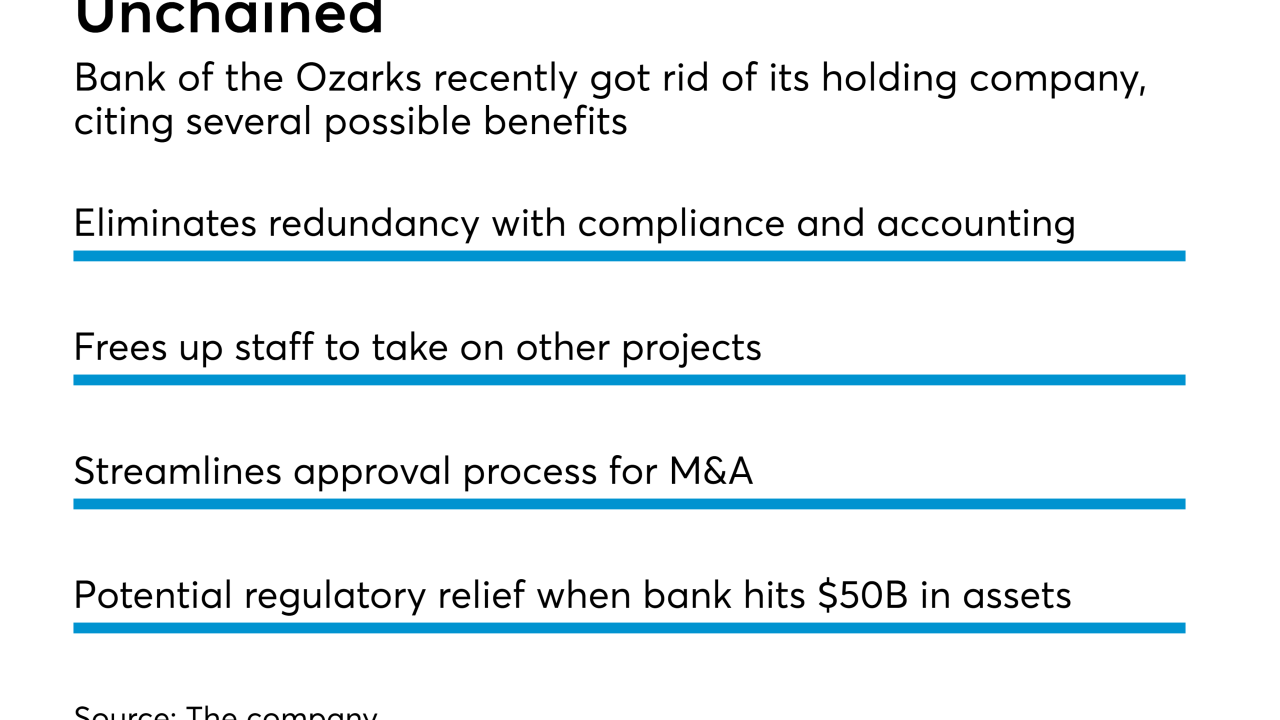

Bank of the Ozarks recently dissolved its holding company in a move that goes against modern banking strategy. There are, however, strong arguments for other institutions to follow the bank's lead.

July 12 -

Royal Bank of Scotland Group agreed to pay $5.5 billion to settle the second of three major U.S. mortgage-backed securities probes the government-owned lender must overcome before it can fully return to the private sector.

July 12 -

The Treasury Department will take a huge hit when Cecil Bancorp sells its bank, while 1st Mariner Bank in Baltimore will see its equity stake completely wiped out. Cecil opted for bankruptcy court when it was unable to resolve an impasse over its trust-preferred stock.

July 11