-

Banks are swapping out long-term holdings for short-term securities to manage interest rate risk. But in the process, they are sacrificing yield — and ammo they might need to pay more for deposits to retain customers.

October 24 -

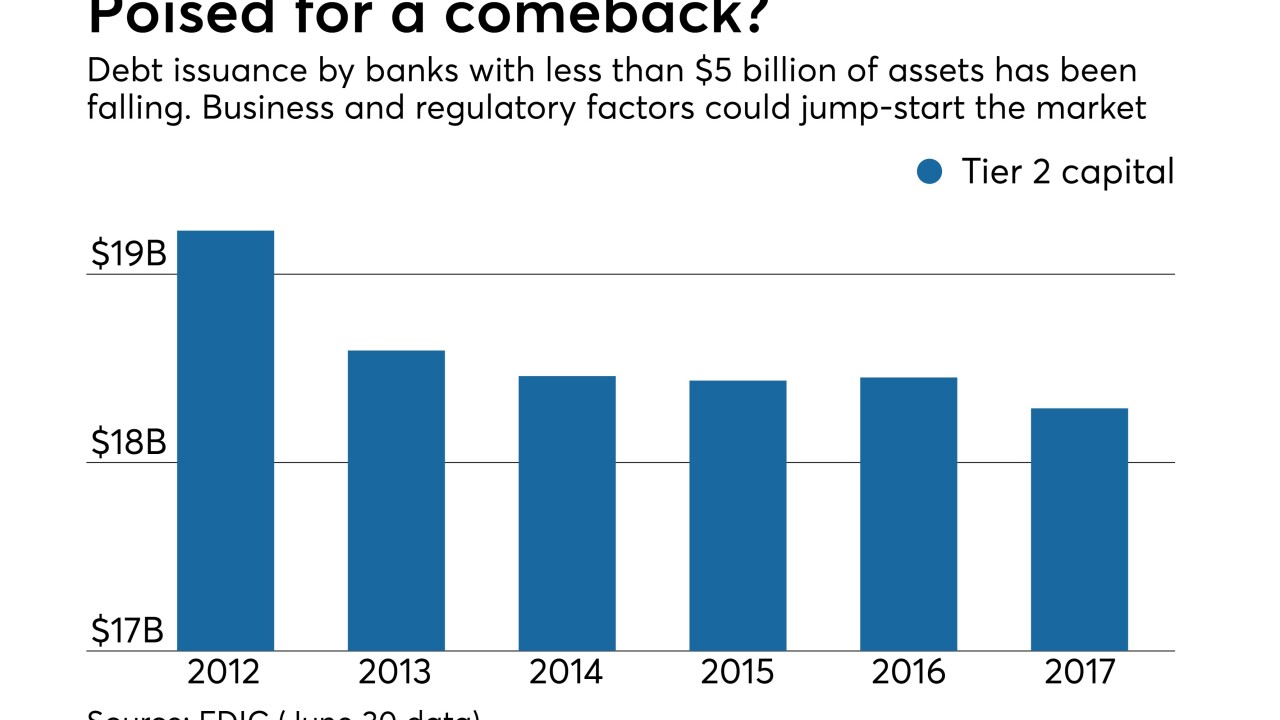

Increased investor appetite and the emergence of specialized debt ratings are expected to spur demand, and community banks are looking for ways to fund expansion and hedge against future economic downturns.

October 23 -

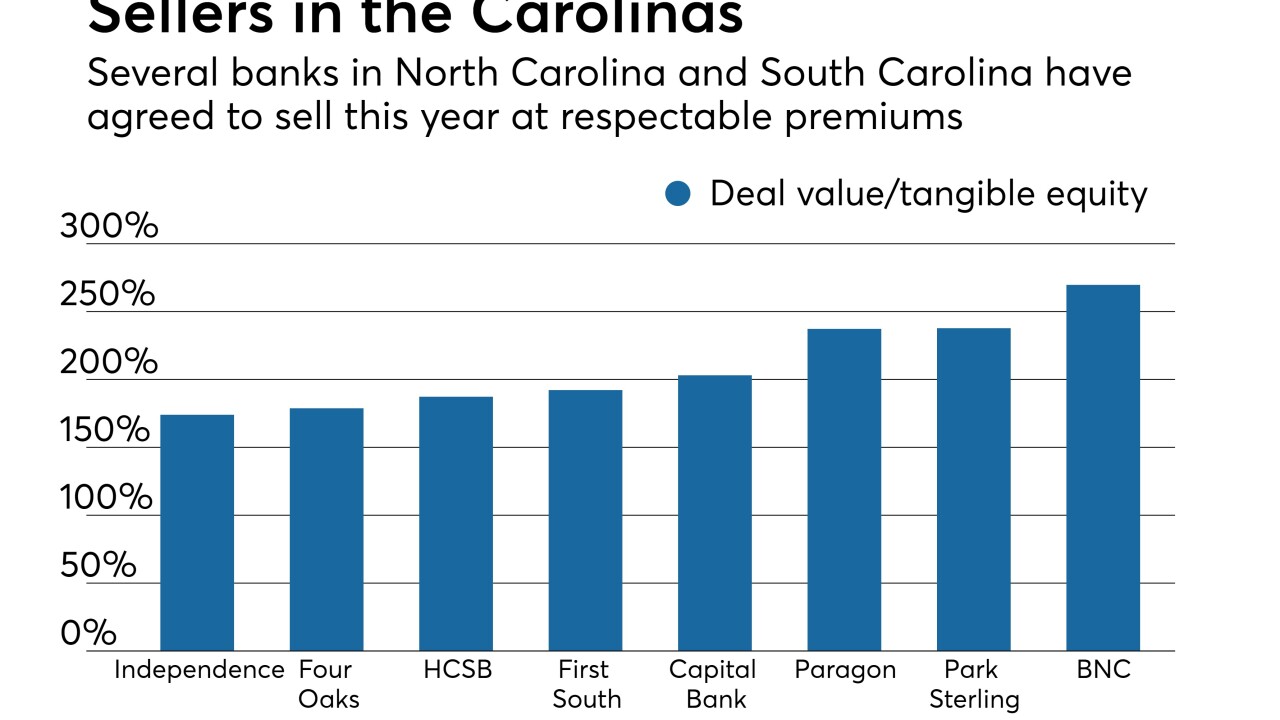

Flush with capital and facing stiff competition for customers, many regional banks appear to be mulling acquisitions to accelerate growth.

October 20 -

While some tackle the problem by offering their own consolidation loans, Sallie Mae is developing products with extended terms that reduce borrowers' monthly payments in an effort to discourage borrowers from refinancing in the first place.

October 19 -

First Reliance in South Carolina, which recently announced its first bank acquisition, is angling to take advantage of disruption caused by bigger mergers in the Carolinas.

October 19 -

Navient has suspended stock buybacks to buy and expand a debt-refinancing firm that faces stiff competition from fintechs, and some shareholders aren’t happy.

October 18 -

The Illinois company, four months removed from its last bank acquisition, just announced the biggest purchase in its history. Alpine Bancorp. will add low-cost deposits and scale to Midland States' wealth management business.

October 18 -

In a surprise move, the Supreme Court will decide whether Amex may bar merchants from steering customers to less expensive card networks. The card issuer will have to prove the consumer gain from its practices outweighs the merchant pain.

October 16 -

Bank of America set aside $100 million in its reserves for representation and warranty claims ahead of a pending settlement to resolve legacy mortgage issues.

October 13 -

The company agreed to buy Commercial Bancshares for $59 million in stock.

October 13