-

The digitally savvy lender MyBucks, which has lent money through a smartphone app and chatbots on WhatsApp and Facebook Messenger, could be a good role model for U.S. banks thinking of using AI in credit decisions.

December 28 -

The energy crisis, hurricane damage and merger costs have hampered earnings per share at the Louisiana bank. Its CEO has to clear those hurdles and convince investors steady growth is ahead.

December 28 -

With so much uncertainty, the only thing that's clear is how different the sector may look a year from now. Here's an overview of the leading trends in technology that will impact banking in 2018.

December 28 -

Consumers’ desire to shop online is creating huge demand for distribution centers and forcing property owners to think creatively about redeveloping vacant retail space. Meanwhile, hundreds of billions of dollars will be spent rebuilding areas hard hit by hurricanes and wildfires.

December 27 -

Some were sold at discounted prices, while others were shut down by their acquirers or quietly ceased doing business.

December 25 -

We never promised the news would be good for all these community bankers, and it wasn’t. One couldn’t stop a failure, and another quit soon after an acquisition. The rest have their banks at different points on the comeback trail.

December 22 -

Though Marlene Caride has no direct experience in the banking industry, she could play a key role in carrying out Governor-elect Phil Murphy’s pledge to create a public bank in the Garden State.

December 21 -

BankMobile, the digital-only subsidiary of Customers Bank in Wyomissing, Pa., is planning to use software by Upstart to offer its first credit product to graduates and other young consumers with little to no credit history.

December 20 -

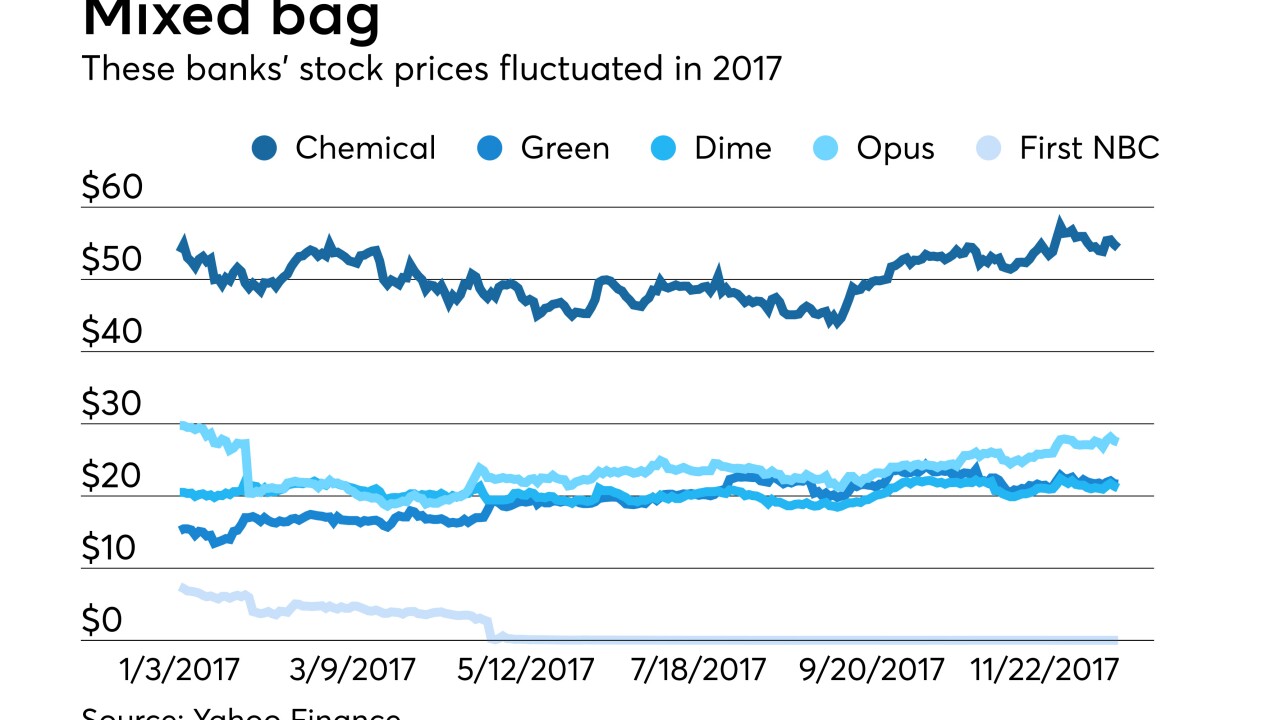

The $280 million securitization is also expected to boost capital levels and lower Dime's loan-to-deposit ratio.

December 19 -

Bankers remember Bob Wilmers not only for spearheading the growth of M&T, but also embracing his role as the industry's voice in turbulent times.

December 18 -

Lenders on the fringe of the financial industry are now pitching a solution to bitcoin investors in need of funds but wary of cashing in: loans using a digital hoard as collateral.

December 14 -

On Sep. 30, 2017. Dollars in thousands.

December 14 -

Departing central bank chief says colleagues are committed to strict bank regulation; marketplace lending not living up to promises as delinquencies continue to rise.

December 14 -

In a year of political upheaval and weak commercial credit growth, lenders sought to capitalize on an economic bright spot — consumer spending — by reviving the personal loan, allying with fintechs and exiting traditional business lines that no longer made sense.

December 13 -

The Fed’s rate hike on Tuesday will raise bank's funding costs, serving as a stark reminder that a return to strong, broad-based business loan demand can’t come soon enough.

December 13 -

Executives at small banks are wary about 2018 as concerns about lackluster loan demand, low yields and rising deposit prices abound.

December 13 -

Grupo Coppel and Insikt, an online lender, would appear to be cut from different cloth, but they share an expertise in providing credit to working-class, largely Hispanic consumers. The retail conglomerate also operates 1,000 bank branches in Mexico, mixing banking and commerce in a way that U.S. regulators have not allowed.

December 13 -

The risk to Canada's financial system from tapped-out borrowers is merely shifting — this time to a market where there's no oversight from the country's national bank regulator and new stress-test rules don't apply.

December 13 -

Can preferential loan terms encourage environmentally friendly practices among corporate borrowers? Barclays, BNP Paribas, and Standard Chartered are working with fintechs — and even Prince Charles — to develop a blockchain to answer that question.

December 11 -

The short-term loan industry is suddenly playing offense in Washington following Mick Mulvaney's appointment as acting head of the Consumer Financial Protection Bureau.

December 8