-

Readers sound off on the 2018 midterm election results, OCC's Otting defending his agency's right to charter fintechs, and predictions the plastic credit card is nearly dead.

November 8 -

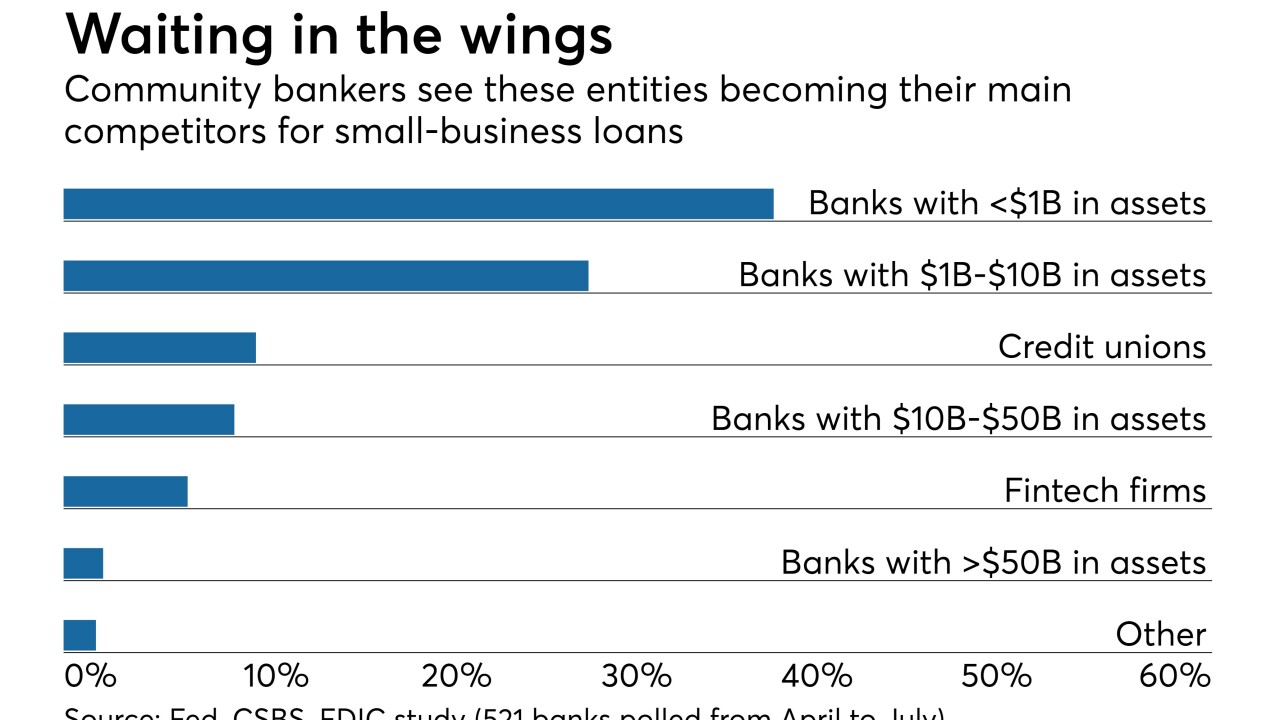

Will it be a bigfoot from Amazon, Google and Apple, or death by a thousand bites from niche rivals? Or can banks and credit unions rally and fend off the insurgents?

November 8 -

Will it be a bigfoot from Amazon, Google and Apple, or death by a thousand bites from niche rivals? Or can banks rally and fend off the insurgents?

November 7 -

Reversing a previous order, the Texas judge granted part of the bureau's request to stay the effective date and allow time for the agency to work on changes to the rule.

November 7 -

The head of the agency developing the special-purpose federal license said the process is moving forward “independent” of legal challenges mounted by state regulators.

November 7 -

The San Francisco company, which has racked up big losses over the last two and a half years, signaled Tuesday that it is on a path to profitability after resolving a series of longstanding regulatory problems.

November 6 -

The Atlanta-based consumer lender, which partners with both retailers and banks, cited a higher-than-expected cost of funds as one reason for its less rosy forecast.

November 6 -

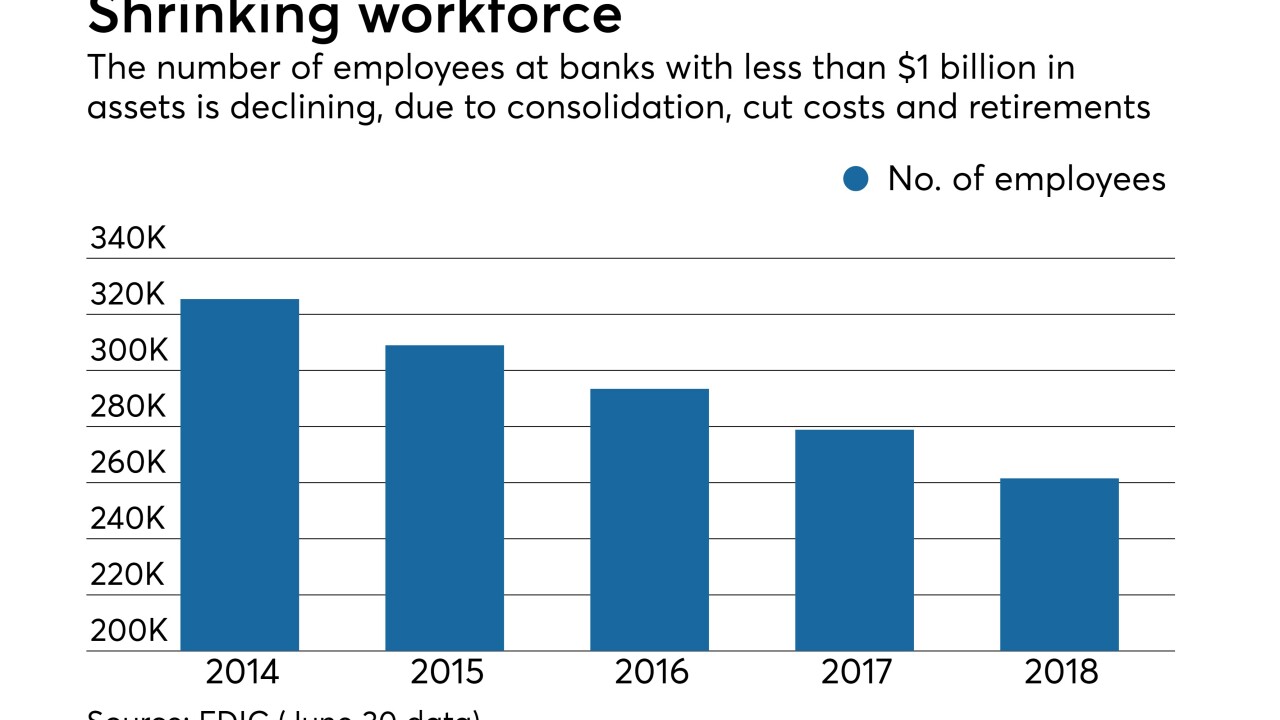

Big banks and fintechs are aggressively adding digital capabilities to process applications quickly, creating a sense of urgency for community banks.

November 6 -

The New York-based online lender plans to spend an additional $15 million next year, largely on bank partnerships and international expansion.

November 6 -

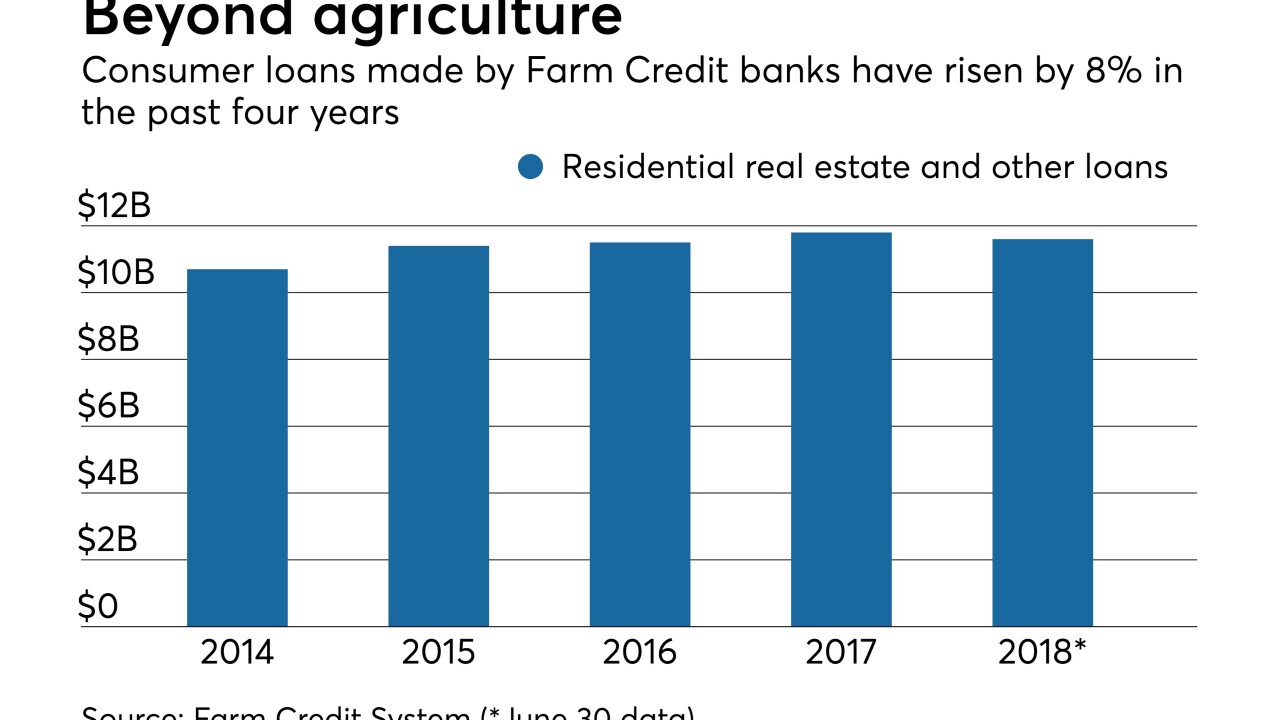

Can farmers — and the banks that lend to them — survive Trump's trade war?

November 5 -

Heightened competition from nonbanks, the rise of populism and the uncertainty surrounding Libor’s demise are just some of the short- and long-term threats facing big banks, risk executives say.

November 2 -

The credit union's organizers believe there is a funding gap in the state for agriculture — and they want to fill the void.

November 2 -

By creating corporate governance courses for prospective board members and a multifaceted financial literacy program for high schoolers, Virginia National aims to deepen its bench for years to come.

November 1 -

Organizers of the credit union believe there is a funding gap in the state for agriculture and want to fill the void.

November 1 -

Harvest is when farmers need funding the most. ProducePay has financed over $850 million of produce in under four years, disrupting traditional finance rules in the farm-to-table process.

October 31 -

Bankers complain that the quasi-governmental system's new program designed to make more residential loans in four states goes well beyond its original mission.

October 31 -

Azlo, Bento, Bank Novo and other neobanks argue they are better at helping small businesses, giving them extra attention, technology and advice.

October 31 -

Traditional financial institutions still have an advantage over challenger banks when it comes to building relationships with small merchants, despite scandals that have befallen megabanks.

October 30 -

The New York unit of Popular has contracted with Biz2Credit to automate commercial loan approvals and handle the underwriting for applications under $100,000.

October 30 -

If approved, the Fed would consider risk factors besides size in how strenuously it oversees individual banks; Capital One's CIO on operating a bank as a technology company.

October 30