Consumer banking

Consumer banking

-

Both developments are part of the company’s strategy of becoming a full-service bank for its young, affluent customer base.

October 28 -

Donald Felix will join the Rhode Island company in January as head of national banking. He recently was responsible for developing a personal finance management strategy for JPMorgan Chase’s consumer bank.

October 28 -

The agency overreached in its proposal to revamp the Community Reinvestment Act when it should have simply required branchless banks to invest more in areas where deposits are taken.

October 28 -

The Mississippi company said Duane Dewey, the president of its bank, will succeed Gerard Host as CEO in January.

October 28 -

Rick Wardlaw at Bank Independent in Alabama gets results by adhering to the servant-leadership model.

October 27 -

The agency found a 40% error rate in the 2016 data submitted by the Seattle bank. In addition to the fine, the institution is required to improve its compliance systems.

October 27 -

Craig Dahl said working seven-day weeks to shepherd the integration with Chemical and then the combined company’s coronavirus response led to his abrupt retirement.

October 27 -

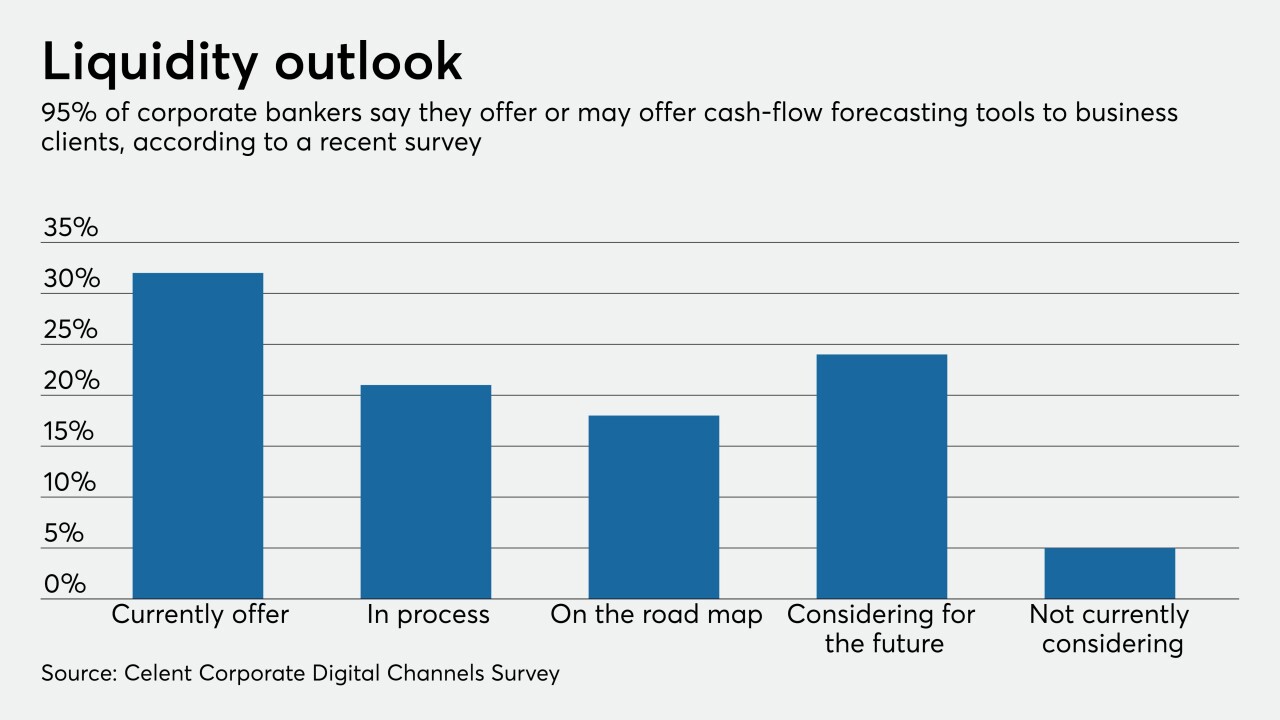

The global bank has rolled out cash-flow forecasting tools as financial institutions race to meet urgent demands from commercial customers trying to navigate uncertain times.

October 27 -

The acquisition will consolidate United's position in the St. Joseph market, where both institutions are based.

October 27 -

With coronavirus cases on the rise, Hoosier Hills CU in Bedford, Ind., has chosen to temporarily restrict access to its facilities. Observers say other institutions are likely to follow suit eventually, whether they want to or not.

October 27 -

Spence’s promotion to president could signal that the Cincinnati banking company is grooming him as a potential successor to Chairman and CEO Greg Carmichael.

October 26 -

The Iowa company said it will pursue a two-step acquisition to address unspecified issues raised by the Federal Reserve as part of its review of the acquisition.

October 26 -

Speculation is part of the reason for the growing differential in market capitalization between legacy financial institutions and upstarts. But one venture capitalist says it's "a call to action" for traditional banks to match fintechs' all-digital, customer-friendly services.

October 26 -

The Paycheck Protection Program and encouraging digital innovation are top priorities for James Edwards, CEO of United Bank in Georgia. He also expects the American Bankers Association to promote diversity and regulatory reform in the next year.

October 26 -

The deal will expand the credit union's reach into western Michigan at a time when a growing number of banks are trimming their networks.

October 26 -

Bank of America made three more investments in minority-focused lenders, bringing its total to 10 in the past two months.

October 26 -

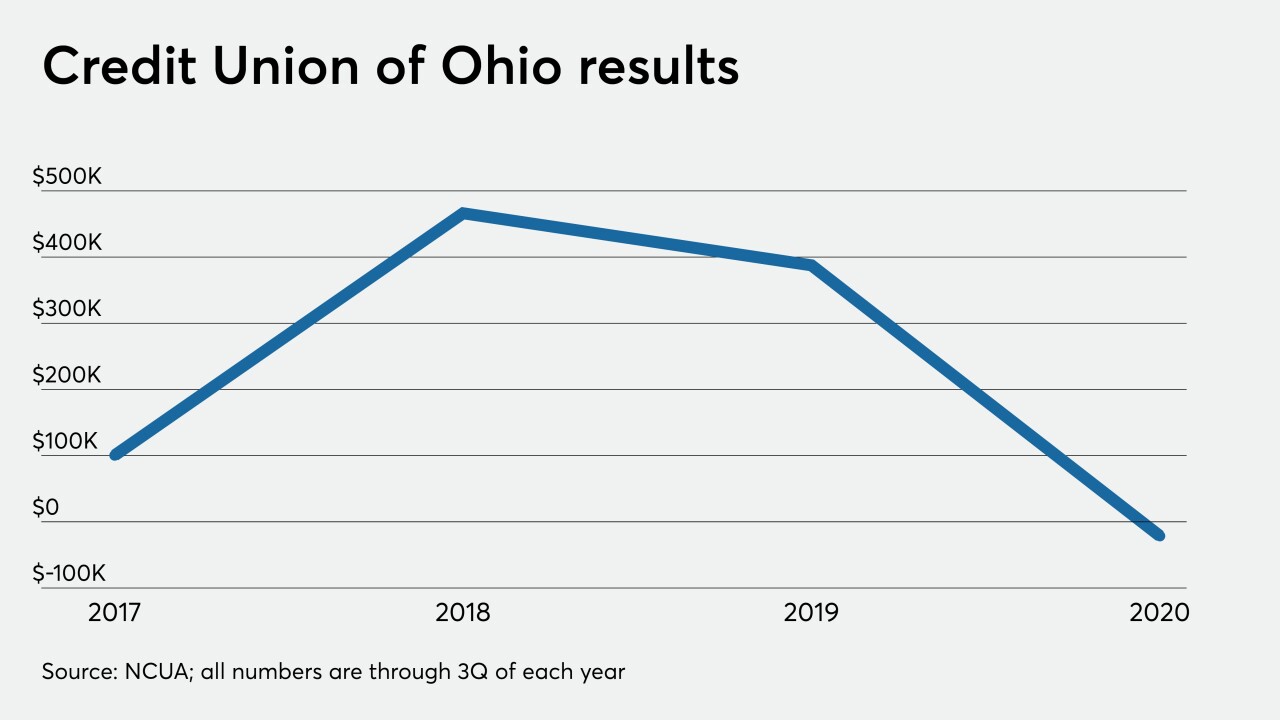

Members of First Choice Community Credit Union will have access to mobile banking and other products once the institution becomes part of Credit Union of Ohio.

October 26 -

Deposits have piled up, curtailing overdrafts and other fees. The trend could force lenders to find other ways to make money — or start cutting to the bone.

October 25 -

Equity Bank agreed to buy most of the assets, and assume all the deposits, of Almena State Bank.

October 23 -

Foreign banks for years have been using technology that folds several communication and information-sharing capabilities into one platform. Now Citigroup and others here are showing interest because of the growing importance of digital in the pandemic.

October 23