Consumer banking

Consumer banking

-

The Iowa company said it will pursue a two-step acquisition to address unspecified issues raised by the Federal Reserve as part of its review of the acquisition.

October 26 -

Speculation is part of the reason for the growing differential in market capitalization between legacy financial institutions and upstarts. But one venture capitalist says it's "a call to action" for traditional banks to match fintechs' all-digital, customer-friendly services.

October 26 -

The Paycheck Protection Program and encouraging digital innovation are top priorities for James Edwards, CEO of United Bank in Georgia. He also expects the American Bankers Association to promote diversity and regulatory reform in the next year.

October 26 -

The deal will expand the credit union's reach into western Michigan at a time when a growing number of banks are trimming their networks.

October 26 -

Bank of America made three more investments in minority-focused lenders, bringing its total to 10 in the past two months.

October 26 -

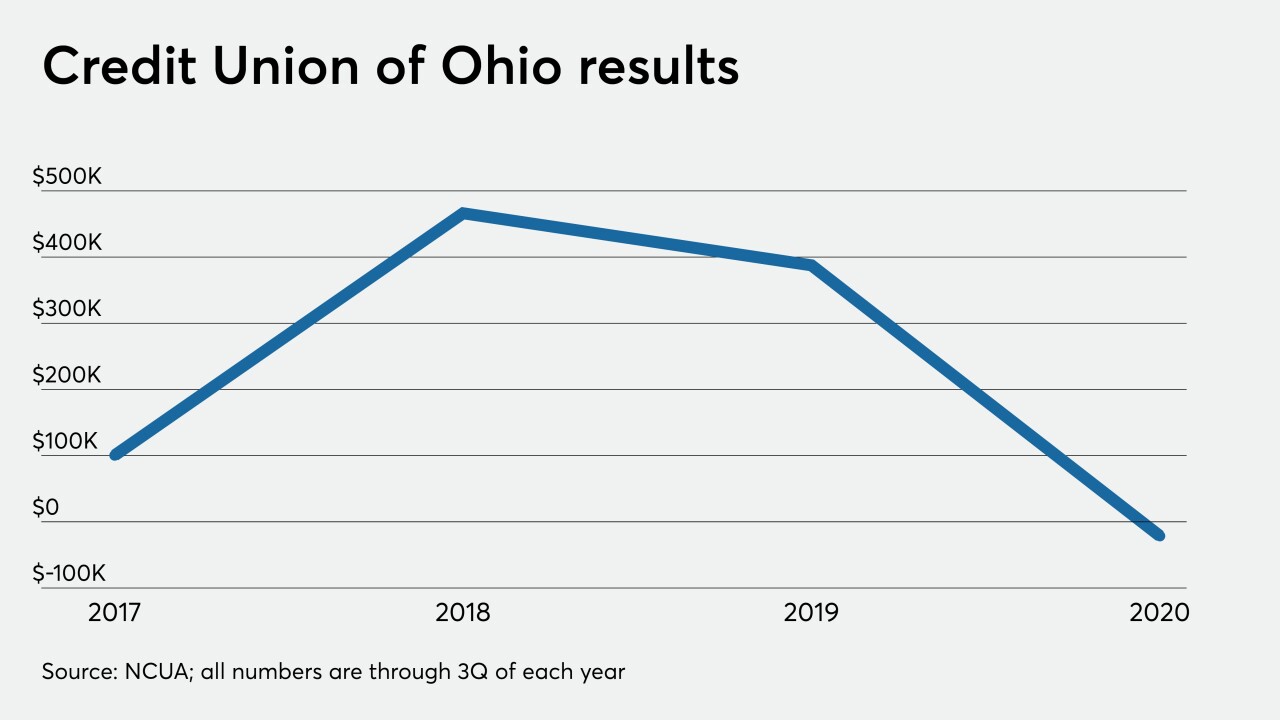

Members of First Choice Community Credit Union will have access to mobile banking and other products once the institution becomes part of Credit Union of Ohio.

October 26 -

Deposits have piled up, curtailing overdrafts and other fees. The trend could force lenders to find other ways to make money — or start cutting to the bone.

October 25 -

Equity Bank agreed to buy most of the assets, and assume all the deposits, of Almena State Bank.

October 23 -

Foreign banks for years have been using technology that folds several communication and information-sharing capabilities into one platform. Now Citigroup and others here are showing interest because of the growing importance of digital in the pandemic.

October 23 -

The bank said the move will give it more flexibility for raising capital.

October 23 -

The assertion by former Goldman Sachs executive Gary Cohn that smaller banks won't be viable in a high-tech world overlooks their success in partnering with fintechs, according to the Independent Community Bankers of America.

October 23 -

The Connecticut company, which began reviewing its operations in January, said the effort gained momentum when the coronavirus pandemic hit.

October 23 -

The company will close nine branches over the next three months.

October 23 -

As the pandemic speeds digital adoption at financial institutions, the technology giants are pitching products that scan in data from mortgage documents and provide security and compliance controls used by in-house tech developers.

October 22 -

The media company Urban One has launched a new account that includes a prepaid debit card and encourages customers to buy from Black-owned business and lets them donate their cash back to charity.

October 22 -

The media company Urban One has launched a new account that includes a prepaid debit card and encourages customers to buy from Black-owned business and lets them donate their cash back to charity.

October 22 -

Banks, lenders, and fintechs have been on a path toward digitizing the mortgage process from end-to-end — long before the term coronavirus entered our daily lexicon. How has the pandemic affected progress?

October 22 -

Highlands Banking would be based in a community near the state's borders with Georgia and South Carolina.

October 22 -

The Oregon company unveiled a sweeping cost-cutting plan that includes more remote work opportunities and up to 50 branch closures.

October 22 -

The company, which shuttered six locations in September, plans to close 14 more branches by the end of this year.

October 22