The shortage of personal protective equipment (PPE) for medical workers is one of the most troublesome elements of the coronavirus outbreak, though prior work to declutter cross-border supply chain payments provides some hope.

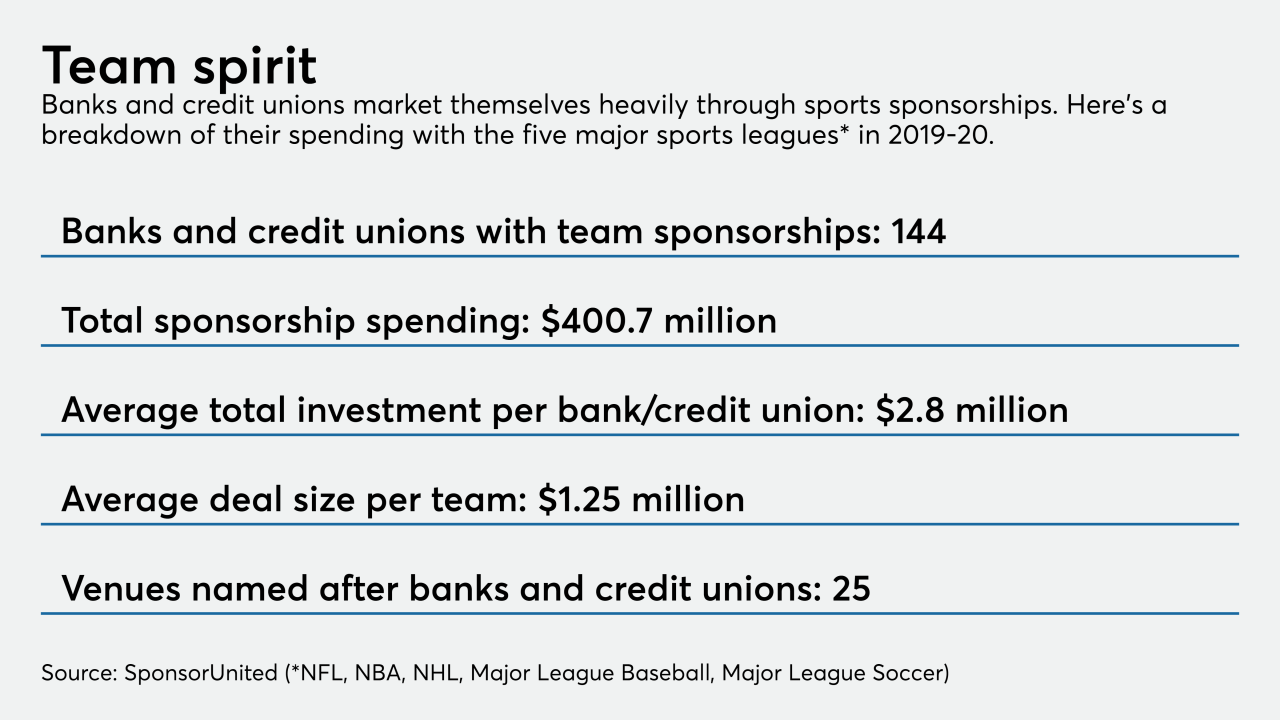

Many banks are slashing their spending. Others are changing their messaging strategies. And those banks that partner with pro sports teams are stuck in limbo, since it remains unclear when games will resume.

Small businesses that received loans from the Paycheck Protection Program pandemic still don’t know how much they may have to repay after the government missed a deadline to give specific guidance.

The deal was expected to close this summer, but First BanCorp said a regulatory review is hitting snags.

Locally sourced campaigns are providing more capital as traditional loans fall short of covering operating expenses.

Credit inquiries for auto lending, revolving credit cards and mortgages fell sharply in March as unemployment surged, according to a Consumer Financial Protection Bureau report.

Federal regulators are now conducting nearly all supervision off-site as a result of the pandemic. The temporary measures are stoking a debate about whether they should be permanent.

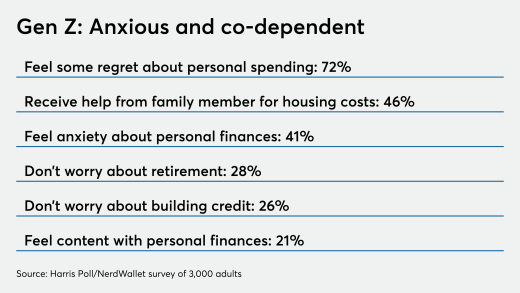

These tech-obsessed consumers still crave human interaction. Banks' challenge: Designing products and services that meet their needs.

-

The shortage of personal protective equipment (PPE) for medical workers is one of the most troublesome elements of the coronavirus outbreak, though prior work to declutter cross-border supply chain payments provides some hope.

May 4 -

Many banks are slashing their spending. Others are changing their messaging strategies. And those banks that partner with pro sports teams are stuck in limbo, since it remains unclear when games will resume.

May 3 -

Small businesses that received loans from the Paycheck Protection Program pandemic still don’t know how much they may have to repay after the government missed a deadline to give specific guidance.

May 3 -

The deal was expected to close this summer, but First BanCorp said a regulatory review is hitting snags.

May 1 -

Locally sourced campaigns are providing more capital as traditional loans fall short of covering operating expenses.

May 1 -

Credit inquiries for auto lending, revolving credit cards and mortgages fell sharply in March as unemployment surged, according to a Consumer Financial Protection Bureau report.

May 1 -

Federal regulators are now conducting nearly all supervision off-site as a result of the pandemic. The temporary measures are stoking a debate about whether they should be permanent.

May 1