There is no doubt that many restaurants and merchants are struggling right now. But it makes no sense to hurt consumers and financial institutions by expanding failed policies like the Durbin Amendment, argues Jeff Tassey, chairman of the board for the Electronic Payments Coalition.

The agency's top supervisory official said the Comprehensive Capital Analysis and Review will proceed on schedule, and signaled that the Fed will look at how institutions are responding to fallout from the coronavirus.

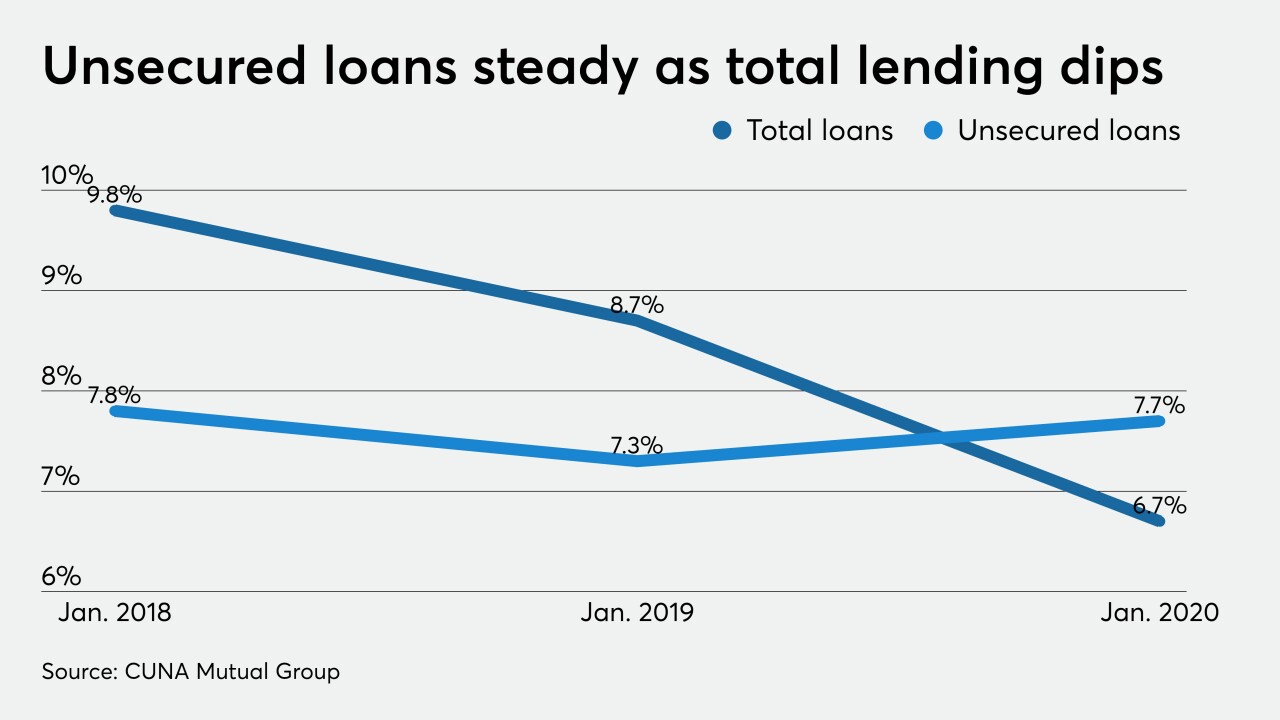

Banks, which previously shunned unsecured small-dollar lending, are now embracing the product because of the outbreak. It's just a matter of whether the shift is permanent.

The $2 trillion coronavirus rescue package and other government moves are designed to provide a lifeline for small businesses, but they also create complications as businesses must quickly accumulate payment records and other information to apply for the loans.

In blue states in particular, governors and attorneys general are taking up the mantle of consumer protection during the coronavirus emergency, effectively adding another layer of regulation to the patchwork of state and federal oversight.

Ginnie Mae will begin taking requests for assistance from issuers who, having exhausted all other options, are having trouble advancing borrowers' principal-and-interest payments to investors amid the pandemic.

After opening-day fiasco, SBA upgrades lender portal with Amazon assist; West Virginia’s First State Bank closed by regulators; BofA offers emergency loans to borrowers first, freezing out depositors; and more from this week’s most-read stories.

Bank of America, which came under fire for prioritizing applications from existing small-business customers, asked a federal judge in Baltimore to reject a request in a lawsuit to temporarily bar it from employing the practice.

-

There is no doubt that many restaurants and merchants are struggling right now. But it makes no sense to hurt consumers and financial institutions by expanding failed policies like the Durbin Amendment, argues Jeff Tassey, chairman of the board for the Electronic Payments Coalition.

April 13 Electronic Payments Coalition

Electronic Payments Coalition -

The agency's top supervisory official said the Comprehensive Capital Analysis and Review will proceed on schedule, and signaled that the Fed will look at how institutions are responding to fallout from the coronavirus.

April 13 -

Banks, which previously shunned unsecured small-dollar lending, are now embracing the product because of the outbreak. It's just a matter of whether the shift is permanent.

April 13 -

The $2 trillion coronavirus rescue package and other government moves are designed to provide a lifeline for small businesses, but they also create complications as businesses must quickly accumulate payment records and other information to apply for the loans.

April 13 -

In blue states in particular, governors and attorneys general are taking up the mantle of consumer protection during the coronavirus emergency, effectively adding another layer of regulation to the patchwork of state and federal oversight.

April 12 -

Ginnie Mae will begin taking requests for assistance from issuers who, having exhausted all other options, are having trouble advancing borrowers' principal-and-interest payments to investors amid the pandemic.

April 11 -

After opening-day fiasco, SBA upgrades lender portal with Amazon assist; West Virginia’s First State Bank closed by regulators; BofA offers emergency loans to borrowers first, freezing out depositors; and more from this week’s most-read stories.

April 10