With coronavirus driving more merchants to promote electronic payments over cash — and contactless payments over cards — many are still asking their customers to share a potentially virus-laden pen to sign a receipt or screen at the point of sale.

The 2008 package proved some banks were too big to fail. But the rushed $2.2 billion stimulus shows now any company can be bailed out.

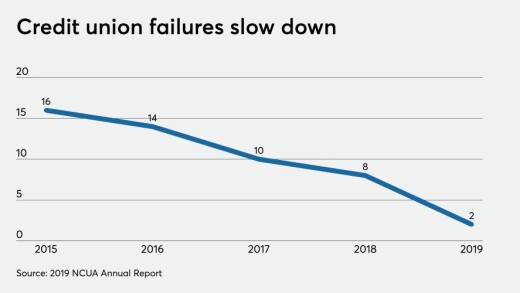

The industry still grapples with stopping corrupt employees — the failure of CBS Employee FCU last year highlights that — and now that could become even harder with the pandemic.

U.K. supermarkets which have been experimenting with mobile scan-pay-go may see more consumers adopting the technology due to social distancing requirements in stores.

Grainne McNamara, financial services principal at Ernst & Young, explains that bank regulators have already been examining banks' cultures, and that's likely to continue. But banks can still fix culture problems during a pandemic.

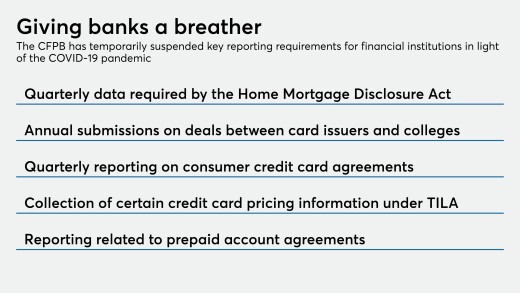

The agency has relaxed some reporting requirements and joined other regulators in encouraging banks to help borrowers, but pressure is building on the bureau to do more to aid consumers suffering financial hardship.

The company once again lowered its outlook for quarterly revenue growth, saying the coronavirus pandemic has led to a sharp decline in cardholders’ overseas spending.

Motivated by the entrepreneur and TV celebrity, Citizens Bank of Edmond is offering an overdraft line to give customers quick access to cash they will eventually receive from the federal government.

-

With coronavirus driving more merchants to promote electronic payments over cash — and contactless payments over cards — many are still asking their customers to share a potentially virus-laden pen to sign a receipt or screen at the point of sale.

March 31 -

The 2008 package proved some banks were too big to fail. But the rushed $2.2 billion stimulus shows now any company can be bailed out.

March 31 Polyient Labs

Polyient Labs -

The industry still grapples with stopping corrupt employees — the failure of CBS Employee FCU last year highlights that — and now that could become even harder with the pandemic.

March 31 -

U.K. supermarkets which have been experimenting with mobile scan-pay-go may see more consumers adopting the technology due to social distancing requirements in stores.

March 31 -

Grainne McNamara, financial services principal at Ernst & Young, explains that bank regulators have already been examining banks' cultures, and that's likely to continue. But banks can still fix culture problems during a pandemic.

March 30 -

The agency has relaxed some reporting requirements and joined other regulators in encouraging banks to help borrowers, but pressure is building on the bureau to do more to aid consumers suffering financial hardship.

March 30 -

The company once again lowered its outlook for quarterly revenue growth, saying the coronavirus pandemic has led to a sharp decline in cardholders’ overseas spending.

March 30