Some corporations are willing to oblige, turning instead to new, pricier term loans or revolving credit lines rather than tapping existing ones, industry officials say.

Commercial real estate is facing another crisis as companies shift to work-from-home policies. Banks and regulators should brace themselves.

The pandemic has the industry rethinking its hiring practices, such as how to onboard employees while limiting in-person interactions, and deciding which roles need to be filled immediately.

Card fraud risks — already soaring prior to the coronavirus outbreak — are changing rapidly as the pandemic deepens, forcing issuers and merchants to rethink protective measures.

Address verification, geolocation and 3-D secure can all play a role, according to Chargebacks 911 and Global Risk Technologies' Monica Eaton-Cardone.

Homeowners reeling from coronavirus-induced economic shock are already enduring extremely long wait times while trying to get relief. Legislation passed last week could worsen the logjams.

The $2 trillion stimulus package, which the House passed earlier in the day, aims to expand Federal Reserve liquidity resources and provide financial institutions with some regulatory relief.

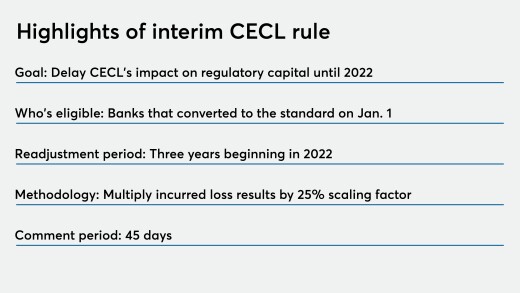

Lawmakers and regulators opted to delay compliance for banks that have implemented the credit loss standard, sparing them near-term capital hits.

-

Some corporations are willing to oblige, turning instead to new, pricier term loans or revolving credit lines rather than tapping existing ones, industry officials say.

March 30 -

Commercial real estate is facing another crisis as companies shift to work-from-home policies. Banks and regulators should brace themselves.

March 30 Community Bank Consulting Services

Community Bank Consulting Services -

The pandemic has the industry rethinking its hiring practices, such as how to onboard employees while limiting in-person interactions, and deciding which roles need to be filled immediately.

March 30 -

Card fraud risks — already soaring prior to the coronavirus outbreak — are changing rapidly as the pandemic deepens, forcing issuers and merchants to rethink protective measures.

March 30 -

Address verification, geolocation and 3-D secure can all play a role, according to Chargebacks 911 and Global Risk Technologies' Monica Eaton-Cardone.

March 30 Chargebacks911

Chargebacks911 -

Homeowners reeling from coronavirus-induced economic shock are already enduring extremely long wait times while trying to get relief. Legislation passed last week could worsen the logjams.

March 29 -

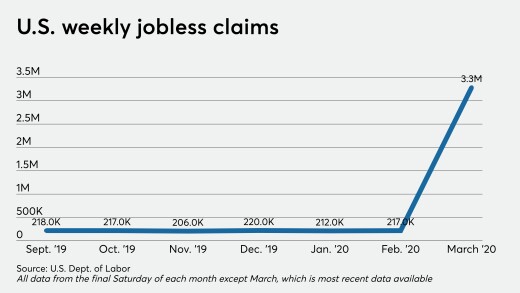

The $2 trillion stimulus package, which the House passed earlier in the day, aims to expand Federal Reserve liquidity resources and provide financial institutions with some regulatory relief.

March 27