Few lenders are finding creative ways to provide much-needed financial advice and emergency services online.

Ginnie Mae and the FHA provided temporary liquidity relief for mortgage servicers bracing for higher delinquencies, but the industry continues to pressure Treasury and the Fed to provide more comprehensive support.

The only current CEO who steered a major U.S. bank through the financial crisis, Dimon said JPMorgan’s earnings will be “down meaningfully” this year as a result of the coronavirus pandemic.

Wells Fargo said it can't fully meet demand from small businesses rushing to participate in a U.S. relief program because of constraints imposed by the Federal Reserve on the bank's growth.

Car loans make up about a third of credit unions' total lending portfolio, and any drop in that sector could resonate across the entire industry.

The potential for fraud fueled by the coronavirus pandemic, coupled with the anticipation of a $2 trillion stimulus, is creating such a lucrative opportunity for scammers that Visa and the Secret Service are predicting a wave of unprecedented levels of fraud.

Ally, Discover and USAA have made technological, managerial and policy changes to help their centers' employees cope with the rush of calls from customers hurt by the pandemic.

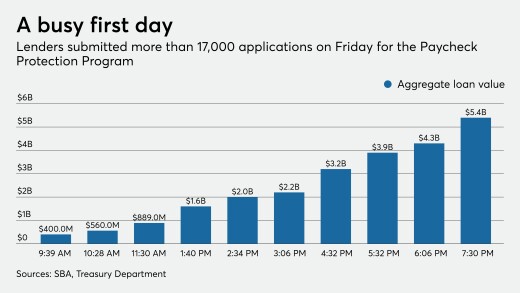

Sen. Marco Rubio, R-Fla., said that $349 billion will likely not be enough meet loan demand from small businesses seeking a lifeline to help them weather the economic downturn brought on by the coronavirus outbreak.

-

Few lenders are finding creative ways to provide much-needed financial advice and emergency services online.

April 6 SigFig

SigFig -

Ginnie Mae and the FHA provided temporary liquidity relief for mortgage servicers bracing for higher delinquencies, but the industry continues to pressure Treasury and the Fed to provide more comprehensive support.

April 6 -

The only current CEO who steered a major U.S. bank through the financial crisis, Dimon said JPMorgan’s earnings will be “down meaningfully” this year as a result of the coronavirus pandemic.

April 6 -

Wells Fargo said it can't fully meet demand from small businesses rushing to participate in a U.S. relief program because of constraints imposed by the Federal Reserve on the bank's growth.

April 6 -

Car loans make up about a third of credit unions' total lending portfolio, and any drop in that sector could resonate across the entire industry.

April 6 -

The potential for fraud fueled by the coronavirus pandemic, coupled with the anticipation of a $2 trillion stimulus, is creating such a lucrative opportunity for scammers that Visa and the Secret Service are predicting a wave of unprecedented levels of fraud.

April 6 - AB - Technology

Ally, Discover and USAA have made technological, managerial and policy changes to help their centers' employees cope with the rush of calls from customers hurt by the pandemic.

April 5