-

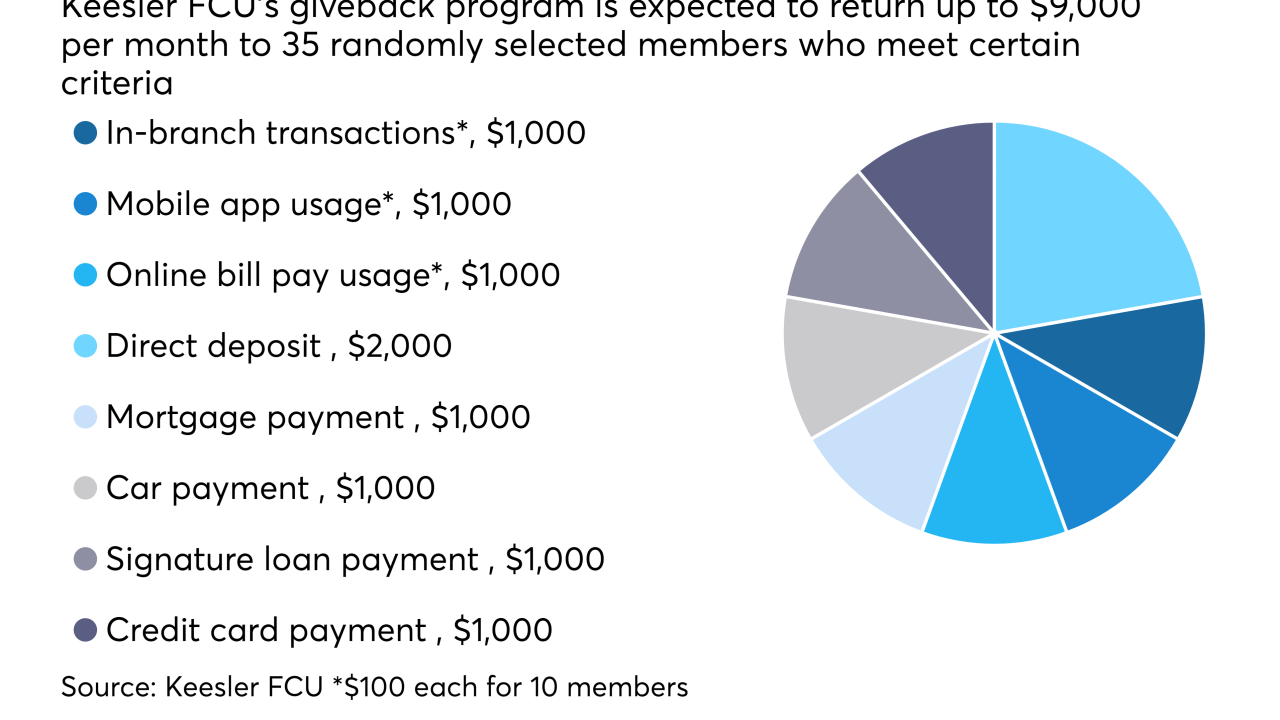

A new initiative at Keesler FCU will return as much as $108,000 in givebacks to members during its first year, but do CUs get any real value from returning that much money to their membership?

May 23 -

The rising regional player has also appointed new chairs for four board committees as it prepares for the retirement of several long-serving directors.

May 23 -

The merger is expected to be completed by year-end, and the combined institution will have assets of more than $1.2 billion, serving more than 105,000 members.

May 22 -

In a world where confidence is rewarded more than indecision, businesses risk elevating confident leaders who overestimate their abilities. In banking, that can have harmful effects.

May 22 IBM Global Business Services

IBM Global Business Services -

The company agreed to buy Commerce Bancshares, which has three branches in Boston.

May 22 -

First Savings Financial in Indiana and Dime Community in New York are keen on making more SBA loans as a way to diversify revenue and generate fees through loan sales.

May 19 -

Financial Institutions in western New York withdrew plans to raise $40 million.

May 19 -

Readers opine on legacy core systems, the negative messaging around the Troubled Asset Relief Program, Jamie Dimon defending his Trump ties, and more.

May 19 -

The credit union will partner with the YMCA of Northwest North Carolina on a two-year health and well-being research study funded by a grant from the Robert Wood Johnson Foundation.

May 18 -

The German bank posted two consecutive years of losses partly because of misconduct fines tied to the Libor and other scandals.

May 18 -

Fifteen participants will be chosen for the two-year innovation curriculum.

May 17 -

Dakotas group elects new leadership, Altura promotes new chiefs and other new hires, promotions and appointments.

-

Along with asset and membership milestones, the credit union celebrated its 100th anniversary in 2016.

May 16 -

JPMorgan Chase's chief caught a lot of Trump blowback at its annual meeting but refused an activist investor's challenge to step down from the president’s council on jobs.

May 16 -

The $489 million acquisition is among the ten biggest bank M&A deals announced this year.

May 16 -

The Minnesota company recently announced that it would stop selling auto loans since credit quality concerns have slowed investor demand, but it is unclear whether its plan to keep all its car loans on its books is less risky.

May 15 -

Stilwell Group, an activist investor, is alleging that HopFed chief John Peck bought two properties from the then-chairman of the Kentucky company's compensation committee and that the deals were a conflict of interest.

May 12 -

Bank First has agreed to pay $76 million in cash and stock for Waupaca Bancorp. The company should have nearly $1.8 billion in assets when it completes the deal.

May 12 -

Executives at the embattled bank made clear Thursday that they are not discarding its long-standing strategy of selling additional products to existing customers.

May 11 -

Wells said slowing loan growth had hurt its aggressive efforts to lower its efficiency ratio, so it is doubling the expenses it aims to cut by 2019.

May 11