-

The credit union regulator's unusual attempt to auction pricey items from a former chairman's office has revealed more about interoffice dynamics at the agency.

February 24 -

Some in the industry are beefing up online educational offerings and enlisting social media ambassadors on college campuses to help recruit younger consumers.

February 22 -

A severe cold snap in the state has tested financial institutions unaccustomed to such weather-related disruption.

February 19 -

Todd Harper, chairman of the National Credit Union Administration, said new assessments are likely needed because of an influx of deposits, but industry groups and other board members say the agency should wait to see if the reserve ratio recovers on its own.

February 18 -

Noninterest income from Paycheck Protection loans and mortgage refinancings isn't enough to make up for shortfalls elsewhere, and growth prospects are hard to identify.

February 16 -

A plan to make expansion easier for credit unions is getting pushback not just from bankers, but also from the regulator's current chairman and a former board member.

February 12 -

Home loans accounted for the bulk of the industry’s lending gains in 2020, but inventory shortages in some markets and an uneven economic recovery may dim prospects this year.

February 9 -

The onset of COVID-19 forced the industry’s largest trade group to put its Open Your Eyes campaign on hold, but nearly a full year later it’s still struggling for industry buy-in.

February 5 -

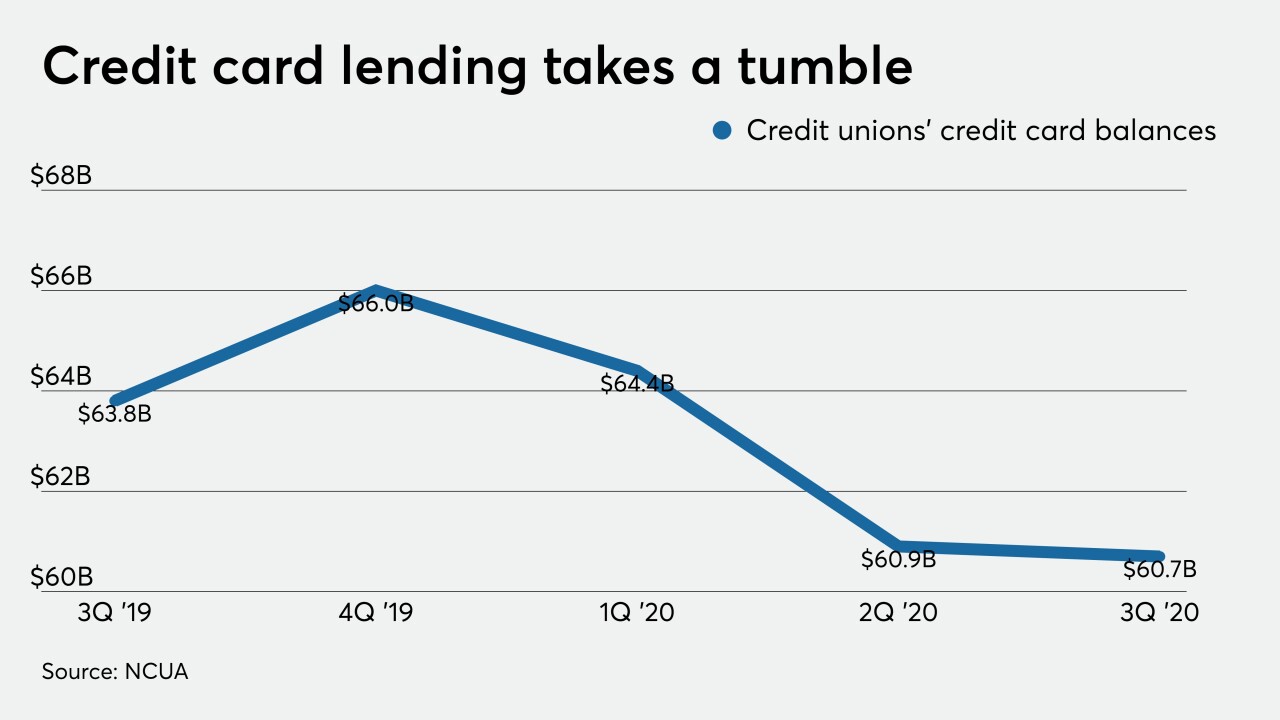

Credit unions are hoping for a return to normal credit card spending patterns sometime during the second half, but the pandemic has created a domino effect of complicating factors.

February 4 -

Any business loan growth the industry sees this year will be closely tied to mass vaccination efforts and a broader economic recovery, meaning it may take until at least the third quarter for pent-up demand to translate into new opportunities.

February 3