-

A new report from the National Credit Union Administration showed institutions in many states are struggling with a deluge of deposits while their lending opportunities are drying up.

December 20 -

The spending plan passed in a party-line vote, but board member Todd Harper's objections indicate he could push for closer oversight if President-elect Joe Biden elevates him to the chairmanship.

December 18 -

Starting in 2022, hundreds of newly eligible institutions will be able to raise funds from investors. Bankers argued that the change will further blur the line between the two industries.

December 17 -

Credit union trade groups said the regulator’s spending plan indicates the agency isn't listening to feedback and needs to make further cuts while providing more support for de novos.

December 17 -

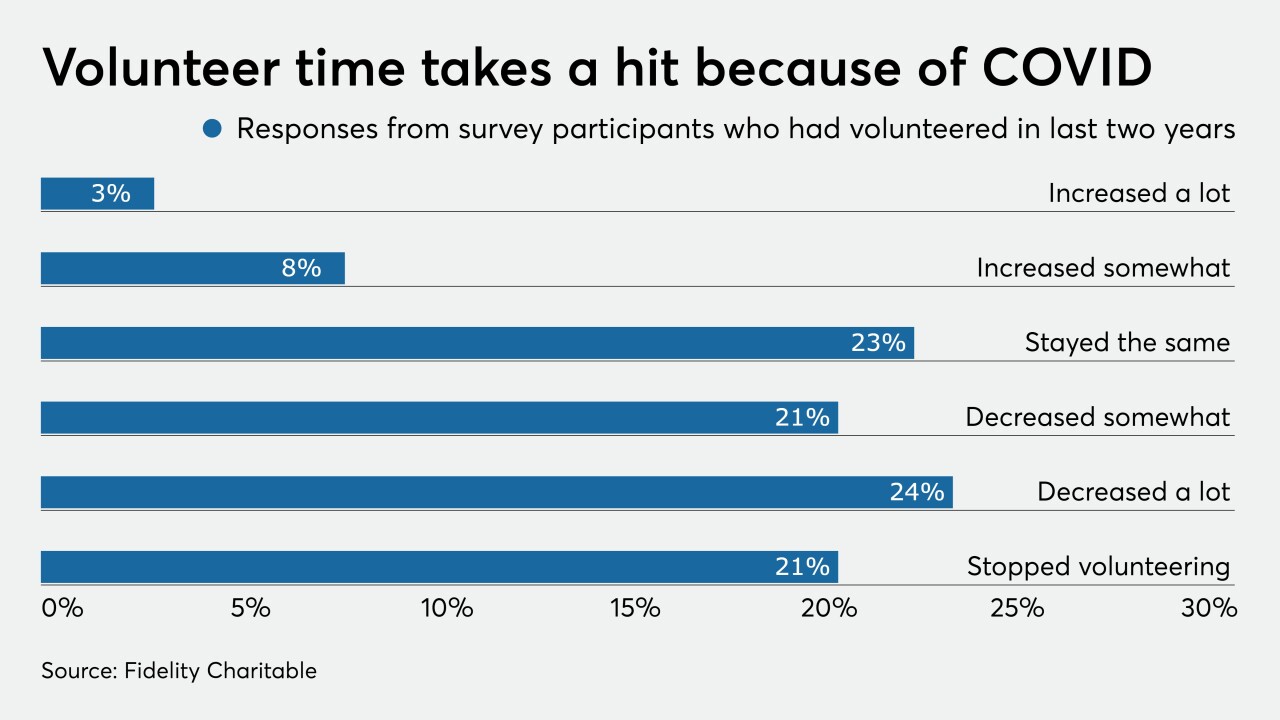

Social distancing has put a crimp in the credit union industry's usual philanthropic activities, but many institutions are finding new ways to give back during this festive season.

December 16 -

Some credit unions that gave bonuses to front-line staff at the onset of the coronavirus outbreak may be too cash-strapped to offer similar payouts during this latest surge.

December 15 -

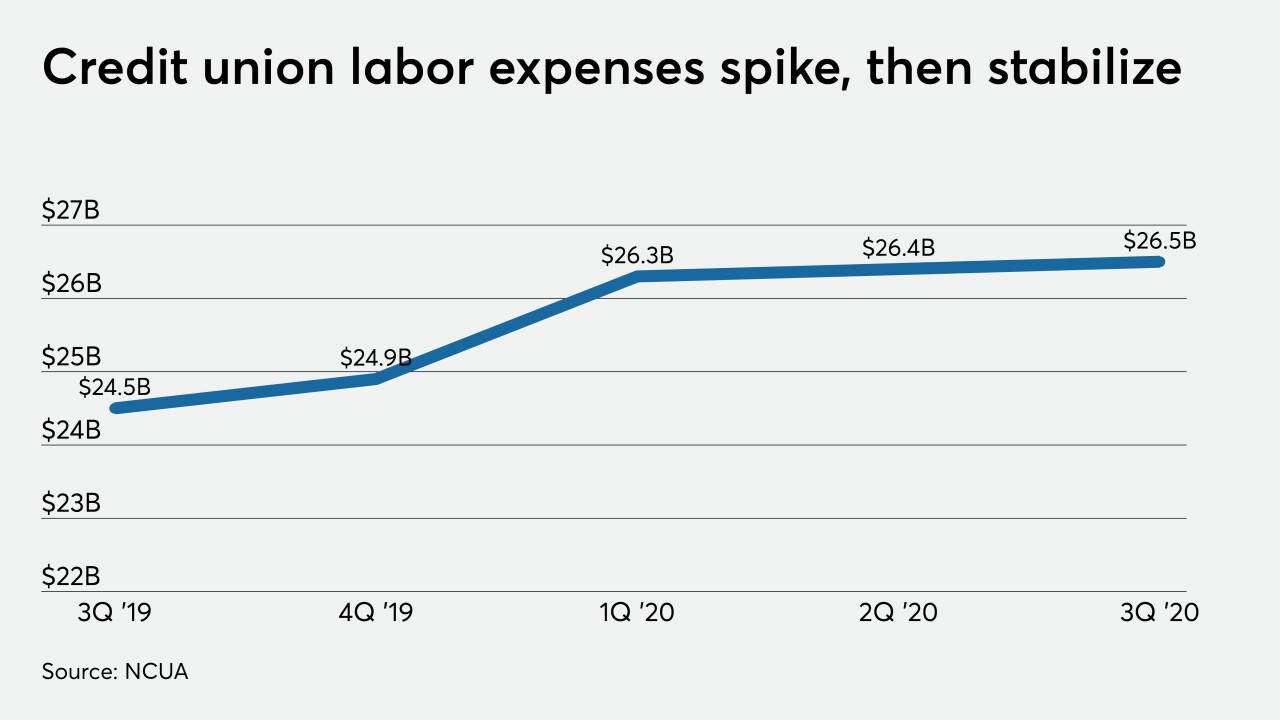

Management teams are forging ahead with technology projects and bonuses for some employees despite a deep slide in net income this year.

December 14 -

To improve a declining rating in the annual American Consumer Satisfaction Index, credit unions may have to make hefty investments in technology upgrades, something most of them can't afford.

December 10 -

It's legal to require vaccinations to ensure health and safety in branches, but employers risk adding to workplace tension.

December 9 -

Credit quality has remained strong at credit unions, but there are hints that some of them — especially the smallest ones — could report lackluster earnings well into next year, according to the National Credit Union Administration's latest intel on industrywide finances.

December 8