-

Members can play an integral role in helping credit unions fight fraud, but only if they have the right training.

October 9 Q2 Holdings

Q2 Holdings -

Collaboration between banks and fintechs still lags, hurting security initiatives such as an authentication hub.

October 9 -

Analysts are split on whether cyber threats have evolved enough for lawmakers to finally grant the National Credit Union Administration third-party vendor oversight.

October 9 -

In monitoring the patterns of a North Korean cyberattack organization that has stolen more than $1.1 billion from global financial institutions since 2014, security firm FireEye says these hackers are still at work in targeting a bank's access to the Swift messaging network.

October 5 -

Cryptocurrency platforms need to take precautions as the number of security incidents seems to be increasing, writes Gaurav Banga, founder and CEO of Balbix.

October 3 Balbix

Balbix -

JPMorgan Chase's Jamie Dimon downplayed "too big to fail," warned against the risk of cyberattacks and lectured high-tech giants about their privacy shortcomings during an appearance in Washington.

October 2 -

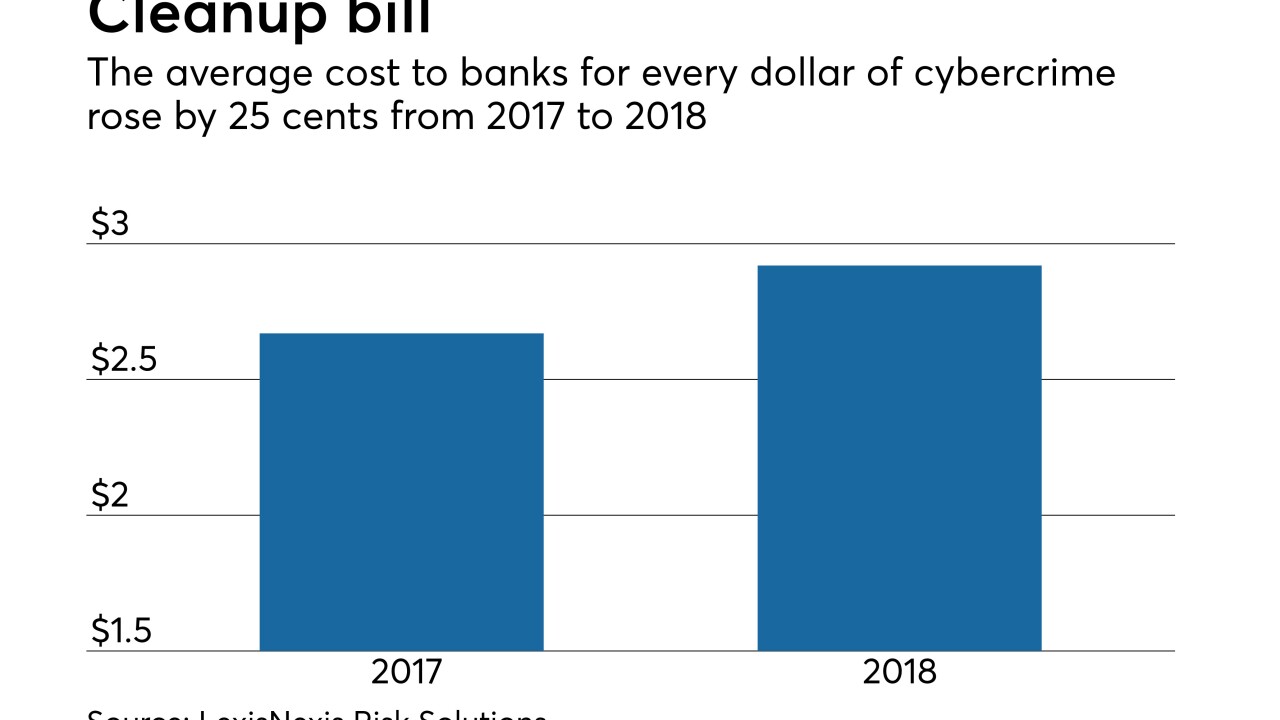

Banks’ tab to fight hackers rose 9% from last year by one measure. Investors want them to rein in tech investments, but security experts say the crooks are getting smarter and smarter.

October 2 -

The cost of fighting fraud at financial institutions is up nearly 10 percent from last year. That means credit unions face significant challenges in being ready for the next threat.

October 2 -

Collaboration is a critical part of how we prevent cyberattacks from turning into breaches that put consumer payment card data at risk, writes Lance Johnson, executive director of PCI SSC.

October 1 PCI SSC

PCI SSC -

Visa is pursuing the online criminals to prevent future fraud. Visa also works with law enforcement agencies to quantify potential losses and, where possible, assist in the threat mitigation.

October 1 -

In September, the National Credit Union Administration barred five people from the industry, including one individual who was accused of working to embezzle more than $1 million.

September 28 -

The law gives residents more — and welcome — control over their data. But it will take work for credit unions to meet the new requirements, such as possibly having to amend third-party vendor agreements.

September 27 Samaha & Associates

Samaha & Associates -

Biometrics make sweeping attacks harder to pull off, but fraudsters are finding new ways to target vulnerable groups of customers.

September 26 -

Card-on-file tokenization systems enable payment details to be instantly refreshed when a card is lost, stolen or expires, according to André Stoorvogel a director at Rambus.

September 26 Rambus

Rambus -

Her primary job is advising senior executives on compliance, technology and data security matters, but Hosein is also making a mark as a champion for up-and-coming female leaders.

September 25 -

The plan identified five risk areas — including cybersecurity — that will be on the agenda for agency examiners next year.

September 25 -

Fintech developers are trying to monetize data without scaring away privacy-conscious consumers — and, increasingly, to make sure bigger financial companies don't overstep the same boundaries.

September 24 -

A deaf woman who had over £8000 stolen from her bank account by fraudsters has become the latest symbol of the insecure practice of using phone numbers as proof of identity.

September 21 -

Every month, from January to April of this year, there were roughly 3.2 billion attacks perpetrated by malicious code that infiltrated business' networks. Representatives of smaller financial institutions disputed the notion that they are one of the weak links in the chain.

September 20 -

State regulators and advocacy groups say a federal breach notification standard could supersede state laws that already benefit consumers.

September 19