-

The use of one-time tokens has picked up steam in the past year, especially with merchant groups waiting for EMVCo to release specifications for a payment account reference.

February 2 -

Banks are checking vendors' security practices; Mnuchin appointment to Treasury put on hold as Democrats stall.

February 1 -

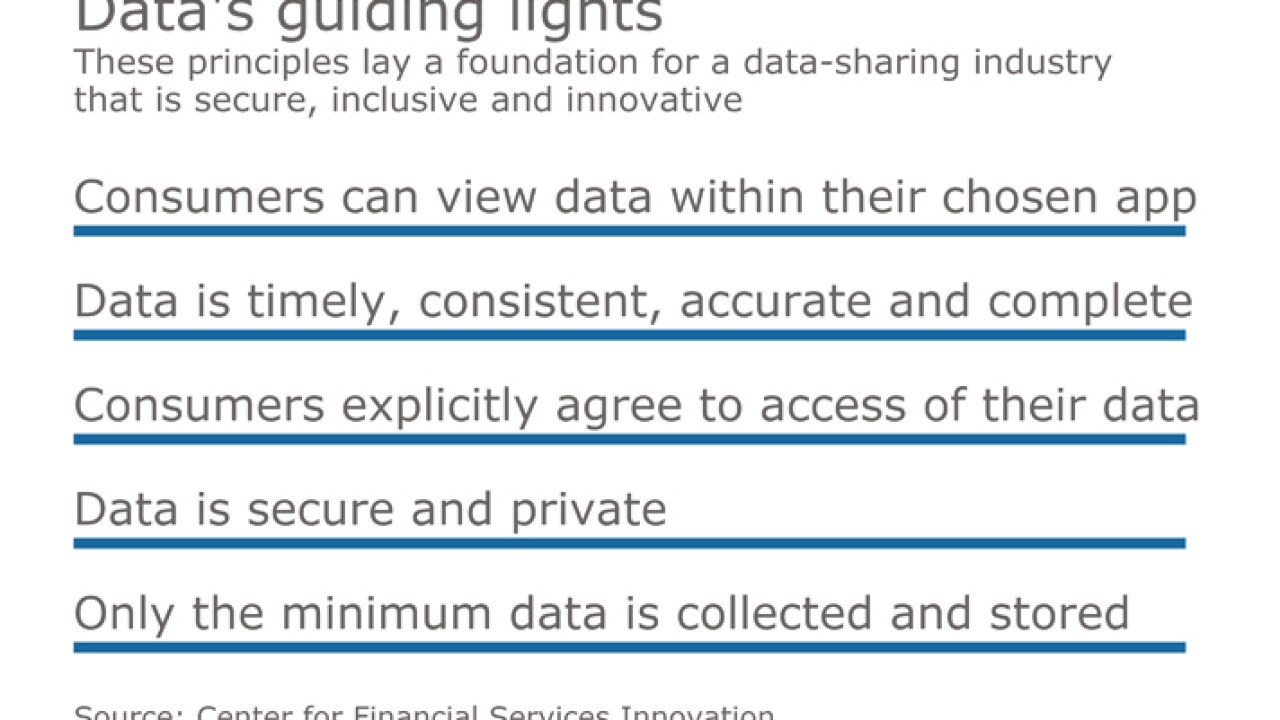

The long-running feud between banks and fintech companies over screen scraping is morphing into a more nuanced and important conversation about how to exchange consumers' financial data securely and fairly.

January 27 -

Recommendations for a framework to develop a "universal security baseline" to protect sensitive payment data at rest and in transit remains a key goal of the Federal Reserve faster payments initiative.

January 27 -

Facebook now lets users log in using a physical token. If banks gave consumers this option, it would strengthen the security of online accounts — or at least bolster their image.

January 26 -

As Facebook users increasingly deal with personal and payment data, the social media giant is turning to the Security Keys standard hosted through the Faster Identity Online Alliance for stronger authentication.

January 26 -

The deal points a way forward, not only to resolve the debate over screen scraping and ownership of customer data but to redefine banks' value proposition.

January 25 -

Customers of JPMorgan Chase will no longer have to surrender their bank credentials in order to use Intuit products like Mint, TurboTax or QuickBooks.

January 25 -

The breaches at large retailers and other companies are continuing, making it time to fully embrace a new authentication method.

January 25 HYPR Corp.

HYPR Corp. -

A pair of technology entrepreneurs hopes the flexibility provided by mobile technology and open development tools can finally kill off the stale authentication method.

January 24 -

Lloyds Banking Group was hit by a cyber attack that disrupted online services for customers two weeks ago, a person with knowledge of the matter said.

January 23 -

Bank consortium R3 CEV, one of the most well-funded blockchain working groups, has endured criticism for its meticulous process. But if blockchains are most valuable with a network effect, maybe forgoing some agility is worth the long while.

January 20 -

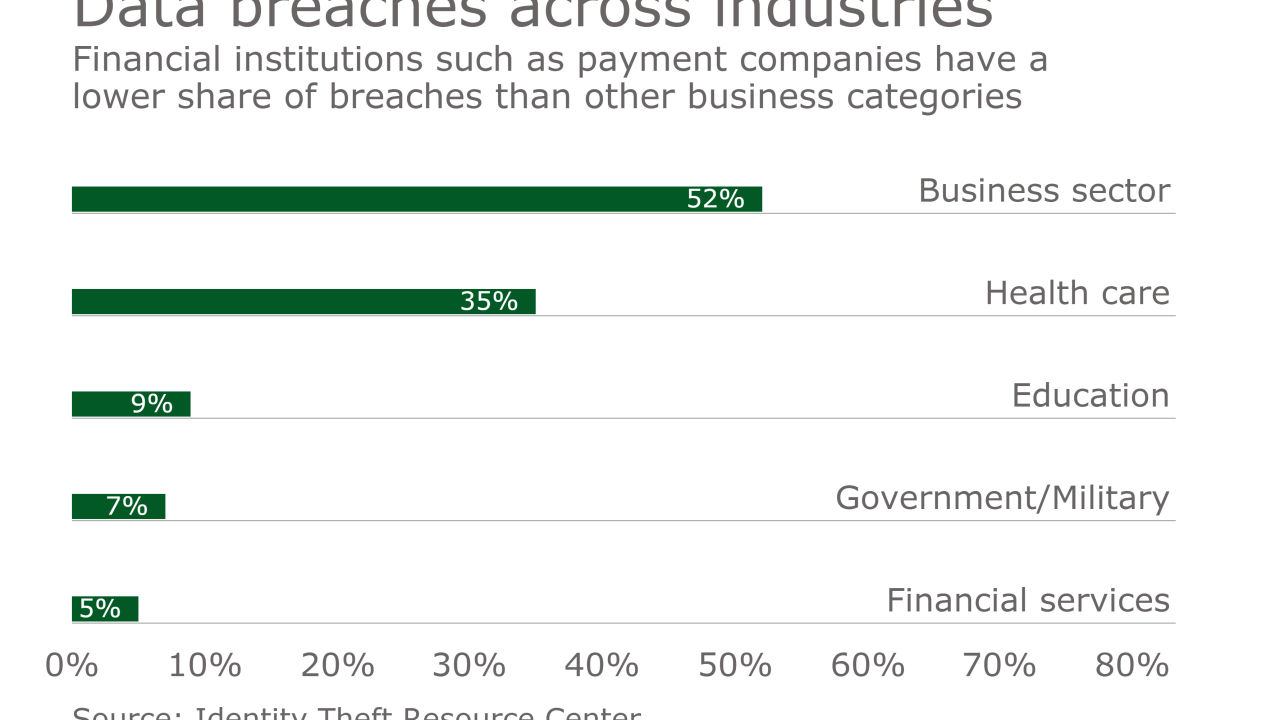

Payment companies and other financial institutions were victimized less than health care, educational institutions and government agencies.

January 20 -

Rather than killing off the plastic card, smartphones are strengthening it. Many issuers' card accounts are more valuable than ever, with perks made possible only through the development of smartphone apps.

January 20 -

It should surprise no one that the cybersecurity rules regulators are drafting are simplistic and written in one size to fit all.

January 19

-

As payments become "invisible," easier execution will also make transactions more safe and power marketing programs

January 19 J.P. Morgan

J.P. Morgan -

HSBC has formed an advisory board to guide it on fintech, cybersecurity and IT infrastructure issues.

January 17 -

Robins Financial recognizes trio of top employees, Numerica ramps up lending department and more CU professionals in the news.

January 13 -

Some vendors have begun offering authentication platforms through which biometrics and other authentication tools can be plugged into any or all channels. TD Bank is sold on this concept, but others are not completely sure.

January 12 -

Credit union technology executives and analysts suggest the industry must collaborate to work on three primary areas: cybersecurity, data and business intelligence and digital-first strategies.

January 12