-

When customers are targeted directly with fake text messages that lead to account takeover, artificial intelligence, and in some cases generative AI, can play a role in fighting the fraud, experts say.

February 5 -

With tougher capital requirements looming, a number of regionals including U.S. Bancorp, Huntington and Santander are using these new instruments to share risk with nonbank investors and lighten their capital load. Experts point out the pros and cons.

February 1 -

Experts explain which features customers expect, which they love and where banks are creating a competitive edge with their apps.

February 1 -

With the growing interest in generative AI, it seems inevitable that some banking jobs will change while others will be eliminated entirely.

January 29 -

Fintechs' venture capital funding began to evaporate last year, while payments startups fared somewhat better by emphasizing quicker pathways to profits. It's a trend experts say is likely to persist this year as investors remain more cautious about costly or long-term plays.

January 23 -

Mike Abbott, global banking lead at Accenture, shared where he sees banks using the technology most effectively in the year ahead.

January 22 -

Longtime executive Raymond Joabar discusses how the card network mixes direct outreach and fintech partnerships to build a global network covering the U.K., the Caribbean and other regions.

January 22 -

Bank regulators Friday said the existing laws governing safety and soundness and fair lending are adequate to address risks posed by artificial intelligence, noting that while AI may be used to inform lending decisions, banks are ultimately responsible for compliance.

January 19 -

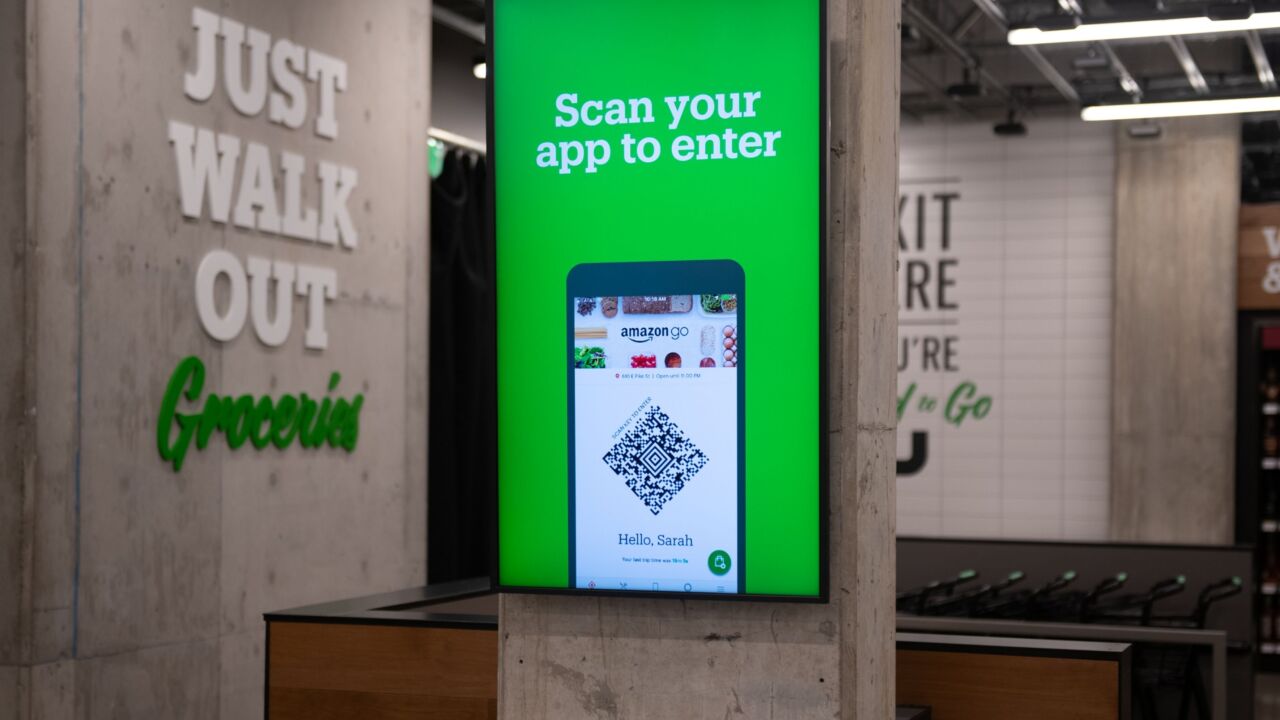

When the e-commerce giant designs and revises new store models like Just Walk Out, it faces a challenge: How do you train technology that requires real-world data that doesn't yet exist?

January 16 -

The card network is creating a generative AI-powered chatbot to give small-business owners personalized assistance, emphasizing 'inclusive' resources and mentorship for minority entrepreneurs.

January 12 -

After being undercapitalized for decades, some minority-led banks finally got large capital infusions in the wake of George Floyd's murder. But higher interest rates have made it harder for them to gather the deposits they need to boost lending substantially.

January 9 -

The Cincinnati, Ohio, bank also promoted three other top executives to new roles. All of the changes will be effective in early 2024.

December 19 -

The Consumer Financial Protection Bureau's annual student banking report reveals that college-endorsed financial products, including credit cards and student ID-linked deposit accounts, often impose high fees and unfavorable terms, reinforcing the CFPB's ongoing scrutiny of potential violations of federal consumer financial protection laws.

December 19 -

The Consumer Financial Protection Bureau ordered U.S. Bank to pay about $21 million for its prepaid debit card program for government benefits, while the Office of the Comptroller of the Currency issued a $15 million fine over similar violations.

December 19 -

Remote work trends and high interest rates have substantially reduced the values of U.S. office buildings. A new academic paper estimates the extent of the deterioration, suggesting that there is perhaps more stress ahead for banks than is widely anticipated.

December 18 -

The $225 billion-asset Citizens Financial Group has partnered with the fintech Pinwheel to streamline the process for new account holders to switch the direct deposit of their paychecks from their old banks.

December 18 -

Left-leaning shareholder groups are asking JPMorgan Chase, Goldman Sachs and other large asset managers to explain a recent decline in their support for certain environmental and social policies at public companies.

December 18 -

The Connecticut bank agreed to pay $350 million to acquire Ametros Financial, a custodian and administrator of medical funds from insurance claim settlements. Some analysts see the deal as a signal that Webster does not plan to sell its health savings account business, which has been the subject of recent speculation.

December 15 -

The muni market finances the "fabric of our nation, and now, because of Citi's exit, the cost of financing for state and local governments is going to go up," a sell-side source said.

December 15 -

The changes include elevating several recently hired executives while eliminating nearly two dozen jobs and trimming annual operating expenses by $6 million.

December 15