-

The company agreed to buy the parent of First National Bank of Crossett for about $13 million.

May 16 -

The Arkansas company's revenue increased largely due to its 2017 purchase of Stonegate Bank.

April 19 -

Loan growth and higher yields helped offset a 20% increase in expenses at the Arkansas bank in the first quarter. Meanwhile, it warned of one-time rebranding costs to come in the third quarter.

April 12 -

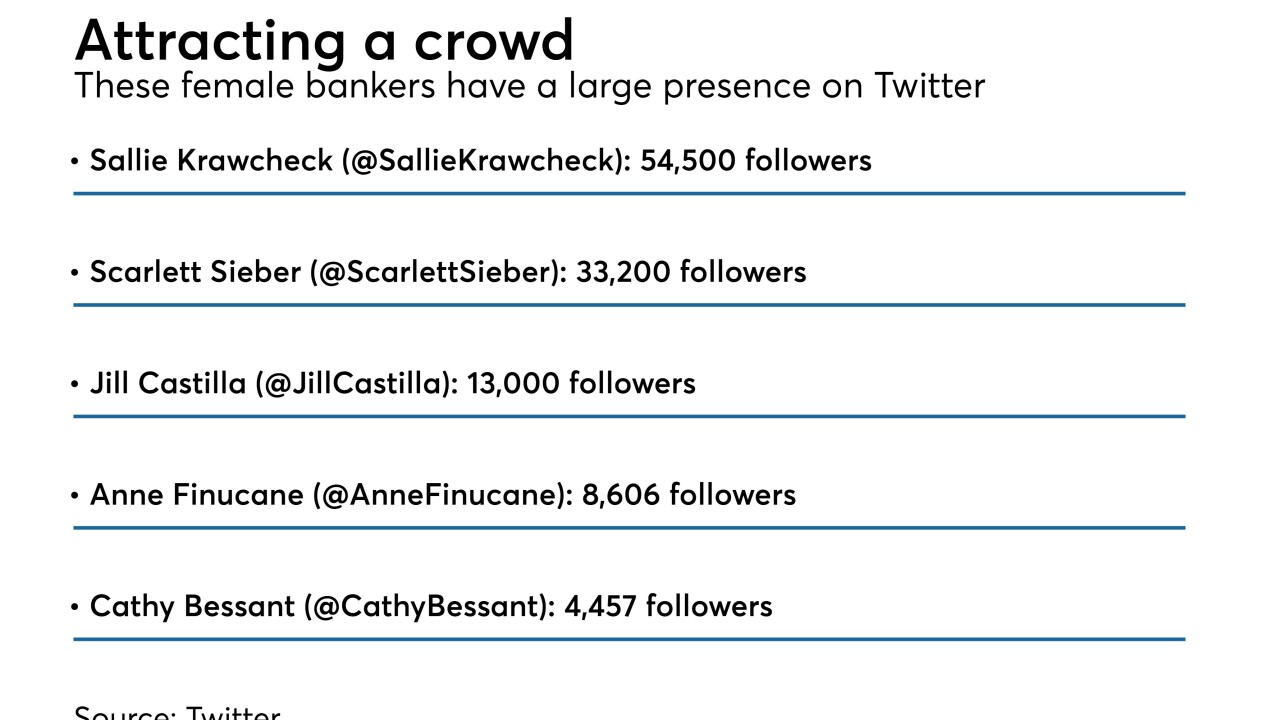

Natalie Bartholomew, a banker in Oklahoma, has launched a blog designed to promote women's issues and tout her peers' accomplishments.

March 2 -

A Georgia Supreme Court case sheds light on the lengths that the often assailed industry has gone to shape policy outcomes. It also raises the question of whether, in evaluating industry-funded research, it is enough to assess the published study itself, or if it is necessary to dig deeper.

February 5 -

The Arkansas company has spent two years trying to reassure nervous investors and analysts that it can rapidly book real estate loans using conservative practices.

January 18 -

The Arkansas company's earnings fell 52% from a year earlier, reflecting a higher provision, a revaluation of its deferred tax asset and higher costs following a series of bank acquisitions.

January 18 -

The Arkansas company's net income topped $100 million for the first time, though it largely reflected the revaluation of its deferred tax liability.

January 16 -

The partnership aims to increase efficiencies and reduce expenses for the three-state league.

January 11 -

A 38% increase in new loan originations led to another quarter of record earnings.

October 11 -

Heartland Bank had been operating under a regulatory order from the Fed since December.

August 29 -

Bank of the Ozarks, Home BancShares and Simmons First have used acquisitions and a business-friendly environment in their home state to become regional powers.

August 23 -

Arvest agreed to pay nearly $400 million in cash for a bank with 42 branches in Arkansas, Missouri and Oklahoma.

August 22 -

Southwest Bancorp, frustrated with a lethargic stock price, opted to find a buyer last summer. It was holding talks with Simmons First when the post-election run-up in bank stocks gave its shares an unexpected lift. Did it do the right thing by proceeding?

July 28 -

The Arkansas bank bought C1 Financial in Florida and Community & Southern Holdings in Georgia last year.

July 12 -

The Arkansas company is selling more than $300 million in stock a year before its DFAST test in June 2018.

May 25 -

One Bank & Trust in Arkansas just sold itself to the Treasury, resolving a legal judgment and clearing the way for a resale to the private sector.

May 9 -

The Little Rock, Ark., bank said first-quarter profits rose slightly and that it plans to dissolve its holding company to trim regulatory costs.

April 11 -

The Arkansas company has bought 12 banks in Florida since 2010, and its CEO said he had coveted Stonegate for years before agreeing to buy it this week. Yet there is nagging talk about a new bubble in the Sunshine State.

March 28 -

The deal comes on the heels of Simmons’ agreement to buy Southwest Bancorp in Oklahoma.

January 24