-

The election of Democrat Phil Murphy as New Jersey's next governor is being hailed as a victory for advocates of state-owned banks. But challenges remain — namely, stubborn opposition from mainstream banks.

November 13 -

The planned sale will also include $70 million of loans in southern California.

November 13 -

SDCCU’s member base increases 10.4 percent in one year, total assets up to $8.2 billion.

November 13 -

Most of Sterling Bancorp's operations are in San Francisco and Los Angeles. The company plans to use some of the $93 million it will raise to expand in New York and Seattle.

November 9 -

Here's a look at the 12 housing markets with the largest percentages of mortgages over $500,000 — the new threshold House Republicans have proposed for the mortgage interest deduction in their tax plan.

November 9 -

Endeavor Bank in San Diego aims to be the third new bank to open this year. There is hope that as many as eight new institutions could open in 2018.

November 8 -

California State & Federal Employees Credit Union was approved to expand its FOM to Humboldt, Del Norte and Trinity Counties

November 8 -

The company has agreed to buy CBBC Bancorp. It also raised $63 million to pay for the deal and fund future growth.

November 8 -

With marijuana sales set to become legal in California soon, a working group there says that a state-backed financial institution should be among the measures weighed to address the lack of banking services available to the pot industry.

November 7 -

Capital Corps, led by Steven Sugarman, aims to provide financing to homeowners and small businesses that it believes are overlooked by banks. The firm features several former Banc of California executives.

November 6 -

A House Republican tax proposal that infuriated housing groups and sent homebuilder stocks sliding would only have a modest impact on the market for new homes and could end up being a net positive for the industry, according to Keefe, Bruyette & Woods analysts.

November 3 -

David Ritchie, a regional manager for U.S. Bank, will succeed the retiring David Tabor in early November.

October 30 -

A new partnership from two of the nation's largest CUSOs will give more credit unions the opportunity to use the Lending 360 loan origination system.

October 27 -

Chief among the credit union’s aid efforts are low- and no-interest loans, and initiatives in concert with other area service providers.

October 20 -

PacWest reversed a valuation allowance on tax credits, which helped boost third-quarter earnings. PacWest also expects its deal for CU Bancorp to close this week.

October 17 -

Wells Fargo was barred by California's treasurer from being hired for another year because of the bank's fraudulent account scandal, leaving the company largely cut off from underwriting work with one of the nation's biggest municipal-bond issuers.

October 16 -

Saying farewell after 25 years with LAFCU and 43 total years in the credit union industry.

October 16 -

Wells Fargo's home state of California passed a law aimed at curtailing the bank's use of closed-door arbitration to shroud complaints from aggrieved customers affected by its scandals.

October 5 -

The Western Independent Bankers will continue to offer conference and educational services as a division of the California Bankers Association.

October 2 -

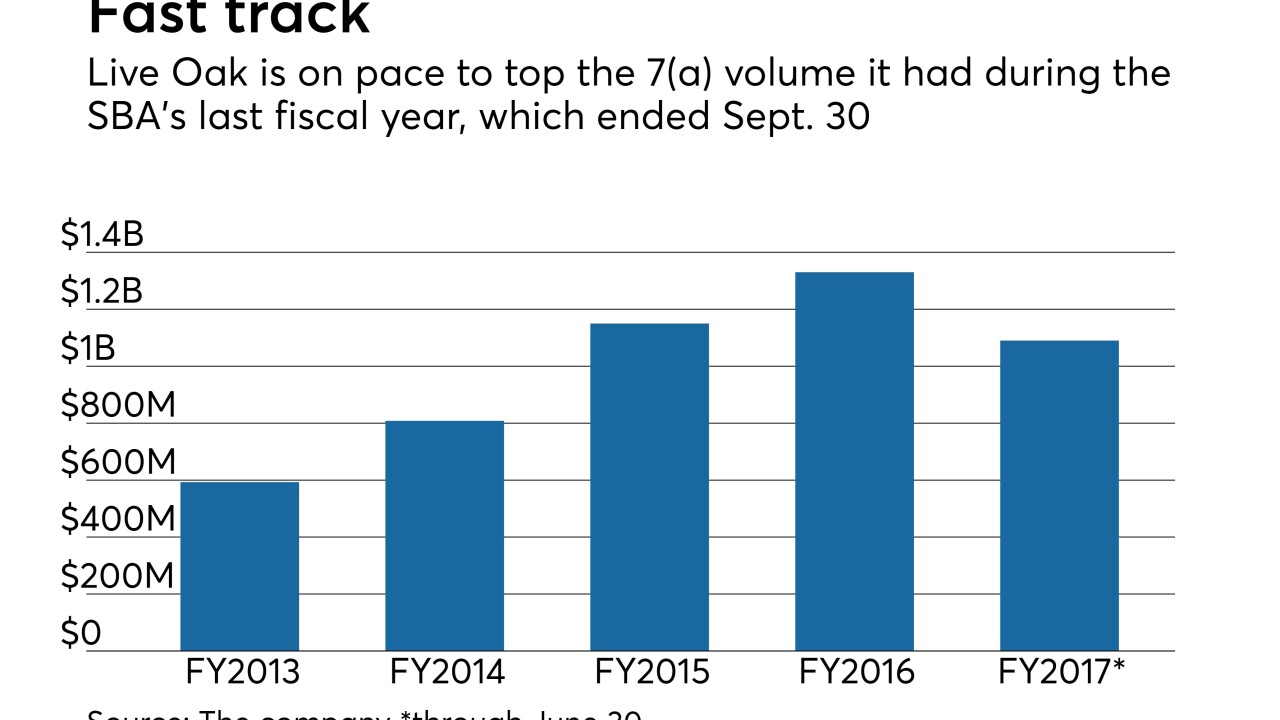

Live Oak Bancshares is used to finding ways to make small-business loans, but its new M&A operation was formed after two bankers pitched the plan to Live Oak's management.

September 22