-

With desirable merger partners hard to find, some credit unions are starting to look well beyond their home base.

October 29 -

ATBancorp had an unusual footprint that included a small bank and a number of fee-based businesses. But it had to slim down before it could find a buyer.

October 26 -

The credit union in San Diego expects to increase its efficiency and add products and services once the switch is complete.

October 22 -

Brett Martinez, president and CEO of Redwood Credit Union, will be honored for his efforts in supporting survivors of California's wildfires in 2017.

October 22 -

JPMorgan Chase plans to open a fintech campus in Palo Alto, California, part of the bank's efforts to attract more Silicon Valley talent.

October 19 -

The California company reported increases in loans and deposits, along with a wider net interest margin.

October 18 -

With its CEO planning retirement, tiny Coast-Tel Federal Credit Union is seeking approval to merge into Bay FCU.

October 11 -

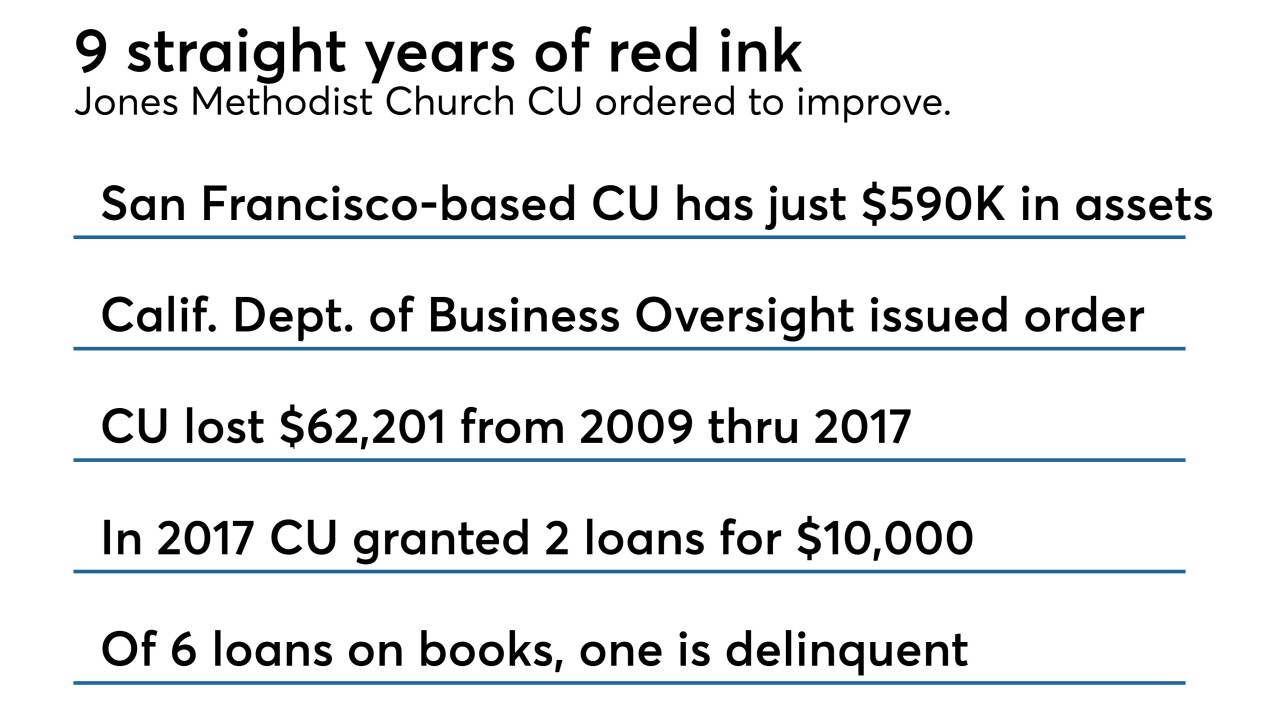

Jones Methodist Church Credit Union has been ordered to address "unsafe or unsound practices" following nine years of losses and other problems.

October 10 -

In what would be its third acquisition in a year, the company formerly known as BofI Holding is buying a firm that clears trades for independent broker-dealers.

October 4 -

Hanmi alleges that SWNB's directors actively advised the Houston bank's investors to reject the merger.

October 3 -

First Foundation sold loans to Freddie Mac to free up space for higher-yielding credits. It then bought the securities that were formed to replace other, lower-yielding assets through an often overlooked program.

October 1 -

From "BayBucks" to service excellence awards, California's Bay Federal Credit Union is committed to recognizing staff who go the extra mile.

September 28 -

Hanmi Financial wants SWNB in Houston to pay a termination fee, citing "material breaches" of covenants tied to their now-defunct merger agreement.

September 27 -

Colin Walsh, Varo Money's CEO, learned a lot from his first stab at deposit insurance. Lesson one: Work with one regulator at a time.

September 27 -

The law gives residents more — and welcome — control over their data. But it will take work for credit unions to meet the new requirements, such as possibly having to amend third-party vendor agreements.

September 27 Samaha & Associates

Samaha & Associates -

Riverside, Calif.-based Altura Credit Union believes happy staffers will lead to happy members.

September 25 -

The legislation would help small-business owners better evaluate financing options by requiring updated disclosures.

September 25 Lending Club

Lending Club -

The merger, recently approved by Denali's membership, will create a $2.2 billion-asset credit union with dozens of branches across five Western states.

September 25 -

All three credit unions hold less than $250 million in assets.

September 20 -

The legislation, which creates new disclosure standards for financing costs, could hamstring commercial lenders that offer revolving credit facilities.

September 19 Commercial Finance Association

Commercial Finance Association