-

George McNichols helped build the Indiana-based institution from $10 million in assets in 1984 to $554 million today.

April 15 -

The Bedford, Ind.-based credit union distributed a $2.7 million dividend to members in recognition of a year that saw loan growth exceed 9%.

April 5 -

Gene Novello will take over at the Crown Point, Ind.-based institution when Mike Hussey retires later this year.

March 18 -

Bill Schirmer, president and CEO of Evansville Teachers FCU, will serve a three-year term on a panel for the Federal Reserve Board of St. Louis.

February 27 -

The Indiana company will pay $68 million for Citizens First.

February 22 -

The division of the Indiana Credit Union League, along with CUs and other industry organizations, has made a number of new hires and promotions.

February 5 -

The Indiana-based institution's distribution for 2018 was up more than 60 percent from the previous year.

January 17 -

Bob Jones will retire in early May. He will be succeeded by Jim Ryan, the Indiana company's chief financial officer.

January 16 -

The $128 million acquisition will provide First Financial with its first branches in Kentucky and Tennessee.

January 8 -

The Indiana-based institution has increased its starting pay for the last three years.

December 19 -

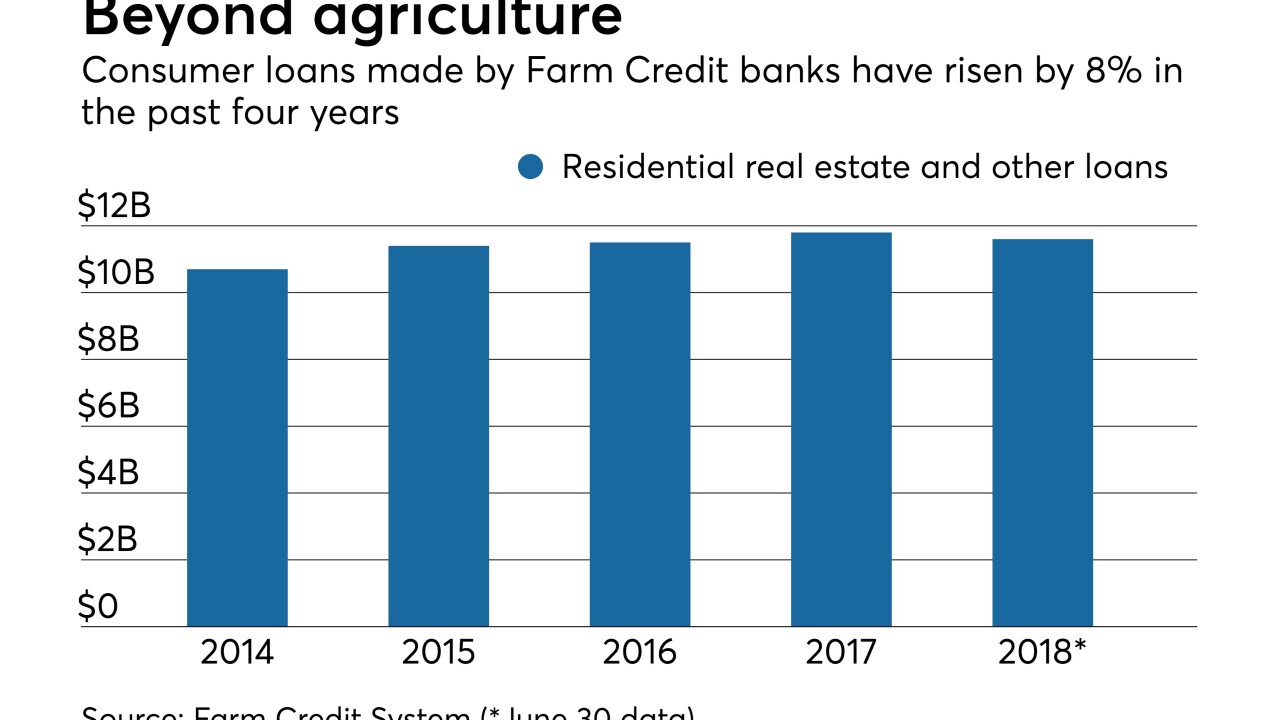

Bankers complain that the quasi-governmental system's new program designed to make more residential loans in four states goes well beyond its original mission.

October 31 -

The acquisition will increase Horizon’s core deposits and add branches around Indianapolis.

October 30 -

First Merchants in Indiana would pass $10 billion in assets by acquiring MBT Financial in Michigan.

October 10 -

Hoosier Hills Credit Union now serves 35 counties and has roughly 29,000 members.

October 10 -

A challenging diagnosis for her son prompted a senior executive to make changes at work, and Old National Bank's reaction offers a lesson for those serious about retaining female leaders.

September 23 -

Notre Dame Federal Credit Union is the latest to join the Hispanic outreach program for CUs, which now serves more than 85 institutions nationwide.

September 18 -

Farmers & Merchants will pay $89 million for the parent of Bank of Geneva.

August 20 -

Despite continued industry consolidation, the company still expects to have at least 10 chances each year to buy another bank.

July 31 -

Old National will have the fifth-biggest deposit market share in the city when it completes the $434 million acquisition.

June 21 -

Ruoff Financial will make its first push into banking with the purchase of SBB Bancshares.

June 19