-

Membership was previously only available to consumers in five counties.

November 26 -

Credit unions and banks in the Great Lakes State could soon offer driver's license renewal and related services.

November 4 -

Julie Kreinbring has been the institution's interim leader since August and previously served as chief strategy officer.

October 25 -

The Flint, Mich.-based institution has selected an executive with expertise in fraud prevention and law to take the helm following CEO Marilyn Reno's retirement.

October 22 -

Tom Lopp will succeed Gary Judd at the end of November.

October 18 -

The merger of Bi-County PTC Federal Credit Union into BlueOx is expected to be completed on Jan. 1.

October 7 -

CUs in the Great Lakes State continue to see positive growth, but several key metrics are increasing at a slower pace.

September 30 -

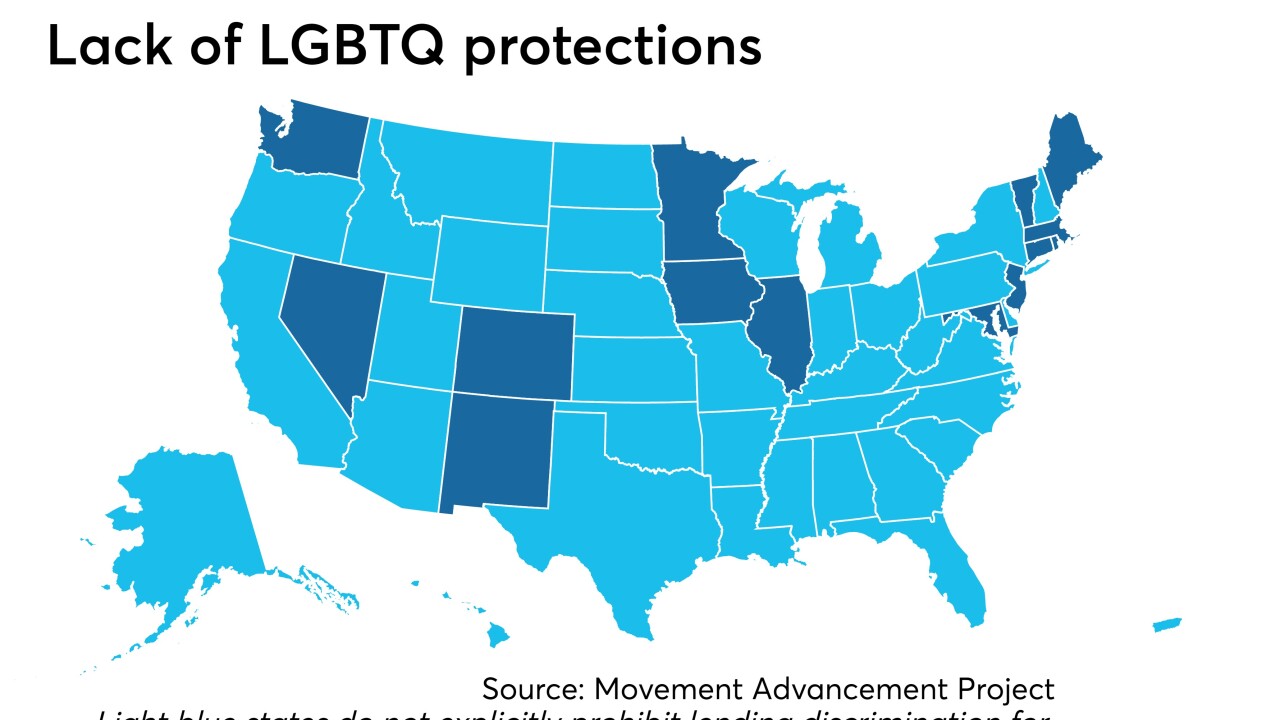

With credit discrimination still legal in many states, the Michigan-based institution aims to help this marginalized group.

September 30 -

The Michigan company sold collateral tied to Live Well, a mortgage company that has filed for bankruptcy protection.

September 20 -

The company will pay $42 million in cash for the parent of Main Street Bank in southeastern Michigan.

September 18 -

Michigan on Monday approved a charter for a new financial institution designed for lesbian, gay, bisexual and transgender customers, clearing the way for online service to begin early in 2020.

September 9 -

The East Lansing, Mich.-based credit union exceeded its growth expectations for card performance during the annual e-commerce event.

September 3 -

Two Michigan credit unions were sued by an individual who claimed their websites didn't comply with the Americans with Disabilities Act.

August 27 -

United Churches Credit Union, which has just one branch, can now serve anyone who worships in two counties.

August 27 -

Recent legislation to lower auto insurance premiums in the Wolverine State could cut into noninterest income, but many institutions are still unclear on how much of a hit they’ll take.

August 23 -

Management at the Wyoming, Mich.-based institution decided on the name Bloom Credit Union after a review of its core values and market position.

August 21 -

The Michigan company will pay $68 million to expand in a high-priority market.

August 13 -

The St. Joseph, Mich.-based institution faced claims that it didn't properly opt members in to its overdraft program.

August 12 -

The Michigan company disclosed that an unnamed client made a large payment on a $6.5 million nonperforming loan.

August 9 -

The year's second-biggest bank merger created a Midwestern regional with nearly $50 billion in assets, and its CEO and executive vice chairman don't intend to stop there.

August 1