-

The credit union changed its name to reflect a wider field of membership.

April 12 -

Credit unions have seen a slew of legal victories in lawsuits claiming CUs' websites violated the Americans with Disabilities Act, but there are fears attorneys pursuing those cases may be changing their strategy.

April 5 -

The Arlington, Texas-based credit union now has more than $1.2 billionin assets and serves more than 114,000 members. The merger was first announced last spring.

April 3 -

The $10.6 million-asset credit union has selected Credit Union Resources, Inc. to conduct a search for CEO Cecil Barker's replacement.

March 21 -

Independent Bank Group said the firms had become shareholders after it bought Carlile Bancshares last year.

March 16 -

Experts say that despite having a few suits thrown out, the matter won't be settled until the Department of Justice provides clarity. But there are steps CUs can take to protect themselves until then.

March 15 -

Banks and payment companies have long been wary of the political and reputational risks of supporting gun sellers. But gun sellers know their customers better than most other merchant categories.

March 13 -

The name change is tied to a field-of-membership expansion, as the credit union moved from a SEG-based institution to a community charter.

March 5 -

Newly expanded Justice Federal Credit Union now has 27 branches in 8 states, plus D.C.

March 2 -

Plaintiff voluntarily dismisses lawsuit 8 days after CU trade associations file amicus briefs.

March 2 -

The Houston-based ATM-management company was previously concentrated in the South.

February 27 -

Bank consolidation in the city has picked up in recent months despite erratic oil prices and flooding tied to Hurricane Harvey.

February 21 -

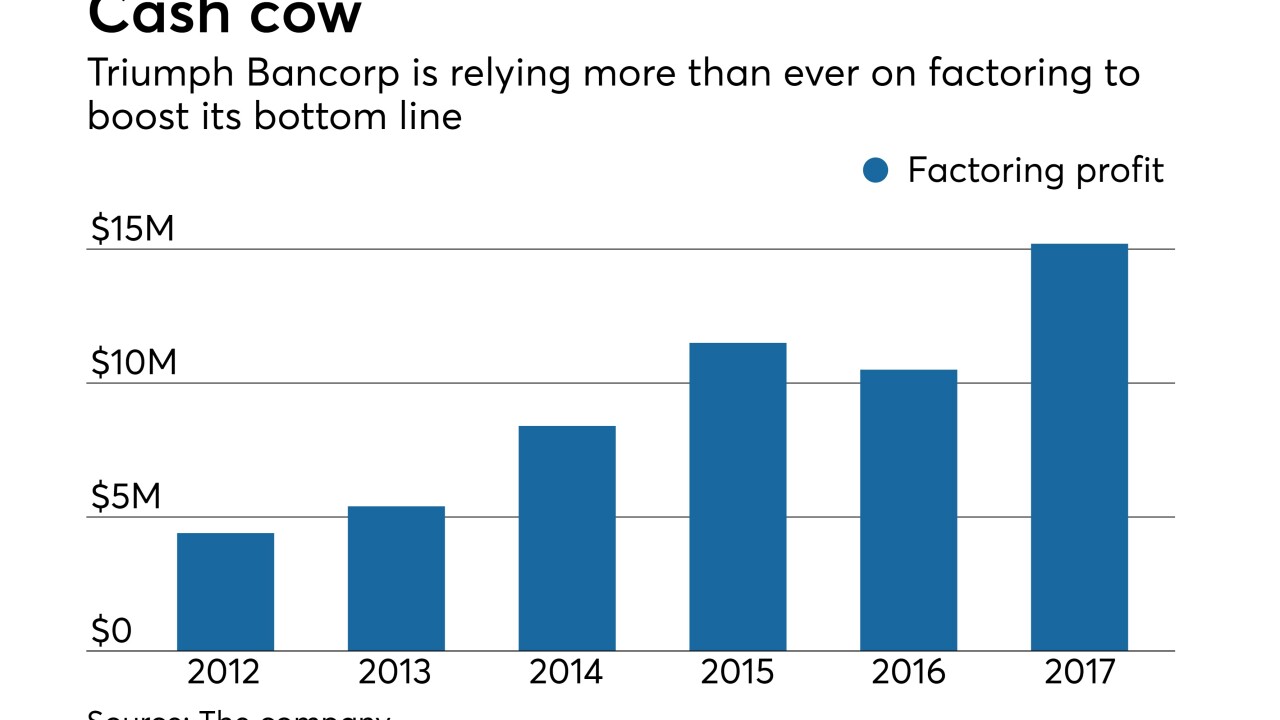

Triumph Bancorp has developed technology to help freight brokers make faster payments to truckers, charging a fee for the service.

February 16 -

The company agreed to buy Bank of River Oaks for $85 million in cash.

February 13 -

The private equity firms plan to sell a total of 3 million shares in the Houston company in coming weeks.

February 2 -

The El Paso-based credit union paid out $1.75 million this year to its members, for a total of $5.75 million ove the last three years.

February 1 -

The Texas company will gain four branches and $160 million in loans after the acquisition closes.

January 29 -

The Dallas company has agreed to sell its health care lending group to an undisclosed buyer.

January 29 -

Tightening its connections to restaurants with a brisk delivery business, Square has acquired a longstanding Dallas-based local food delivery service to add to its Caviar food-ordering platform.

January 25 -

Which large and midcap bank stocks have the most momentum? These 12 banks started the year off with the biggest bang, as measured by gains in stock price.

January 17