-

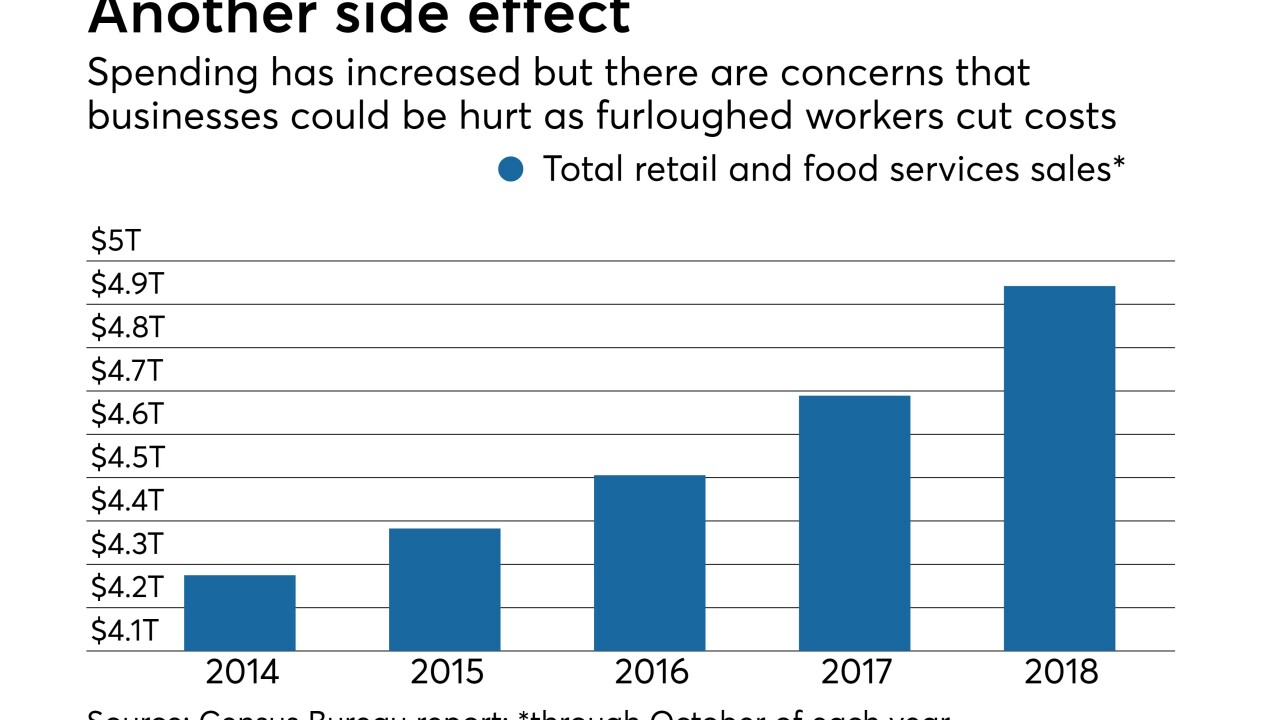

If the government insists on forcing another shutdown, business owners are intent on letting Congress know how much the last one hurt.

February 11 -

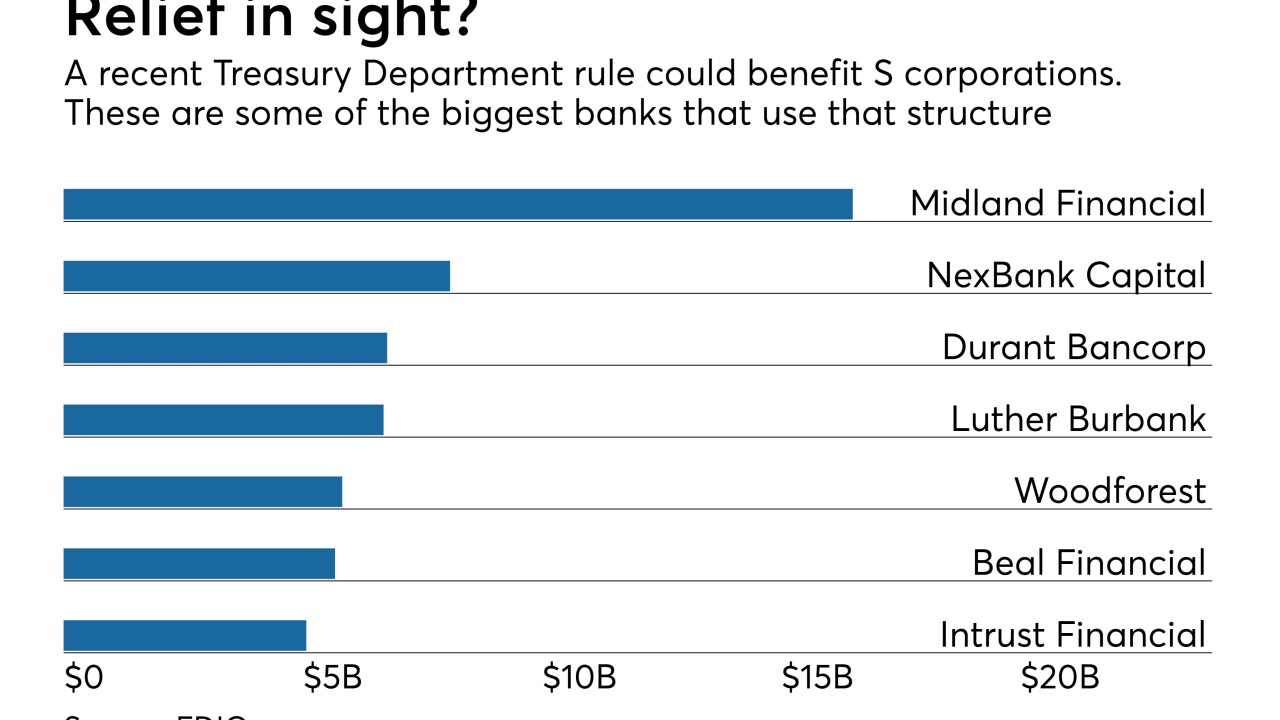

Shareholders in Subchapter S corporations will get some tax relief of their own under a new Treasury Department rule that will let them take a 20% deduction on qualified business income, which includes loan originations and sales.

February 5 -

The shutdown is keeping the agency from approving about 300 loans per day, according to CBA President Richard Hunt.

January 22 -

Credit union and bank executives say the federal work stoppage hasn’t hit business lines yet, but that could change if things drag on much longer.

January 18 -

Farm Service Agency staff will have three days to work on existing loan applications and provide tax documents for existing loans.

January 17 -

Though it would be based in the nation's capital, MOXY Bank would also have significant operations in Charlotte, N.C.

January 14 -

The impasse has halted grant and loan applications and frozen many farm subsidies just weeks ahead of planting season.

January 14 -

Despite the ongoing federal work stoppage, some scheduled activities are still taking place this week in Washington.

January 14 -

The tricky part: raising awareness without appearing to take advantage of borrowers at a time when agencies like the SBA are out of commission.

January 11 -

President Trump has threatened that the closure may go on for a prolonged period. This could lead to higher loan delinquencies at credit unions that serve federal workers.

January 10 -

The 10 startups will receive initial investments, mentoring and training as part of the ICBA ThinkTECH Accelerator.

January 9 -

The agency is unable to process loan applications and faces a daunting backlog once Washington returns to work.

January 8 -

Now the third-longest shutdown in history, there are few signs the government will reopen anytime soon, and that's causing problems for lenders.

January 7 -

Industry trade groups, which have been active in fighting lawsuits that allege violations of the Americans with Disabilities Act, hailed the decision.

January 3 -

As the federal budget dispute shoves an increasing number of government workers to the sidelines, there’s a window to provide payments relief that’s superior to options such as payday lending and bartering.

January 2 -

The directory, which will debut next year, should help community banks find potential fintech partners.

December 14 -

One week after NCUA filed its own appeal brief, three major organizations banded together in support of the expanded field-of-membership rule

December 14 -

Dozens of House members and four senators agree with arguments by farmers and lenders that a proposed change to the 7(a) program would disqualify worthy borrowers.

December 5 -

Through a new partnership with the Military Spouse Advocacy Network, the trade group will help provide training, videos and classes to the spouses of service members.

December 5 -

Tepid loan and deposit growth has been a persistent theme in 2018, but that could soon change for community and regional banks in the New York and Washington markets.

November 14